Barclays Exit Of Energy Business Triggers Surge In Oil Options Trades

Jul 24, 2017

Jeremy Parkinson

Finance

Several hours before the US stock market opened on Monday, the commodity world was shaken by an unexpected surge in crude options trades, with traders noting that “someone is either moving positions, blown up or getting out of commodities. MASSIVE amount of blocks going through in crude options.” Someone is either moving positions, blown up […]

Sector Strength – Monday, July 24

Jul 24, 2017

Jeremy Parkinson

Finance

We are on watch for a peak in this short-term uptrend. This failed break out for the Transports is a bit worrying, but so far not too much damage has been done. The bullish percents continue to support the market uptrend. Sector Strength What is this spreadsheet telling us? QQQ is still the market leader, […]

World Markets Update – Monday, July 24

Jul 24, 2017

Jeremy Parkinson

Finance

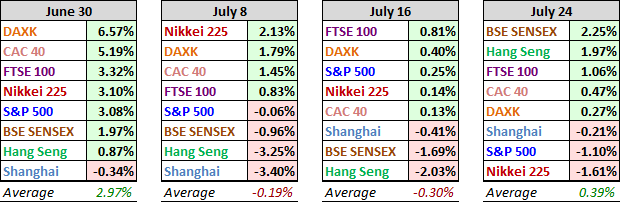

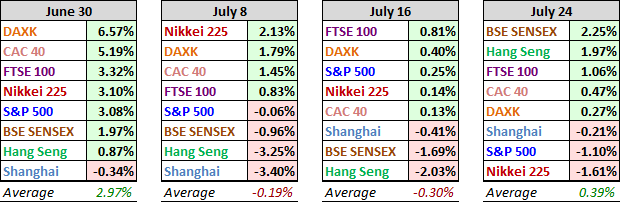

All eight indexes on our world watch list have posted gains for 2017 through July 24. The top performer thus far is Hong Kong’s Hang Seng with a gain of 22.03%, followed closely by India’s BSE SENSEX at 21.10%. In third is our own S&P 500 with 10.32%. The Last Four Weeks The tables below […]

Norway’s Oil Consumption Rises Despite Surging Electric Vehicle Sales

Jul 24, 2017

Jeremy Parkinson

Finance

The “peak demand” hypothesis is the idea that demand for oil will peak as alternatives to oil become widespread. The notion that peak demand will happen within the next few years – and that EVs will be the primary driving force behind this shift – has gained in popularity over the past couple of years, […]

Dodge Construction Index Shows Weakening Trend In Mature Market

Jul 24, 2017

Jeremy Parkinson

Finance

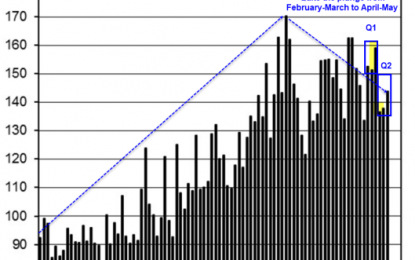

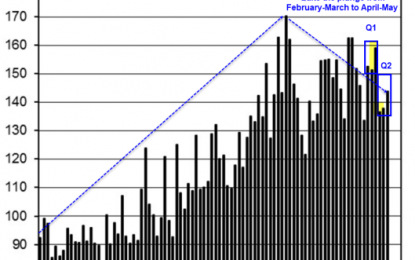

Construction starts rose four percent in June according to the Dodge Index of New Construction. For the second quarter, construction starts are down substantially. The overall trend is also down, indicative of a mature market. New construction starts in June grew 4% from the previous month to a seasonally adjusted annual rate of $679.9 billion, according […]

38% Of The S&P500 Has Earnings

Jul 24, 2017

Jeremy Parkinson

Finance

Stocks end the day quiet has all eyes are on the earnings announcements this week. In fact the handful of stocks that make up 38% of the S&P are reporting this week. Watch this video to find out what to expect from these stocks… Video Length – 00:14:42

Gold Market Update – Monday, July 24

Jul 24, 2017

Jeremy Parkinson

Finance

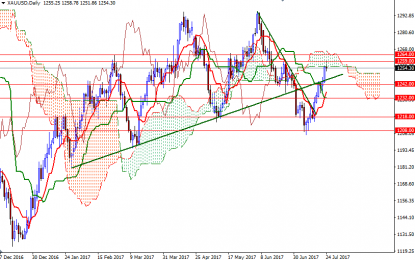

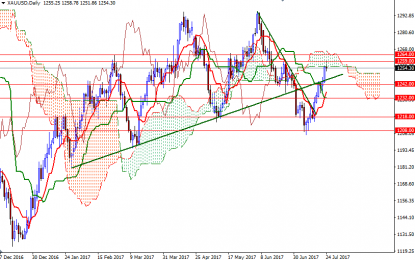

Gold prices are slightly lower in afternoon New York trading, suffering from a bounce in the U.S. dollar index. XAU/USD hit the highest level in nearly 4 weeks earlier but the expected resistance at $1259 kicked in and blocked the bulls’ way. The market is currently fluctuating around the $1255 level, the bottom of the daily Ichimoku […]

US Fed Meet, Q1 Results And Cues To Watch Out Today

Jul 24, 2017

Jeremy Parkinson

Finance

Indian stock markets rose to all time high as Reliance Industries, ITC and TCS posted strong gains. At the closing bell yesterday, the BSE Sensex closed higher by 217 points. While, the NSE Nifty finished higher by 51 points led by software stocks and FMCG stocks. As the markets continue to rally, corporate earnings of June quarter will be crucial for the NSE […]

EUR/JPY: Continuation Or Correction- Range Break To Offer Opportunity

Jul 24, 2017

Jeremy Parkinson

Finance

EUR/JPY Daily Timeframe Technical Outlook: EUR/JPY has continued to trade within the confined of this broad ascending pitchfork formation extending off the July 2016 lows. The pair is consolidating within its initial monthly opening range after encountering confluence resistance earlier this month at 130.69. Near-term support rests with the monthly open at 127.96 and the focus is on a […]

Phased Not Confused – What Happens Next?

Jul 24, 2017

Jeremy Parkinson

Finance

Nearly ripe for the picking, I am busy putting the final touches on my manuscript. The book’s working title, “Phased Not Confused: A Multisensory Teaching Approach to Understanding Your Money, Investments and the Economy” combines how to define, identify and trade within weekly phases. I also include the Modern Family and ten Megatrends as a […]