Morning Call For November 24, 2014

Nov 24, 2014

Jeremy Parkinson

Entertainment

OVERNIGHT MARKETS AND NEWS December E-mini S&Ps (ESZ14 +0.24%) this morning are up +0.18% and European stocks are up +0.99% at a 1-3/4 month high after German business confidence unexpectedly rose for the first time in 7 months. European bank stocks and government bonds also rose on speculation the ECB will expand stimulus after ECB President […]

Central Banks: When We Succeed, We Fail

Nov 24, 2014

Jeremy Parkinson

Entertainment

Goosing stocks ever higher will eventually push wealth inequality to the point that it unleashes social instability. Central banks around the world share a few simple goals: 1. Defeat deflation by sparking inflation–in the cost of goods and services, not wages. 2. Weaken the currency to boost exports and counter beggar thy neighbor devaluations by other exporting […]

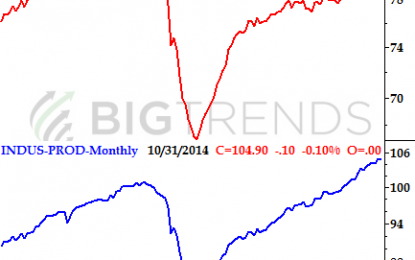

Oil & Dollar At Crucial Long-Term Areas – Weekly Market Outlook

Nov 24, 2014

Jeremy Parkinson

Entertainment

While the release of the Federal Reserve’s meeting minutes on Wednesday of last week was supposed to be catalytic, the market seemed a little disappointed – and disinterested – in the fact that Janet Yellen and her cohorts didn’t really say much (or decide much) of anything during last month’s gathering. It wasn’t until Friday’s […]

Facebook Looking To Profit With News

Nov 24, 2014

Jeremy Parkinson

Entertainment

Facebook Inc. (NASDAQ:FB)’s desire to become a reliable ‘personal newspaper’ for its world-wide user base could mean more trouble for the ailing news media segment. Editorial decisions about what users read will not be decided from a journalistic perspective, but rather from an algorithmic standpoint. In other words, Facebook will target readers with news they […]

Financial Repression Authority With Axel Merk

Nov 24, 2014

Jeremy Parkinson

Entertainment

Gordon T. Long and Axel Merk discuss financial repression. Audio Length: 00:24:42

A Conversation

Nov 24, 2014

Jeremy Parkinson

Entertainment

Imagine a financial adviser* approached you with an investment opportunity** without telling you specifically what it was. And right up front he tells you it’s likely to generate a zero to negative return over the coming decade. What would you say? I imagine any investor with any common sense would respond by saying something like, […]

Germany Surprises, Helps Euro Tick Up

Nov 24, 2014

Jeremy Parkinson

Entertainment

The US dollar has begun the holiday-shortened week on a firm note, but the stronger than expected German IFO report helped steady the euro near $1.2400. Although Japanese markets were closed earlier today, the dollar rebounded toward JPY118.40, as participants recognize official jawboning was more about the pace of the yen’s decline than the level. The […]

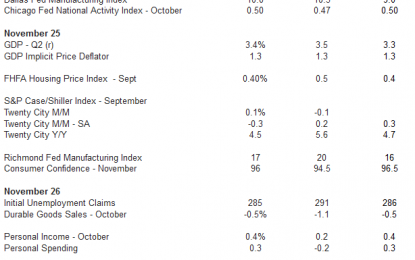

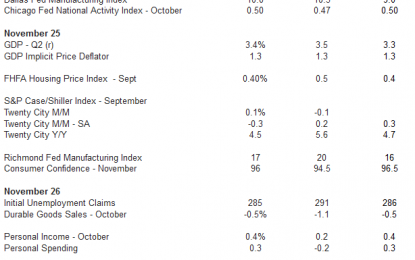

The Week Ahead: Forecast For Upcoming Economic Reports

Nov 24, 2014

Jeremy Parkinson

Entertainment

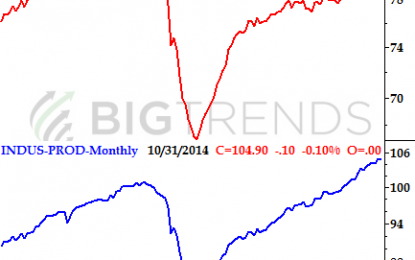

This week markets will focus on the revised GDP report, which the consensus shows falling a bit from last month’s flash estimate of 3.5 percent. Potentially upsetting markets, the consensus expects durable goods orders fell 0.5 percent in October; however, that would be mostly adjustments in the volatile transportation sector—dominated by the lumpiness in aircraft […]

China SGE Gold Withdrawals For Week 52 Tonnes

Nov 24, 2014

Jeremy Parkinson

Entertainment

The Shanghai Gold Exchange withdrawals were 52.26 tonnes for the week ending 14 November. To put this into perspective, there are a total of 27 tonnes of gold bullion in the registered ‘deliverable’ at these prices category in all the Comex warehouses now. That’s only a few days supply work in Shanghai. The point of this, […]

Stocks: What Do The Charts Say Now?

Nov 24, 2014

Jeremy Parkinson

Entertainment

Things have happened fast over the past four weeks. Video takes a step back and looks at the new evidence that has surfaced in the stock market since the October 15 low. Video Length: 00:16:35