Are ETFs And Index Funds More Dangerous In A Bear Market?

Jul 17, 2017

Jeremy Parkinson

Finance

Here’s an interesting claim I see more and more often: “The nature of ETFs and passive investment is worth noting. A vanilla S&P 500 ETF, for example, effectively puts company and sector fundamentals to one side and buys or sells 500 stocks at a time. This is fine in a rising market, but potentially dangerous in […]

Five Stocks To Watch – Monday, July 17

Jul 17, 2017

Jeremy Parkinson

Finance

Bank of America (BAC): Financials – Diversified Financial Services | Reports July 18, before the open. The Estimize consensus calls for EPS of $0.46, three cents higher than Wall Street consensus and an increase of 28% YoY. Currently, the Estimize community is looking for sales of $22.25B, also higher than Wall Street’s $21.91B. Since […]

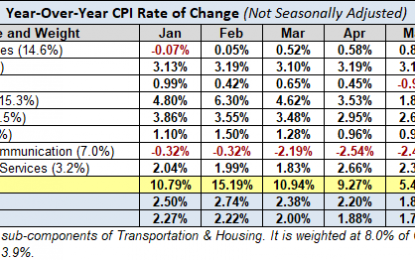

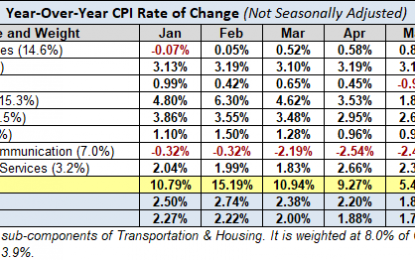

Inflation: An X-Ray View Of The Components – Monday, July 17

Jul 17, 2017

Jeremy Parkinson

Finance

Here is a table showing the annualized change in Headline and Core CPI, not seasonally adjusted, for each of the past six months. Also included are the eight components of Headline CPI and a separate entry for Energy, which is a collection of sub-indexes in Housing and Transportation. We can make some inferences about how […]

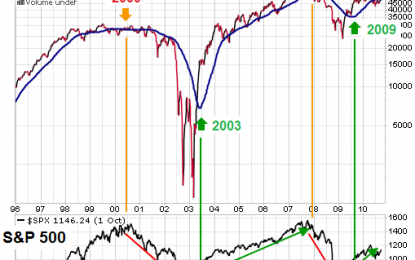

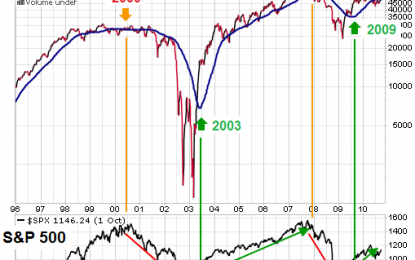

Is Volume/Breadth Aligned With Bullish Case?

Jul 17, 2017

Jeremy Parkinson

Finance

An August 2016 analysis outlined a long-term bullish signal for stocks that has occurred only ten other times in the last thirty-five years. If we fast forward to July 2017, is market breadth/volume aligning with or contradicting bullish data we have in hand? The chart below shows up/down volume (1996-2010) for the NYSE Composite Stock Index, along with its […]

S&P 500 ETFs Face Off: SPY Versus IVV

Jul 17, 2017

Jeremy Parkinson

Finance

The S&P 500 is marching higher, hitting multiple fresh highs amid Washington turmoil, geopolitical risks, decline in oil price and lofty valuation. The benchmark has risen about 9.8% in the year-to-date timeframe buoyed by strong corporate earnings, accelerating economic activity, continued job gains and improving consumer confidence. The trend is likely to continue in the […]

USD/JPY June Rebound Unravels, Bearish RSI Trigger Takes Shape

Jul 17, 2017

Jeremy Parkinson

Finance

Ticker Last High Low Daily Change (pip) Daily Range (pip) USD/JPY 112.74 112.87 112.33 19 54 USD/JPY may continue to give back rebound from the June-low (108.80) as market participants push back bets for the next Fed rate-hike. The Bank of Japan’s (BoJ) July 20 meeting is likely to spark a limited reaction in USD/JPY […]

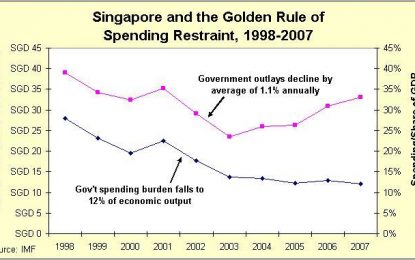

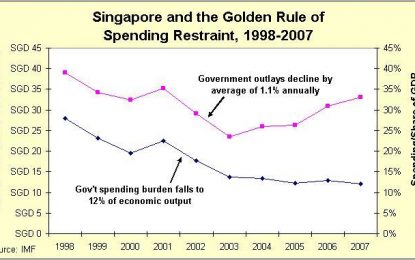

The Recipe For Singapore’s Prosperity

Jul 17, 2017

Jeremy Parkinson

Finance

Singapore is one of my favorite nations for the simple reason that it consistently gets very high scores from Economic Freedom of the World and the Index of Economic Freedom (as well as from Doing Business, Global Competitiveness Report, and World Competitiveness Yearbook). I also greatly admire Singapore’s for a 10-year period beginning in the late 1990s. Government spending actually shrank by […]

China’s Ghosts Are A Future Property

Jul 17, 2017

Jeremy Parkinson

Finance

The term “ghost city” is a loaded one, often deployed to skew toward a particular viewpoint. In the context of China’s economy, it has become shorthand for perhaps the largest asset bubble in human history. While that may ultimately be the case, in truth China’s ghost cities aren’t about the past but its future. There […]

EUR/USD Elliott Wave Forecast: Bullish Impulse

Jul 17, 2017

Jeremy Parkinson

Finance

The bullish trend is present in EUR/USD currency pair, 15 minutes chart. The price of EUR/USD currency pair is going to rise up now on a short-term basis to create a Bullish Impulse Elliott wave pattern and Spot Forex traders should consider taking a possible buy trading chance. Strong key support level is present at 1.1433 […]

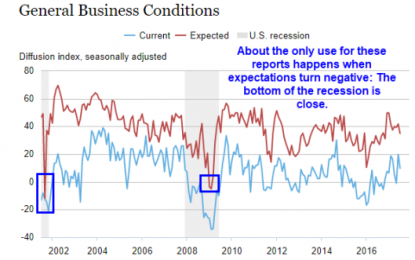

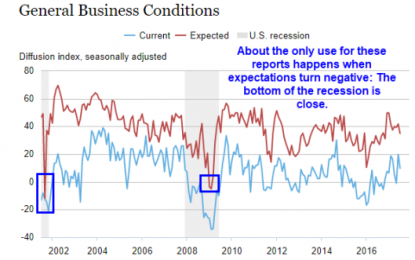

Empire State Manufacturing: Another Strong Regional Report Bearing Little Resemblance To Reality

Jul 17, 2017

Jeremy Parkinson

Finance

I have not commented on the regional manufacturing reports much lately because they bear no resemblance to reality. Setting reality aside, let’s take a look at the Empire State Survey which kicks off another month of regional surveys. The Econoday consensus estimate for the Empire State region diffusion index was 15. The actual report was +9.8. Econoday praised this meaningless […]