Choose A Bond Fund For Greater Diversification

Nov 24, 2014

Jeremy Parkinson

Entertainment

Bond funds offer investors an opportunity for diversification and professional management. Fund performance Just because a mutual fund company buys bonds, owners of the fund still must accept certain risks. One example is “interest rate risk,” which means that as interest rates rise, bond values fall. Therefore, the money you invest in a bond fund […]

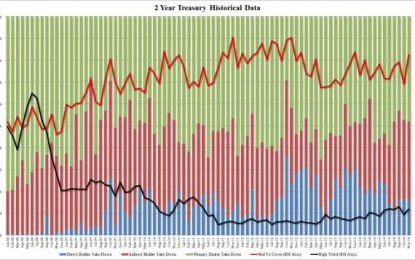

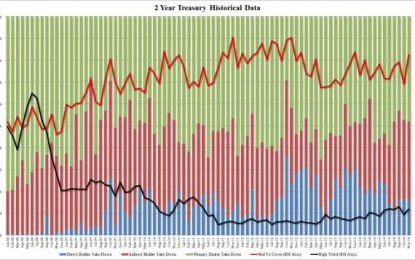

Blistering Demand For 2 Year Paper Send Entire Curve Tighter

Nov 24, 2014

Jeremy Parkinson

Entertainment

If the sellside community was expected to side with the Fed and sell Treasury paper, especially near maturities, then today’s 2 Year auction, which just priced at a hot 0.542%, or 1.1 bps through the 0.553% When Issued, indicated more than ample demand for Treasury paper. Further confirming the demand was the surging Bid to […]

Russian Triangle

Nov 24, 2014

Jeremy Parkinson

Entertainment

Although I wouldn’t short a U.S. ETF with a 10 foot pole these days, I am totally comfortable shorting Russia at present price levels:

Newmont Mining (NEM) Prepays $100M Of $575M Term Loan

Nov 24, 2014

Jeremy Parkinson

Entertainment

Newmont Mining Corporation (NEM – Analyst Report) has prepaid $100 million toward a 5-year $575 million unsecured amortizing term loan received in Mar 2014. The term loan was utilized to repay $575 million of convertible debt which matured in Jul 2014. The $100 million prepayment also includes the proceeds received by Newmont after the government of Suriname exercised […]

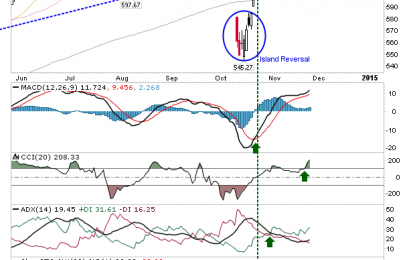

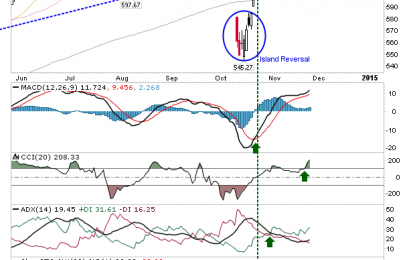

Semiconductors Continue To Gain

Nov 24, 2014

Jeremy Parkinson

Entertainment

Again, it was left to Semiconductors to do the leg work for the day as it added nearly 1%. The question is whether strength in this index will contribute to further gains for the Nasdaq and Nasdaq 100. The ‘bull trap’ in the Semiconductor index is now negated. The Nasdaq 100 is up against […]

Deutsche Bank’s Modest Proposal To Central Banks: “Purchase The Gold Held By Private Households”

Nov 24, 2014

Jeremy Parkinson

Entertainment

From the bank that a few days ago informed us that “People Are Talking About Helicopter Money And Debt Cancellation Being The End Game”, comes the logical next step. Here it is, without commentary and the key section highlighted: From Deutsche bank Behavioral Finance: Daily Metals Outlook Although gold market operators are currently pre-occupied with […]

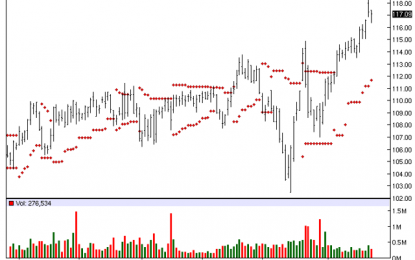

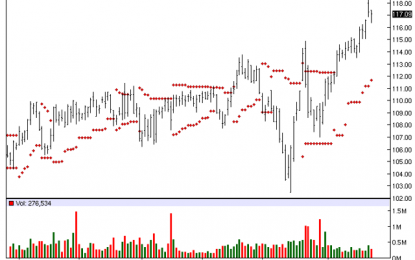

Airgas: Chart Of The Day

Nov 24, 2014

Jeremy Parkinson

Entertainment

The Chart of the Day belongs to Airgas (NYSE:ARG). I found the stock by sorting the All Time High List for the stocks with the most frequent new highs In the last month then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 10/21 the stock gained 2.85%. […]

Gold Daily And Silver Weekly Charts – Quiet Options Expiration On The Comex

Nov 24, 2014

Jeremy Parkinson

Entertainment

Today was the last option expiration for 2014 Comex precious metal options. Gold and silver were under slight pressure most of the day, but closed largely unchanged. Gold was down about five dollars while silver was up a penny. Let’s see how the trade winds down this week. A nor’easter is expected to work its […]

Market Commentary: Markets Closed Quietly, New Closing Highs On Large Caps

Nov 24, 2014

Jeremy Parkinson

Entertainment

Written by Gary Markets remained in the green and the DOW sea-sawed back and forth across the unchanged line remaining mostly flat. The small caps melted higher while the SP500 traded sideways in a narrow four point range all day on sometimes anemic volume. By 4 pm the SP500 and DOW closed on new closing highs […]

Another Keynesian Debt Boondoggle: How Brussels Plans To Turn $26 Billion Into $390 Billion

Nov 24, 2014

Jeremy Parkinson

Entertainment

The desperation and fraud of the Keynesian policy apparatus gets more stunning by the day. Apparently, the pettifoggers in Brussels will soon be announcing a new $400 billion bazooka to blast the euro-economy out of its lethargy. This massive new “stimulus” is supposed to spur all manner of infrastructure and private investment that is purportedly bottled-up for want of […]