U.S. Oil Exports Reduce Trade Deficit With China

Jul 12, 2017

Jeremy Parkinson

Finance

There’s a really exciting story developing in the international trade between the United States and China, two of the world’s largest trading partners. Here, the legalization of oil exports in 2016 from the United States has subsequently led to a rather dramatic surge in exports of petroleum products from the U.S. to China in 2017. China imported nearly 100,000 barrels […]

‘Questioning Your Religion’: Crude Surges On API Data, Underscoring Manic Market

Jul 12, 2017

Jeremy Parkinson

Finance

Somebody asked me earlier if this, out earlier today from Goldman, was a contrarian indicator: Given the recent rebound in net speculative length from its 18-month lows, we believe, however, that a failure for these shifts to materialize soon could push prices below $40/bbl as the market tests OPEC’s and shale’s reaction functions. The answer, at least for […]

Oil Prices Continue Higher

Jul 12, 2017

Jeremy Parkinson

Finance

Oil prices extended their gains at the start of Wednesday’s Asian session after the U.S. government slashed its crude production expectations for next year and fuel inventories declined. U.S. WTI futures were up 1.58 percent at 10:30 a.m. HK/SIN, trading at $45.75 per barrel. Brent crude futures were up 1.33 percent to $48.15 per barrel.These […]

Connecticut Capital Hartford Downgraded To Junk By S&P

Jul 12, 2017

Jeremy Parkinson

Finance

One week ago, Illinois passed its three year-overdue budget in hopes of avoiding a downgrade to junk status, however in an unexpected twist, Moody’s said that it may still downgrade the near-insolvent state, regardless of the so-called budget “deal.” In fact, a downgrade of Illinois may come at any moment, making it the first U.S. state […]

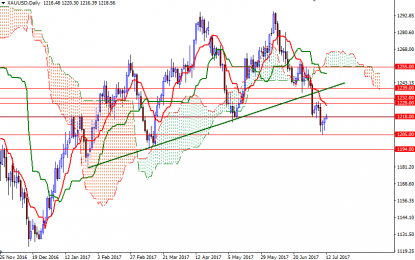

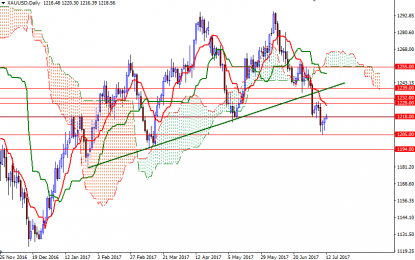

Gold Edges Higher Ahead Of Yellen Testimony

Jul 12, 2017

Jeremy Parkinson

Finance

Gold prices rose yesterday, edging further away from a 4-month low struck earlier this week, as the dollar weakened ahead of an appearance by Federal Reserve chair Janet Yellen in front of a congressional committee. Despite the negative outlook, daily charts show a short-term bottoming out above the $1208-$1205 area. XAU/USD is trading above the […]

USD: Fed Yellen’s Testimony On 3 Topics To Look For – BofAML

Jul 12, 2017

Jeremy Parkinson

Finance

After the troubles of Trump Junior downed the dollar, the next test is Yellen’s testimony. Here is a preview: Here is their view, courtesy of eFXnews: Fed Chair Yellen will be testifying in front of the House Financial Services Committee on Wednesday and Senate Banking Committee on Thursday. Her prepared remarks will be released at 8:30 […]

Crude Oil Prices Eye Inventory Data, Yellen May Drive Gold Lower

Jul 12, 2017

Jeremy Parkinson

Finance

Crude oil prices suffered intraday amid reports that Saudi Arabia breached the output quota it agreed to as part of the OPEC-led production cut effort. The move quickly fizzled however as the markets braced for the release of an updated EIA short-term energy outlook and API inventory flow statistics. The cautious tone proved prescient. The EIA downgraded its forecast for US production and […]

EUR/USD Bullish Bounce And Breakout Reaches First Target At 1.15

Jul 12, 2017

Jeremy Parkinson

Finance

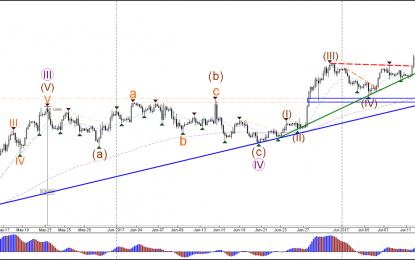

EUR/USD 4 hour The EUR/USD bounced at the support trend line (green) and then broke above the previous top (red). Price has now reached the 1.15 target which could cause a potential retracement. A break above 1.15 could see price continue with the uptrend towards the 61.8% Fibonacci target at 1.1550. 1 hour The EUR/USD […]

The VIX Drivers And Outlook

Jul 12, 2017

Jeremy Parkinson

Finance

We discuss the the drivers of the CBOE Volatility Index (VIX) and assess the outlook and possibility for VIX spikes based on where the indicators are tracking. One of the key charts shows 5 different single-factor models which have historically described where the level of the VIX is and provide a guide to where it “should” be based […]

Overview And Intraday Times

Jul 12, 2017

Jeremy Parkinson

Finance

Since 3/1H at 2400.98 SPX, for 4 1/2 months now, we have a net gain of 20 SP’s, suggesting the Bull market has been stalling. Since 6/2 we have been in a narrow (red) sideways channel, since 6/19H we have been in a mild down channel. We are currently stuck in those same red channels, […]