Has This Time Been Different?

Jul 16, 2017

Jeremy Parkinson

Finance

One of the main tenets at this space has been to cut away the extremes in your [equity] investing strategy. There are those who see market tops and imminent crashes everywhere, and then there are those who believe debt-financed share buybacks and dividend payments can continue to propel the market higher forever. They are both wrong, but the […]

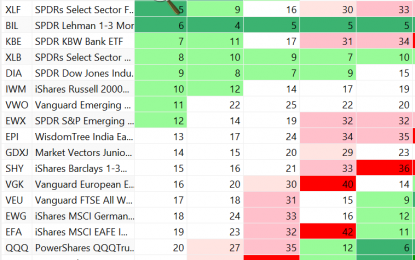

Momentum Rankings

Jul 16, 2017

Jeremy Parkinson

Finance

Momentum rankings for last week (July 14) follow: Momentum Rankings The highest momentum rankings have been quite stable for the last three weeks. Biotech has been unusually strong.

Oil Forecasters Have To Work Harder

Jul 16, 2017

Jeremy Parkinson

Finance

Those in the oil industry who take a long view increasingly worry about insufficient new supply. It’s hardly today’s problem, with crude oil back to the mid $40s as OPEC’s production cuts are offset by increased shale output. But depletion of existing fields is generally believed to take 3-4 million barrels a day (MMB/D) off […]

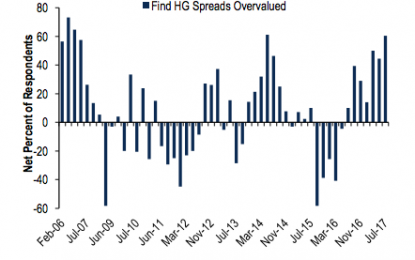

BofAML Clients Now Expect A Credit Selloff

Jul 16, 2017

Jeremy Parkinson

Finance

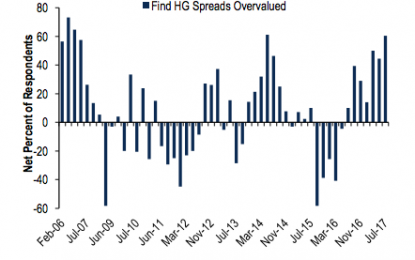

Listen, here’s the thing: at some point, credit markets are going to wake up. Now I’ll confess I have no idea when that’s going to be and if the last 13 months have taught us anything, it’s the DM central bank liquidity tsunami is capable of keeping spreads near their post-crisis tights even in the […]

Why 125 USD Is Critical To Ethereum’s Bull Market

Jul 16, 2017

Jeremy Parkinson

Finance

The price of Ethereum has collapsed in recent weeks. It touched $415 intra-day just 5 weeks ago. Now it is trading around $180, a 55 percent decline. Is this the end of the bull market in Ethereum? The answer to that question is very simple: Ethereum’s price must hold $180 and, ultimately, $125 in order to continue […]

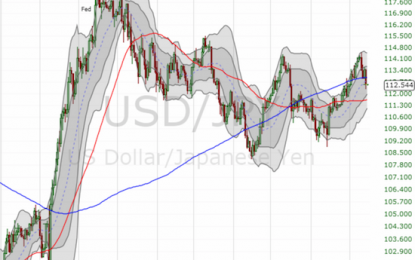

Forex Critical: Speculators Ride The Wave Against The Japanese Yen

Jul 16, 2017

Jeremy Parkinson

Finance

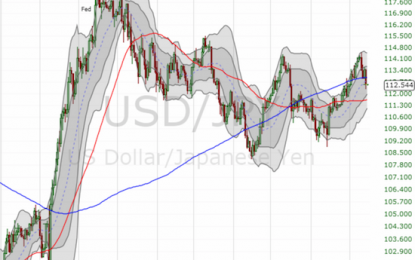

The Japanese yen (FXY) is the one major currency that has been notably weaker than the U.S. dollar for most of the past month. USD/JPY peaked in December, 2016, but it looks like the sell-off bottomed out in April. Source: FreeStockCharts.com Against the U.S. dollar, the Japanese yen was never able to reverse the Trump bump […]

This Is The Analyst That Made Nvidia Spike 4% In One Day

Jul 16, 2017

Jeremy Parkinson

Finance

Shares in chipmaker Nvidia (Nasdaq:NVDA) exploded by 4% following a belated upgrade from SunTrust Robinson analyst William Stein. Nvidia closed on July 12 up $6.63 to $162.51. And shares continued to rise for the rest of the week, finishing on Friday at a very strong $164.95. Nvidia is a major player in the fast-growing artificial intelligence (AI) […]

This Sector Is Ready To Move

Jul 16, 2017

Jeremy Parkinson

Finance

This sector is showing the price pattern known as the ‘heart’, it is ready to move. Last time we saw this pattern price doubled. With reference to our swing trade idea of long Barrick Gold (Symbol:ABX) the sector is setting up again, for a big move. Get ready and time your entry!. Click for popup. Clear […]

U.S. Producer Prices Up: ETFs In Focus

Jul 16, 2017

Jeremy Parkinson

Finance

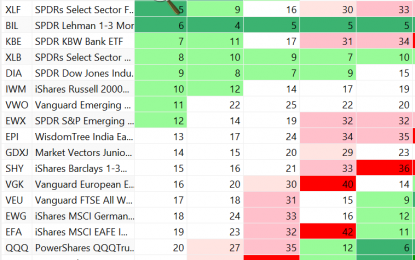

A measure of U.S. wholesale price inflation ticked up in June. U.S. producer prices rose in June, owing to increases in the cost of services. Prices for services edged up 0.2% in June, contributed almost 80% of the increase in the index. In June 2017, the producer price index (PPI) grew 2% year over year compared with […]

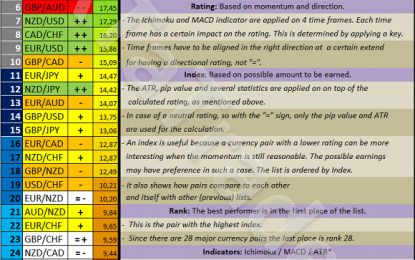

Forex Metrics And Chart Week 29 / 2017

Jul 16, 2017

Jeremy Parkinson

Finance

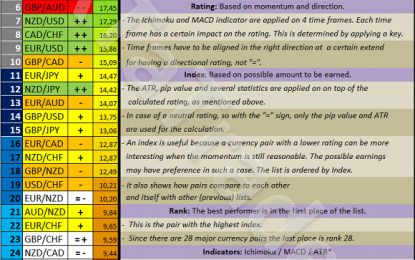

The Top 10 of the Ranking and Rating list for the coming week shows the following stronger currencies being well represented for going long: the AUD(4X) with the CAD(4X) . The weaker currencies are the USD(4X) followed by the JPY(2X) and the CHF(2X). By diversifying a nice combination can be traded in the coming week like e.g.: […]