Stocks Have ‘Friends In High Places’

Aug 24, 2017

Jeremy Parkinson

Finance

Well, former trader and man who has been trying really, really hard lately to keep from flipping the fuck out in his daily missives, Richard Breslow, is out with his latest and it’s a winner. Richard’s Thursday piece touches on a variety of stories we’ve mentioned here over the past month, including the fact that the SNB […]

Freezing Of Bank Accounts: A New Threat For Savers

Aug 24, 2017

Jeremy Parkinson

Finance

Savers are getting strangled by regulations: new laws are threatening their assets and limiting their freedom. They have become prey to a sicker and sicker banking and monetary system. We have already warned about the BRRD directive, which authorizes a failing bank to bail itself out using its clients’ accounts, and mentioned in passing that the 100,000 […]

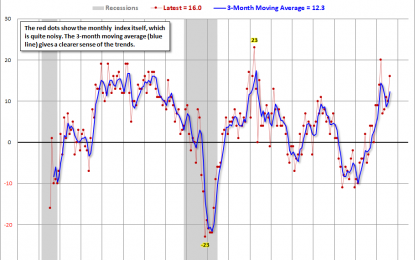

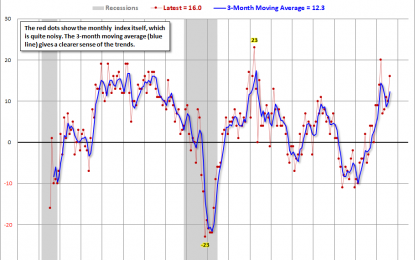

Kansas City Fed Survey: Accelerating Activity In August

Aug 24, 2017

Jeremy Parkinson

Finance

The Kansas City Fed Manufacturing Survey business conditions indicator measures activity in the following states: Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri, and northern New Mexico. Quarterly data for this indicator dates back to 1995, but monthly data is only available from 2001. New seasonal adjustment factors were introduced in January 2017 and slight revisions […]

Will The China Shock Operate In Reverse?

Aug 24, 2017

Jeremy Parkinson

Finance

Everyone knows that China’s economy has had explosive economic growth in recent decades, with tidal effects through the rest of the global economy. In fact, China’s economy has come so far and so fast that some of the main shocks it has caused in recent decades may be about to move into reverse. At least, […]

Existing Home Sales Unexpectedly Decline To 2017 Lows

Aug 24, 2017

Jeremy Parkinson

Finance

On the heels of an unexpected decline in new home sales yesterday, comes news of an unexpected decline in existing home sales today. The Econoday consensus estimate for existing home sales was 5.565 million at a seasonally adjusted annualized rate up from a reported 5.520 million in June. Instead, existing home sales fell 1.3% from a downward […]

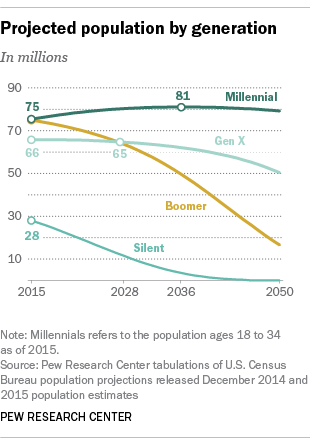

Wage Growth And Demographics: One More Time

Aug 24, 2017

Jeremy Parkinson

Finance

I messed up earlier this week in discussing the possible impact of demographic changes in the composition of the labor force on the rate of wage growth, but this is an important issue that we should be able to think about clearly. The question is whether the slow pace of wage growth in the last year or […]

Analysts See China Mobile Tender As Beneficial For Optical Names

Aug 24, 2017

Jeremy Parkinson

Finance

Yesterday, China Mobile (CHL) announced on its Chinese language website a major coherent transport order of 42K-70K ports. Commenting on the news, Needham analyst Alex Henderson said it may cause “a meaningful change” in the demand trajectory out of China, helping optical names. While his peer at B. Riley acknowledged that the tender could be […]

Stop Losses Are A Must For Retirement Investors

Aug 24, 2017

Jeremy Parkinson

Finance

Dad pointed his finger at me, raised his voice and said, “Sit down, shut up, and listen!” His face was beet red; I’d pushed him too far. My parents invested in Certificates of Deposit ONLY – they never touched stocks. I showed dad charts from my economics professor outlining how much more an investor would […]

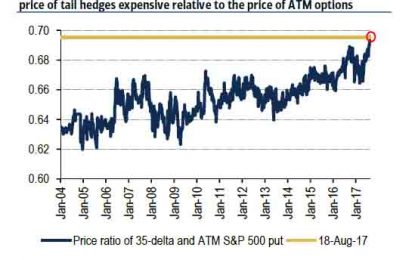

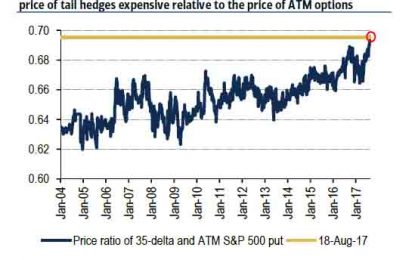

The Cost Of Market Crash Insurance Just Hit A Record High

Aug 24, 2017

Jeremy Parkinson

Finance

With the VIX surging, and then quickly getting pummeled on two occasions in the past three weeks, dizzy traders could be forgiven to assume that any latent “risk off” threat, whether from North Korea or the US political front, has been taken off the table. However, a deeper look inside the vol surface reveals something […]

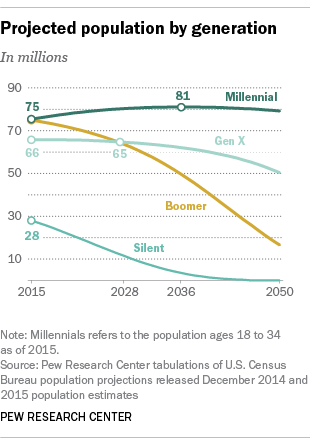

Revulsion For Banking Conglomerates Generational, For Good Reason

Aug 24, 2017

Jeremy Parkinson

Finance

In the 1960’s and 70’s my depression-era grandparents helped raise me. Because of their life experiences in the 1920’s and 30’s they had developed a healthy distrust and aversion to the “God damn bankers” as my grandpa used to say. In my own adult and professional experience over the past 30 years, I came to […]