Zillow Latest To Slip In Response To Amazon Expanding Services

Jul 12, 2017

Jeremy Parkinson

Finance

As Amazon (AMZN) seeks to move into several different market sectors, companies including Zillow (Z, ZG), Best Buy (BBY) and Core-Mark (CORE) have been brought into focus on the risk of increased competition. REAL ESTATE: Amazon seems to be preparing to offer consumers the option to hire real estate agents through its professional services marketplace, […]

OPEC Output Increases, Saudi Arabia Seeks Solution

Jul 12, 2017

Jeremy Parkinson

Finance

Increased oil production by Libya and Nigeria combined with increased production by Saudi Arabia lead the group’s total production to increase by 32.6 million barrels per day in June. The group’s production increase, roughly 393,500 barrels per day, comes despite OPEC’s commitment to production cuts that it confirmed in May and recently sought to extend […]

A List Of Short Trade Setups Just In Case The Market Ever Does Roll Over

Jul 12, 2017

Jeremy Parkinson

Finance

The bears are simply trying to show us now, how quickly it can blow golden opportunities. Yesterday’s 20 minute sell-off was impressive. For moment there, it looked like it could really, really get ugly, but it didn’t. Instead a change to the Senate schedule (favorable towards getting health care and tax reform done) was released […]

BCE: Blue-Chip, High-Yield Telecommunications Leader

Jul 12, 2017

Jeremy Parkinson

Finance

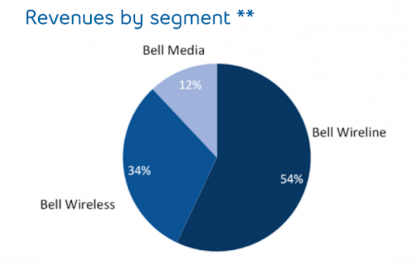

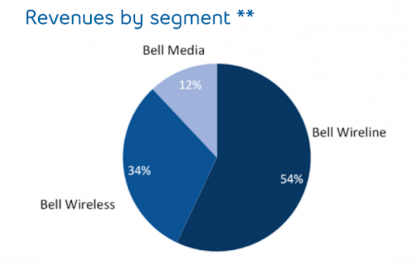

When investors think of high-quality dividend stocks in the telecommunications sector, the first two businesses that come to mind are likely AT&T (T) and Verizon Communications (VZ). However, there are plenty of other attractive investment opportunities in this sector. Surprisingly, the Canadian telecommunications industry is a fantastic source of high yield dividend stocks. BCE Inc. […]

Avoiding Overpriced Winners: A Better Way To Capture The Momentum Premium?

Jul 12, 2017

Jeremy Parkinson

Finance

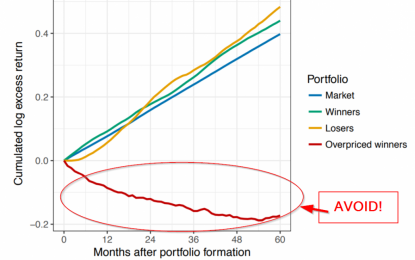

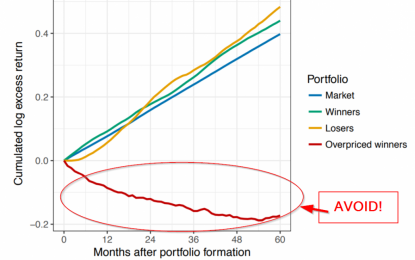

Any frequent reader of our blog knows we are fans of momentum investing. At this point, investment professionals should know that momentum historically works, that momentum is painful, and we have our own opinions on how to implement momentum investing via our Quantitative Momentum Index. Sometimes we feel there is nothing new when it comes to momentum. However, a new […]

Decoding Yellen’s Message

Jul 12, 2017

Jeremy Parkinson

Finance

“I know you think you understand what you thought I said but I’m not sure you realize that what you heard is not what I meant” Alan Greenspan On July 12, 2017 in her semiannual testimony to Congress, Janet Yellen stated the following: “the Federal Funds rate would not have to rise all that much […]

The Next Problem Could Be…

Jul 12, 2017

Jeremy Parkinson

Finance

Don’t look now fans, but bonds may be back on the list of things to worry about in the stock market. Jeff Gundlach, who has apparently been anointed the new king of the bond market, has suggested that bonds are on the precipice of a bear market and that Ten-year Treasury yields are on course […]

Big Bank Friday – Three Stocks To Watch

Jul 12, 2017

Jeremy Parkinson

Finance

Photo Credit: Sam Valadi JPMorgan & Chase (JPM) Historically, JPM has tended to outperform both Estimize and the Street on earnings, 65% and 77% of the time, respectively. This quarter, Estimize predicts EPS to be $1.63 and the Street predicts EPS at $1.60. Regarding revenue, the stock tends to outperform both Estimize and the Street 61% […]

PayPal Rises After Being Added As Payment Option By Apple

Jul 12, 2017

Jeremy Parkinson

Finance

PayPal (PYPL) is rising after Apple (AAPL) added it as a payment option, which JPMorgan analyst Tien-tsin Huang sees as a “significant,” but difficult to size, win for the payment company. Also viewing the announcement as positive, his peer at Craig-Hallum argued that this is the type of “expanding relationships” that makes PayPal a potential […]

The Law Of 2%

Jul 12, 2017

Jeremy Parkinson

Finance

It would be preferable, of course, if what Janet Yellen said in any setting made little noise whatsoever. We aren’t nearly there yet, but are moving in that direction. Her testimony today before Congress in the Fed’s semi-annual Humphrey-Hawkins kabuki relic might actually help in that matter. If economists like Yellen were caught so unprepared […]