EUR/USD Bearish Momentum At 1.15 Could Start Wave 4 Retracement

Jul 13, 2017

Jeremy Parkinson

Finance

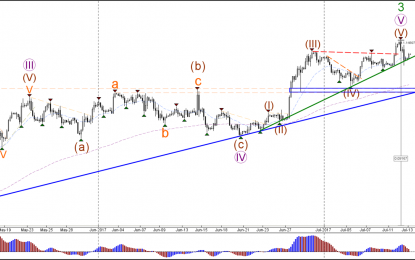

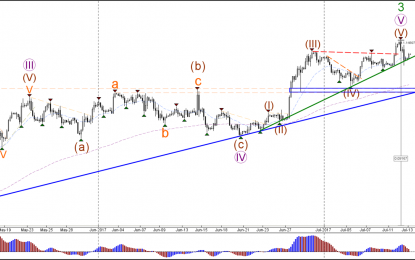

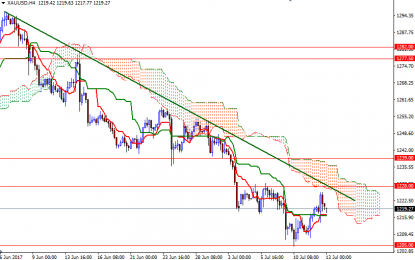

EUR/USD 4 hour The EUR/USD bullish breakout reached the 1.15 target but then fell quickly down to 1.14. The bearish reaction could indicate that the waves 5 have been completed within wave 3 (green), which could indicate the start of a bearish retracement within wave 4 (green) towards the Fibonacci retracement levels of wave 4 […]

![EUR/USD: Price Has Restored To The 45th Degree]()

EUR/USD: Price Has Restored To The 45th Degree

Jul 13, 2017

Jeremy Parkinson

Finance

Previous: On Wednesday, trading on the euro closed down. Market volatility was high as Janet Yellen’s pre-prepared remarks were published. She remarked that the US economy was growing fast enough for another rate hike and plans to continue normalising the Fed’s balance sheet. The dollar strengthened against its major rivals on this news. In theory, […]

Indian Indices Continue Momentum; Sensex Hits 32,000

Jul 13, 2017

Jeremy Parkinson

Finance

After opening the day on a positive note, stock markets in India have continued their momentum. Sectoral indices are trading on a positive note with stocks in the FMCG sector and realty sector witnessing maximum buying interest. The BSE Sensex is trading up 235 points (up 0.7%) and the NSE Nifty is trading up 67 points (up 0.7%). The BSE Mid Cap index is trading up by […]

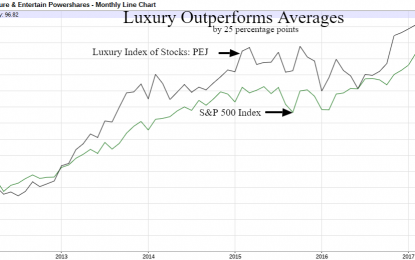

Luxury Bull Market

Jul 13, 2017

Jeremy Parkinson

Finance

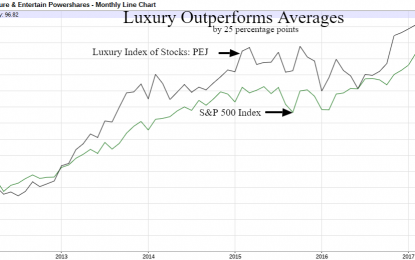

The wall of worry continues to propel stocks higher as this long plodding economic expansion is assumed to be in the later innings. With low interest rates and slow growth, many are still waiting for the the full throated recovery to manifest. However, for the luxury and leisure world the good times just keep rolling. […]

Stock Market Tsunami Siren Sounds A False Alarm?

Jul 13, 2017

Jeremy Parkinson

Finance

Wolf Richter sounds the alarm about the S&P 500’s current price earnings ratio: Before we go any further, let’s acknowledge that Wolf would be absolutely right if earnings were the fundamental driver of stock prices. Unfortunately, they’re not. Instead, dividends serve that function (here’s the math and several years of forecasting results to back that claim up). From that perspective, the seeming inexplicable levitation of stock […]

Dealing With A Dividend Cut In Your CEF Portfolio

Jul 13, 2017

Jeremy Parkinson

Finance

If you dabble in the closed-end fund market long enough, you are probably going to own a fund that sees its dividend cut. This seemingly innocuous event can have numerous ripple effects for shareholders that should be carefully evaluated before you respond with any knee-jerk reactions. Closed-end funds generally operate their dividend schedules in two […]

UK’s Unemployment Rate Falls To A 42-Year Low

Jul 13, 2017

Jeremy Parkinson

Finance

The monthly jobs report from the UK was a mixed bag with the unemployment rate falling to a 42-year low at 4.5%, down from 4.6% previously. Despite the solid headline, wages continued to disappoint. The unemployment rate fell to 4.5% and marked the lowest unemployment rate in the UK since 1975. Official data from the […]

Gold Rises On Yellen Testimony

Jul 13, 2017

Jeremy Parkinson

Finance

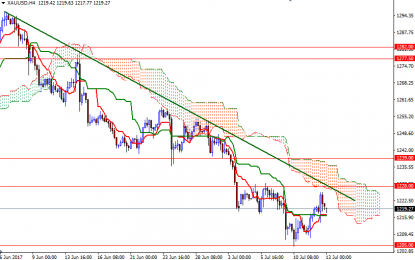

Gold prices ended Wednesday’s session up $3.80 an ounce, extending their gains to a third-straight session, after Federal Reserve Chair Janet Yellen signaled a cautious approach to further monetary tightening. Yellen said the Federal Reserve will need to keep gradually raising interest rates in the coming years, but not to levels seen in previous rate […]

Brexit Briefing: EU Negotiator Ramps Up The Rhetoric

Jul 13, 2017

Jeremy Parkinson

Finance

Ahead of next Monday’s meeting, EU chief negotiator Michel Barnier was in no mood to offer his UK counterpart David Davis an olive branch as he once again highlighted the obligations that the UK must adhere to before trade talks could commence. Barnier said that there still remained ‘numerous differences’ on the rights of EU […]

Fed In Wait-And-See Mode; Next Hike Likely In September – SEB

Jul 13, 2017

Jeremy Parkinson

Finance

What did we learn from Fed Chair Janet Yellen? Her prepared statement contained some worries about inflation, but she later balanced things out. Here is the view from SEB: Here is their view, courtesy of eFXnews: SEB Research comments on Fed Yellen’s testimony before the Congress. “Today’s testimony reinforces our view that the Fed is currently in […]