The Economic Futurist: The Labor Force Of The 2020s

Aug 24, 2017

Jeremy Parkinson

Finance

Shutterstock As an economic futurist, I try to deal in highly likely projections, and population trends are the likeliest. Who will be available to work for your company in 10 years? The news here is bad, at least for business owners and executives with a vision of growing their companies. There won’t be much growth […]

Main Street Businesses Rush To Protect Your Data

Aug 24, 2017

Jeremy Parkinson

Finance

It happens so often that most of us barely take note anymore… Just in the past few months, hackers dropped a virus into hospitals’ computer systems, shutting them down. Then online bad guys penetrated HBO’s system, pilfering thousands of documents. A big part of the problem? In past years, companies did not invest enough in […]

Walmart Tumbles After Amazon Says It Will Cut Whole Foods Prices Monday

Aug 24, 2017

Jeremy Parkinson

Finance

Here comes even more of that deflation the Fed hates so much. Walmart stock is getting whacked, as is the broader grocery sector, after Amazon announced moment ago that the acquisition of Whole Foods will close on Monday, and that in keeping with the company’s tradition of stealing market by underpricing its competition, it will […]

Debt Ceiling Is Even More Politically Charged

Aug 24, 2017

Jeremy Parkinson

Finance

The stock market sold off on Wednesday because of the threat President Trump made in his speech on Tuesday to shut the government down if he didn’t get funding for the southern border wall. This is in direct conflict with the Treasury Department which is asking Congress to raise the debt ceiling. Usually presidents are in favor […]

World Markets At Inflection Point

Aug 24, 2017

Jeremy Parkinson

Finance

I don’t have much to say about the markets (as of Wednesday’s close), except to note that the World Market Index (50-day MA and 1900 near-term support level) and the SPX:VIXSPX: (200 price level) are, once again, at/near their respective inflection point. Downtrending technical indicators are not (yet) supportive of continuing strength in these equity markets and may be […]

Priceline: A Growth Powerhouse – Forecast Profits And/Or Cash Flow Not Prices!

Aug 24, 2017

Jeremy Parkinson

Finance

Introduction This is the second in a series of articles where I will cover popular and/or high profile stocks. The primary objective of this series will be to put a spotlight on the importance of forecasting future growth prior to making an investment decision. The central idea is to determine whether or not a reasonable […]

Crude Oil – Declining Inventories Vs. Climbing Production

Aug 24, 2017

Jeremy Parkinson

Finance

On Wednesday, light crude gained 1.21% after the EIA weekly report showed declines in crude oil and gasoline inventories. As a result, the black gold came back above the lower border of the trend channel, but can we trust this increase? Crude Oil’s Technical Picture Let’s take a closer look at the charts and find […]

Gold – Crossing The Rubicon

Aug 24, 2017

Jeremy Parkinson

Finance

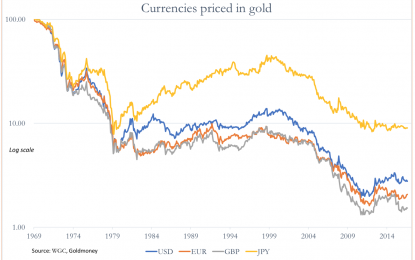

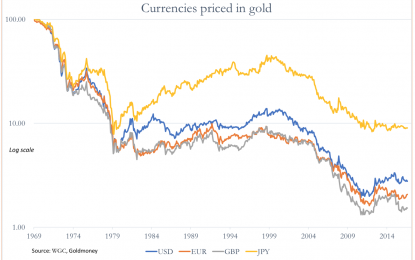

Gold is challenging the $1300 level for the third time this year. If it breaks upwards out of this consolidation phase convincingly, it could be an important event, signalling a dollar that will continue to weaken. The factors driving the dollar lower are several and disparate. The US economy is sluggish relative to the rest […]

3 Soaring Hot Stocks With Big Insider Buying

Aug 24, 2017

Jeremy Parkinson

Finance

Using TipRanks’ popular Insiders’ Hot Stocks tool, we found which stocks best-performing corporate insiders like right now. We differentiate between informative and uninformative insider transactions in order to find the most compelling opportunities. Uninformative transactions indicate that an insider is buying/selling shares for reasons that do not necessarily indicate confidence in the company, such as exercising share options. […]