E

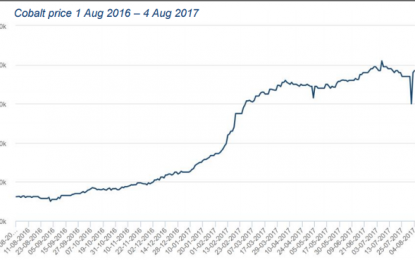

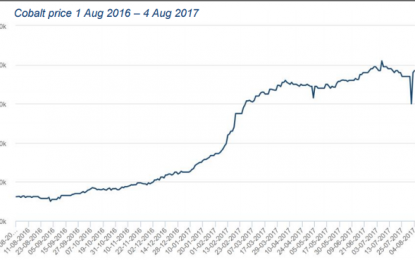

Rare Opportunities In Rare Metals

Aug 24, 2017

Jeremy Parkinson

Finance

Investors constantly search for the “next big thing”, the next innovation that will disrupt entire industries and make early investors a lot of money. Now that “next big thing” is electric cars and alternative energy. The question is what is the best way to take advantage of the coming boom in these fields. The answer […]

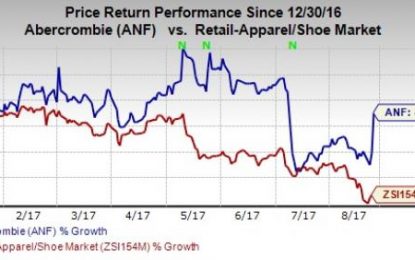

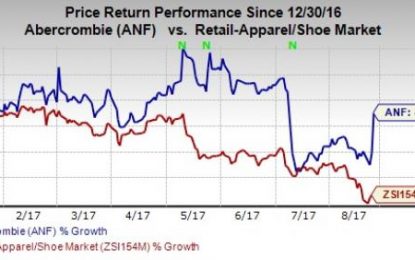

Abercrombie Soars Despite Q2 Loss, Back To Beat Trend

Aug 24, 2017

Jeremy Parkinson

Finance

The distressed Abercrombie & Fitch Co. (ANF – Free Report) came up with a solid quarterly performance in a long time as it reported top and bottom-line beat in second-quarter fiscal 2017. Further, the company’s results compared favorably from the prior-year period. Notably, this was the company’s first positive bottom-line surprise in the last six quarters, following in-line results […]

Utilities ETFs Hitting All-Time Highs Amid Market Turmoil

Aug 24, 2017

Jeremy Parkinson

Finance

Volatility is rearing its ugly head, and the utilities sector is making the most of all the uncertainty that’s looming around. No wonder, most utility stocks and ETFs are hitting fresh highs. The S&P 500 utilities index has gained 12% so far this year and some strategists see further upside for the sector players. Here, we discuss […]

Dollar Tree’s Q2 Results Demonstrate A Proven Business Model, Experienced Leadership Team & Business Momentum

Aug 24, 2017

Jeremy Parkinson

Finance

Dollar Tree, Inc. (NASDAQ: DLTR), North America’s leading operator of discount variety stores, today reported results for its second fiscal quarter ended July 29, 2017. About Dollar Tree, Inc. Dollar Tree operates 14,581 stores across 48 American states and 5 Canadian provinces under the brands of Dollar Tree, Family Dollar, and Dollar Tree Canada. To learn […]

Valuations Matter – Even For Millennials

Aug 24, 2017

Jeremy Parkinson

Finance

I recently wrote a blog discussing some of the fallacies and myths surrounding “real” long-term investing especially as it relates to young millennial investors. The valuation levels when you start investing, have everything to do with the ultimate outcomes. You can read the full article here: (Video length 00:07:53)

Looking To The Weight Of The Evidence

Aug 24, 2017

Jeremy Parkinson

Finance

Stocks pulled back a bit yesterday in response to Donald Trump’s threat to shut down the government if he didn’t get his border wall. On this topic, it is important to note that (a) the government is slated to run out of money on October 1 and (b) the House has already approved $1.6 billion […]

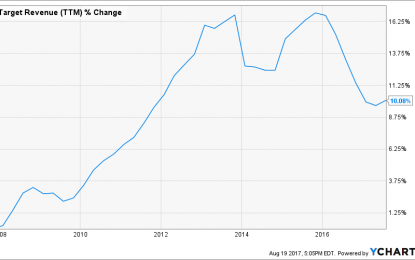

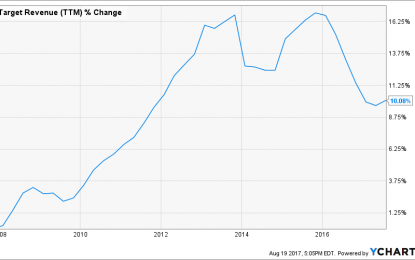

5 Reasons To Sell TGT Before It’s Too Late

Aug 24, 2017

Jeremy Parkinson

Finance

#1 TGT benefits from a stellar dividend growth history and classic business model in order to maintain the interest of investors. #2 Many investors see TGT as being the opportunity of the year and claim it is clearly oversold. #3 On my side, all I see is declining revenues, margins under pressure and no growth […]

More Currency Wars: Forint Plunges As NBH Loses Patience

Aug 24, 2017

Jeremy Parkinson

Finance

Ok, who was short the forint going into today? EURHUF exploded higher on Thursday after the National Bank of Hungary told Bloomberg, in response to e-mailed questions, that the central bank is “closely examining the possibility to apply further unconventional policy tools.” Apparently, a change in the final sentence of the statement that accompanied the bank’s decision […]

E

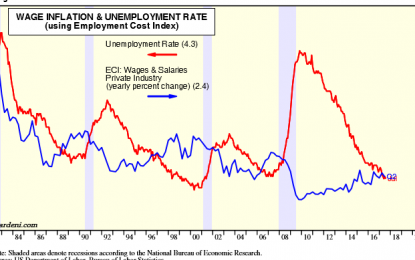

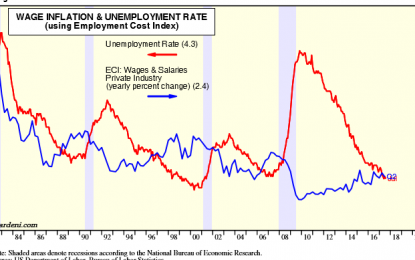

We Should Not Be Surprised That The Phillips Curve Has Broken Down

Aug 24, 2017

Jeremy Parkinson

Finance

It takes a long time for economists to recognize and concede that a theory is no longer valid. This is certainly the case when it comes to understanding the relationship between falling unemployment rates and wage gains—- the Phillips curve made famous by William Phillips in the 1960s. The curve has become a cornerstone of […]

July 2017 Headline Existing Home Growth Slows Again

Aug 24, 2017

Jeremy Parkinson

Finance

The headline existing home sales growth slowed with the authors saying “Contract activity has mostly trended downward since February and ultimately put a large dent on closings last month”. Our analysis of the unadjusted data agrees. Analyst Opinion of Existing Home Sales The rolling averages have been slowing in 2017 – so it is easy […]