EUR/USD Bullish Bounce And Breakout Reaches First Target At 1.15

Jul 12, 2017

Jeremy Parkinson

Finance

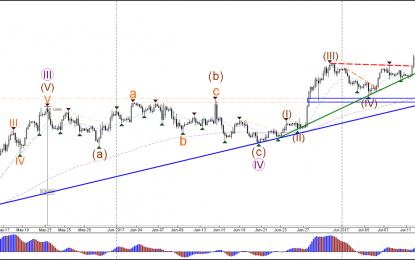

EUR/USD 4 hour The EUR/USD bounced at the support trend line (green) and then broke above the previous top (red). Price has now reached the 1.15 target which could cause a potential retracement. A break above 1.15 could see price continue with the uptrend towards the 61.8% Fibonacci target at 1.1550. 1 hour The EUR/USD […]

The VIX Drivers And Outlook

Jul 12, 2017

Jeremy Parkinson

Finance

We discuss the the drivers of the CBOE Volatility Index (VIX) and assess the outlook and possibility for VIX spikes based on where the indicators are tracking. One of the key charts shows 5 different single-factor models which have historically described where the level of the VIX is and provide a guide to where it “should” be based […]

Overview And Intraday Times

Jul 12, 2017

Jeremy Parkinson

Finance

Since 3/1H at 2400.98 SPX, for 4 1/2 months now, we have a net gain of 20 SP’s, suggesting the Bull market has been stalling. Since 6/2 we have been in a narrow (red) sideways channel, since 6/19H we have been in a mild down channel. We are currently stuck in those same red channels, […]

Sensex Opens Marginally Higher; Metal & PSU Stocks Gain

Jul 12, 2017

Jeremy Parkinson

Finance

Asian stocks markets are trading lower in morning trade as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.31% while the Hang Seng is down 0.90%. The Shanghai Composite is down 0.13%. Overnight, the US markets closed flat after volatile trade. Meanwhile, Indian share markets have opened the day marginally higher. BSE Sensex is trading higher by 63 points and NSE Nifty is […]

S&P 500 And Nasdaq 100 Forecast – Wednesday, July 12

Jul 12, 2017

Jeremy Parkinson

Finance

Video Length – 00:01:19 S&P 500 The S&P 500 fell rather dramatically during the day on Tuesday, as word got out that Donald Trump Junior had to release emails involving Russia. However, the market turned right back around and showed its resiliency. By forming a hammer for the daily candle, it’s likely that we will […]

Upbeat U.K. Job/Wage Growth Report To Curb GBP/USD Losses

Jul 12, 2017

Jeremy Parkinson

Finance

Trading the News: U.K. Employment Change A 120K expansion in U.K. Employment paired with a pickup in core household wages may spark a near-term rebound in GBP/USD as it puts pressure on the Bank of England (BoE) to start normalizing monetary policy. Why Is This Event Important: There appears to be a growing rift within in the BoE […]

“Love It” Smoking Gun Hype Vs Reality

Jul 12, 2017

Jeremy Parkinson

Finance

The preposterous anti-Trump drumbeat from mainstream media is never-ending. The latest non-news revelation is Donald Trump Jr posts emails from Russia offering material on Clinton: ‘I love it’. Why should anyone give a rat’s ass? Donald Trump Jr has been forced to release damning emails that reveal he eagerly embraced what he was told was […]

Today The VIX Closed Lower And The SPY Closed Lower

Jul 11, 2017

Jeremy Parkinson

Finance

SPX Monitoring purposes; Covered short on 7/6 at 2409.75=gain 1.2%; Short SPX 6/26/17 at 2439.07 Monitoring purposes Gold: Neutral Long Term Trend monitor purposes: Neutral Above is a sentiment indicator; which is the Rydex Asset Ratio minus bear funds plus money market/Bull assets. This ratio shows that the Rydex traders are leaning in the bullish […]

Quick Shock

Jul 11, 2017

Jeremy Parkinson

Finance

Podcast: Play in new window | Play in new window (Duration: 13:15 — 7.6MB) DOW + 0.55 = 21,409 SPX – 1 = 2425 NAS + 16 = 6193 RUT + 4 = 1413 10 Y – .01 = 2.36% OIL + .70 = 45.10 GOLD + 3.10 = 1218.20 BITCOIN – 1.35% = 2300.63 USD ETHEREUM – 3.79% […]

Will There Ever Be Another Correction?

Jul 11, 2017

Jeremy Parkinson

Finance

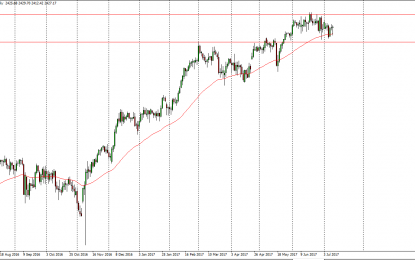

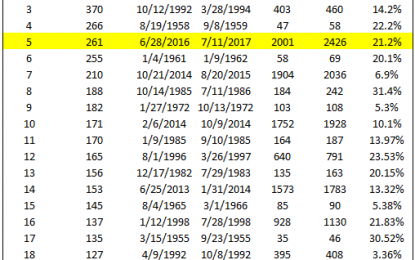

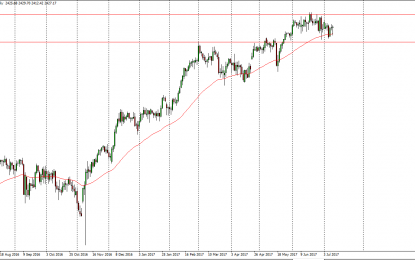

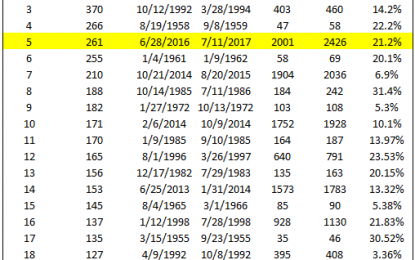

Will there ever be another correction? An absurd question to be sure, but one I’m fielding with increasing frequency these days. Why? It’s been more than a year since the S&P 500 declined as much as 5% from a prior high. That’s quite a long time, now the 5th longest period without a correction in history. […]