Bi-Weekly Economic Review: Attention Shoppers

Jul 16, 2017

Jeremy Parkinson

Finance

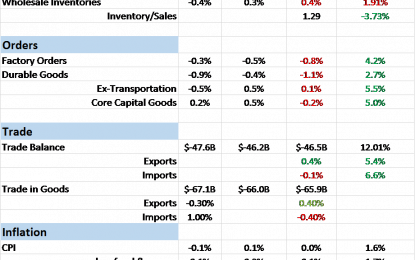

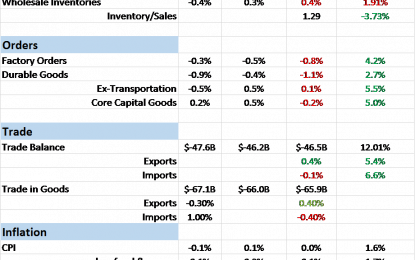

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports […]

Global Stocks Soared $1.5 Trillion This Week – Now 102% Of World GDP

Jul 16, 2017

Jeremy Parkinson

Finance

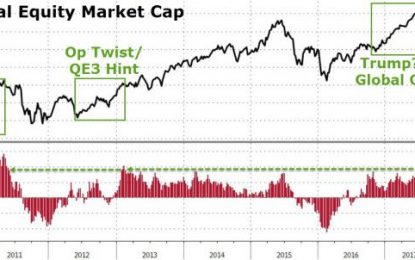

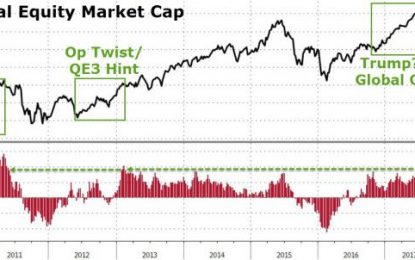

Thanks, it seems, to a few short words from Janet Yellen, the world’s stock markets added over $1.5 trillion to wealthy people’s net worth this week, sending global market cap to record highs. The value of global equity markets reached a record high $76.28 trillion yesterday, up a shocking 18.6% since President Trump was elected. This is the […]

UnitedHealth (UNH) To Report Q2 Earnings: What To Expect

Jul 16, 2017

Jeremy Parkinson

Finance

UnitedHealth Group Inc. (UNH – Free Report) is scheduled to report second-quarter 2017 results on Jul 18, before the opening bell. Last quarter, UnitedHealth surpassed the Zacks Consensus Estimate by 8.72%. Let’s see how things are shaping up for this announcement. Q2 Flashback We expect the quarter’s results to show broad-based growth across the enterprise. Its segment, UnitedHealth […]

Biggest Fed Flip Flop In History

Jul 16, 2017

Jeremy Parkinson

Finance

Analyst/trader Gregory Mannarino says the Federal Reserve just did an about-face on raising interest rates in a matter of weeks. Mannarino contends, “This is incredible and hard to get my head around. This has got to be the flip-flop of all flip-flops. At the last FOMC meeting, Janet Yellen was practically pounding the table talking […]

5 Water ETFs To Invest In

Jul 16, 2017

Jeremy Parkinson

Finance

By John Szramiak of Vintage Value Investing cocoparisienne / Pixabay Water is one of the most plentiful compounds on Earth and it is essential for life.However, fresh water isn’t nearly as common as salt water and it is under pressure. As climate change rapidly shifts the weather pattern, fresh water is drying up. At the same time, pollution, […]

World Market “Buy” Signal Triggered

Jul 16, 2017

Jeremy Parkinson

Finance

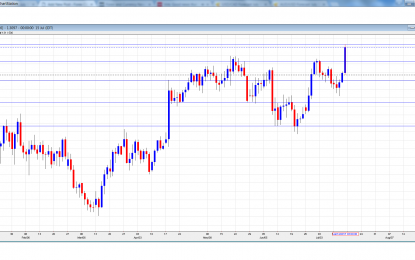

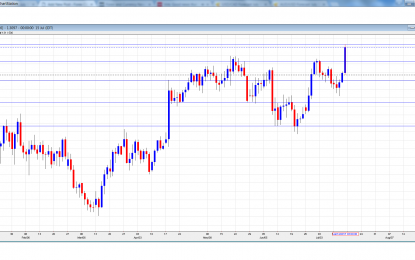

A new “BUY” signal has just triggered on the World Market Index. I last wrote about this index on June 29th. Price punched through 1900 (which will now need to hold as major support), the RSI has broken its latest downtrend and is back above 50, and there are new bullish crossovers on the MACD and PMO indicators, as shown on […]

The ‘Permanent State Of Exception And A New Status Quo’

Jul 16, 2017

Jeremy Parkinson

Finance

Putting out something outstanding is difficult for most people. When it comes to sell-side strategists, the burden of having to be both rigorous and some semblance of articulate is usually too much and when you throw in time constraints, you’ve got a recipe for notes that are bland, that state the obvious, or worse, both. […]

GBP/USD Forecast July 17-21

Jul 16, 2017

Jeremy Parkinson

Finance

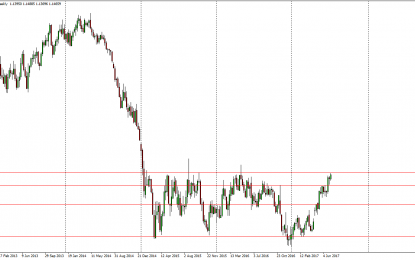

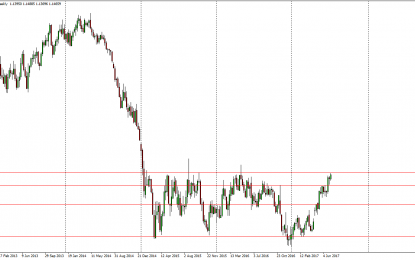

GBP/USD reversed directions last week, gaining 200 points. The pair closed at the 1.31 line. This week’s highlights are CPI and Retail Sales. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD. In the UK, Brexit jitters increased as all three PMIs reported softer growth in May and missed estimates. […]

BofA Lashes Out At The Fed: “Take That Punch Bowl Away” Or Face A Crash

Jul 16, 2017

Jeremy Parkinson

Finance

In a dramatic appeal for rationality at the Fed, Bank of America’s global FX strategy team released a note titled “take that punch bowl away”, which laments that while central banks backtracked from their hawkish recent rhetoric this week, it warns that “they will be sorry if they allow bubbles” and predicts that vol will increase […]

Weekly Forex Forecast – Sunday, July 16

Jul 16, 2017

Jeremy Parkinson

Finance

EUR/USD The EUR continues the overall consolidation that we have seen for 2 ½ years, but we are getting very close to the top of that range, the 1.15 level. In this point, I suspect that we are going to try to break out but we need to see at the very least a daily […]