Bitcoin Showdown

Jul 12, 2017

Jeremy Parkinson

Finance

Investment guru Bill Miller and his son, Bill Miller IV, are big bitcoin bulls, believing the digital currency whose price has soared this year is bound for disruptor status. “It is a true disruptor and true innovation in money,” the elder Miller told CNBC. “We haven’t seen that in thousands of years.” Everything is affected by this technology, […]

“Buy All The Things” – Yellen’s Dovish Flip Sparks Bid In Stocks, Bonds, Bullion, & Bitcoin

Jul 12, 2017

Jeremy Parkinson

Finance

Did The Fed just step in to replace the Trump premium as Junior’s email dashes hopes of tax breaks further? Timing is certainly interesting… Equities and Treasuries rose and the dollar sank after markets interpreted Chair Yellen’s testimony before Congress as dovish even as it echoed the most recent FOMC statement. The rally was aided as […]

Hot Options Report: End Of Day – Wednesday, July 12

Jul 12, 2017

Jeremy Parkinson

Finance

Most Active Equity Options And Strikes For The End Of Day, July 12, 2017

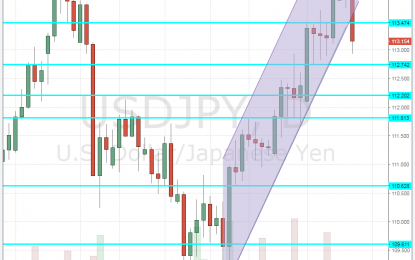

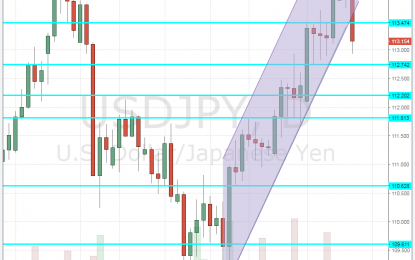

USD/JPY Slipping Off Steep Uptrend Support – Big Downfall Coming?

Jul 12, 2017

Jeremy Parkinson

Finance

USD/JPY has been riding the tiger in recent weeks: climbing off 108.80 all the way to 114.50 at a fast clip. The 600+ pip move higher took less than a month. On its way, the pair made symbolic drops to mark a line of uptrend support, which was quite steep. The momentum was strong enough […]

Potential Further Yield Curve Steepening

Jul 12, 2017

Jeremy Parkinson

Finance

Earlier this year I used the positioning in the 10-year bond to predict a rally which lasted for over 3 months. It ended recently as yields have risen about 35 basis points in the past few weeks. Now we’re at a similar point with the 2-year bond. As you can see from the chart below, […]

Oh No, Not ‘Dovish’ At All

Jul 12, 2017

Jeremy Parkinson

Finance

It is hypocritical, I suppose, to claim that Janet Yellen is irrelevant while at the same time constantly writing about the oblivious things she says. The Fed doesn’t matter but we need to obsessively focus on monetary policy anyway. Often the reasoning is upside down. By that I mean, we hope that by highlighting how […]

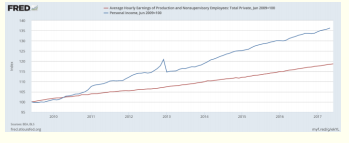

Central Banks Are Waking Up

Jul 12, 2017

Jeremy Parkinson

Finance

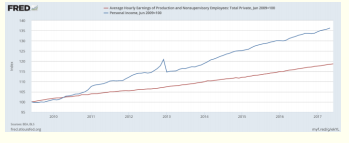

Central Banks are slowly waking up to the fact that they cannot fix structural economic issues. In fact, evidence from the great monetary experiment of the last decade, indicates that they probably enhance them. The real economic problem is growing income inequality. Real economic growth is dependent on middle class consumption, and absent real wage […]

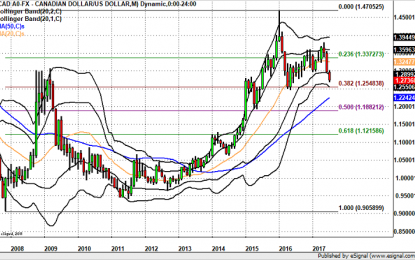

USD/CAD To 1.25

Jul 12, 2017

Jeremy Parkinson

Finance

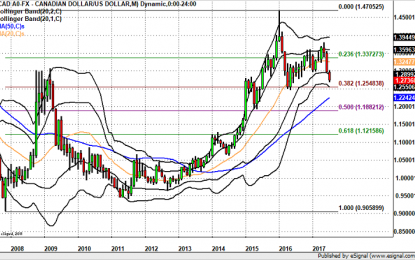

USD/CAD dropped through 3 big figures as the Canadian dollar rose to its strongest in nearly a year versus the U.S. dollar. As expected the Bank of Canada raised interest rates by 25bp and upgraded their 2017 and 2018 GDP forecasts. They attributed the slowdown In inflation to temporary factors and while Governor Poloz said […]

IBM Facing Tough Fight To Win In AI Despite Watson’s Strengths

Jul 12, 2017

Jeremy Parkinson

Finance

In a research note this morning, Jefferies analyst James Kisner cut his price target for IBM (IBM) saying that while the company may offer one of the more mature cognitive computing platforms today, the “hefty services” component of many Artificial Intelligence deployments will be a hindrance to adoption. TOUGH FIGHT IN AI: Jefferies’ Kisner lowered […]

JPM Vs. Citigroup: Which Is Better Ahead Of Earnings?

Jul 12, 2017

Jeremy Parkinson

Finance

Key bank earnings are scheduled for release this Friday which are likely to provide a better understanding of the sector’s prospects in the near future. Banking stocks were buoyed by their success in the recently conducted stress tests. Moreover, the Federal Reserve has allowed all sector heavyweights to go ahead with their capital spending plans. […]