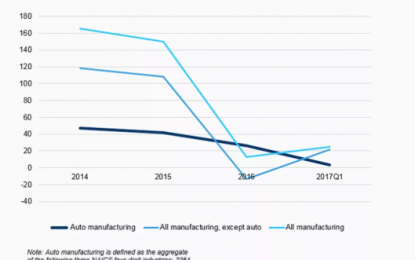

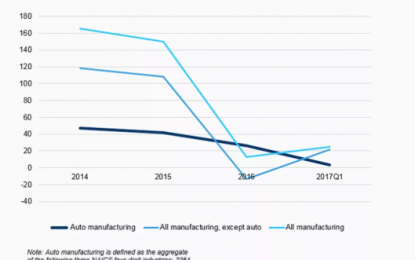

Auto Time Bomb: Slowdown Coming Up, Manufacturing Has Peaked This Cycle

Jul 13, 2017

Jeremy Parkinson

Finance

The Brookings Institute says Auto slowdown Flashes Caution Lights for Manufacturing Employment and Trump. A switch to self-driving, trends towards electric, and a glut of used cars are all in the spotlight. After seven years of strong growth following the 2008 economic crisis and federal bailouts of both General Motors (GM) and Chrysler (FCAU), auto sector […]

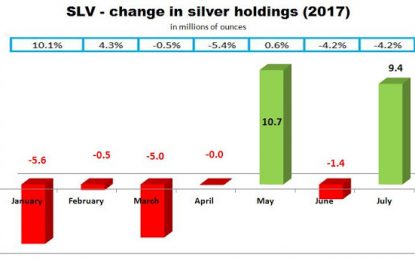

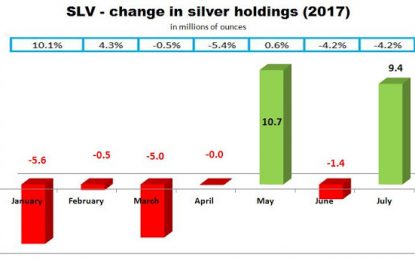

Silver – The Demand In Action

Jul 13, 2017

Jeremy Parkinson

Finance

Although for the last two days gold and silver regained some ground but, generally, precious metals investors feel a lot of pain this year. For example, on July 10 the silver was trading at this year’s lowest level so far. However, it looks like lower prices of silver attracted a bunch of investors who started aggressive accumulation […]

Stocks Watch-List: WB, A, QSR

Jul 13, 2017

Jeremy Parkinson

Finance

Today’s stock picks: Long Weibo (WB) Long Agilent Technologies (A) Short Restaurant Brands International (QSR)

EUR/USD Forex Signal – Thursday, July 13

Jul 13, 2017

Jeremy Parkinson

Finance

Yesterday’s signals were not triggered as there was no bullish price action at 1.1461. Risk 0.75%. Trades may be entered before 5pm London time today only. Long Trades Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1409 or 1.1382. Place the stop loss 1 pip […]

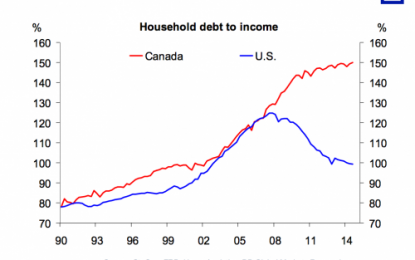

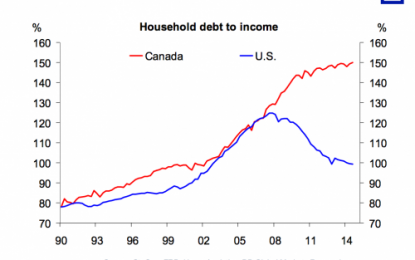

“Canada Is In Serious Trouble” Again, And This Time It’s For Real

Jul 13, 2017

Jeremy Parkinson

Finance

Some time ago, Deutsche Bank’s chief international economist, Torsten Slok, presented several charts which showed that “Canada is in serious trouble” mostly as a result of its overreliance on its frothy, bubbly housing sector, but also due to the fact that unlike the US, the average household had failed to reduce its debt load in time. Additionally, […]

Fed Yellen’s Testimony: Uncertainty About Inflation A Signal Of Slower Pace Of Further Hikes – ABN AMRO

Jul 13, 2017

Jeremy Parkinson

Finance

Fed Chair Janet Yellen said they are monitoring inflation closely, but also expressed optimism about the economic situation. What does it mean for the Fed? Here is the view by ABN AMRO: Here is their view, courtesy of eFXnews: ABN AMRO Research comments on Fed Yellen’s testimony before the Congress. “Although the Fed seemed to stick to […]

EUR/USD Bearish Momentum At 1.15 Could Start Wave 4 Retracement

Jul 13, 2017

Jeremy Parkinson

Finance

EUR/USD 4 hour The EUR/USD bullish breakout reached the 1.15 target but then fell quickly down to 1.14. The bearish reaction could indicate that the waves 5 have been completed within wave 3 (green), which could indicate the start of a bearish retracement within wave 4 (green) towards the Fibonacci retracement levels of wave 4 […]

![EUR/USD: Price Has Restored To The 45th Degree]()

EUR/USD: Price Has Restored To The 45th Degree

Jul 13, 2017

Jeremy Parkinson

Finance

Previous: On Wednesday, trading on the euro closed down. Market volatility was high as Janet Yellen’s pre-prepared remarks were published. She remarked that the US economy was growing fast enough for another rate hike and plans to continue normalising the Fed’s balance sheet. The dollar strengthened against its major rivals on this news. In theory, […]

Indian Indices Continue Momentum; Sensex Hits 32,000

Jul 13, 2017

Jeremy Parkinson

Finance

After opening the day on a positive note, stock markets in India have continued their momentum. Sectoral indices are trading on a positive note with stocks in the FMCG sector and realty sector witnessing maximum buying interest. The BSE Sensex is trading up 235 points (up 0.7%) and the NSE Nifty is trading up 67 points (up 0.7%). The BSE Mid Cap index is trading up by […]

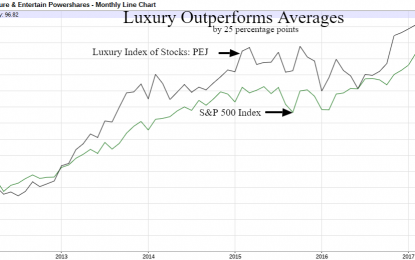

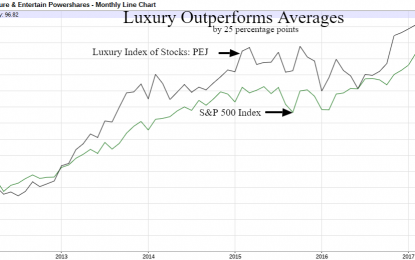

Luxury Bull Market

Jul 13, 2017

Jeremy Parkinson

Finance

The wall of worry continues to propel stocks higher as this long plodding economic expansion is assumed to be in the later innings. With low interest rates and slow growth, many are still waiting for the the full throated recovery to manifest. However, for the luxury and leisure world the good times just keep rolling. […]