Retail Sales Weren’t Soft

May 15, 2015

Jeremy Parkinson

Finance

Headline writers were falling all over themselves yesterday to get the news out that retail sales were weaker than the Street conomist crowd consensus guess. The stock market soared as trading algos surmised that this meant that the Fed won’t raise rates anytime soon. There’s just one problem. As so often is the case, the […]

Weakness In Corporate Revenue Is A Bad Sign For ‘Buy-N-Hold’ Investors

May 15, 2015

Jeremy Parkinson

Finance

There is one thing that has always nagged me during the 2nd longest bull market run in U.S. history. Corporations have roughly the same revenue per share today as they did halfway through 2007. And yet, sales growth per stock share has only recovered to the pre-crisis levels of 2007, whereas the S&P 500’s price […]

Buy-Write Funds: Got You Covered

May 15, 2015

Jeremy Parkinson

Finance

Fairly early in an investor’s development comes the lesson about covered call writing. The lecture usually sounds like this: “Income can be generated in a flat market by writing calls against assets held in portfolio.” Well, you probably noticed the domestic equity market has been churning on either side of unchanged over the past month. […]

E

From Dividends To EPS – Why Stock Prices Are What They Are, Part 2

May 15, 2015

Jeremy Parkinson

Finance

<< Read Part 1: Why Stock Prices Are What They Are This is the second installment in a series that explains why stocks are priced as they are (or for those who prefer a more precise view, why supply and demand trends for a stock are such as to cause the two to converge at […]

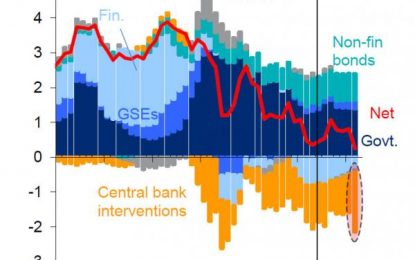

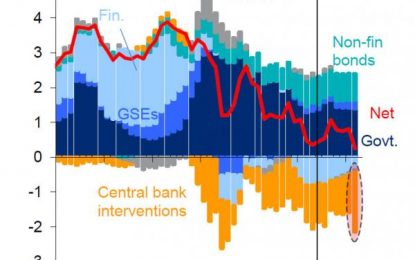

So You Want To Fight The Central Banks? Then Short Treasurys

May 15, 2015

Jeremy Parkinson

Finance

Following the great financial crisis in which capitalism was almost wiped out due to too much debt, a funny thing happened on the path to recovery (paved with some $57 trillion in even more debt) – Quantiative Easing, that deus ex conceived by central bankers as the miracle tool that would fix the world, stopped working. And it stopped working […]

The Big Four Economic Indicators: Industrial Production

May 15, 2015

Jeremy Parkinson

Finance

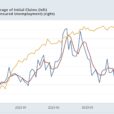

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. This committee statement is about as close as they get to identifying their method. There is, however, a general belief that there are four big indicators that the committee weighs […]

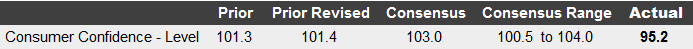

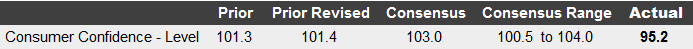

Consumer Confidence Plunges Below Any Economist’s Estimate; Consumers Shock Economists

May 15, 2015

Jeremy Parkinson

Finance

Consumer confidence is the third miss by economists in a single day. Please consider the Bloomberg Consensus Estimate for Consumer Confidence. Consumer confidence has fallen back noticeably this month, down more than 6 points to a much lower-than-expected 95.2. This compares very poorly with the Econoday consensus for 103.0 and is even far below the Econoday […]

Big Surprise; Greece Demands An Emergency Meeting With The Euro-Group

May 15, 2015

Jeremy Parkinson

Finance

As expected, Greece was able to make the 750M EUR payment to the International Monetary Fund last Tuesday but in order to get its hands on the cash, the country had to force all of its public service departments to fork over the remaining cash they had left. Source As we were warning in a previous […]

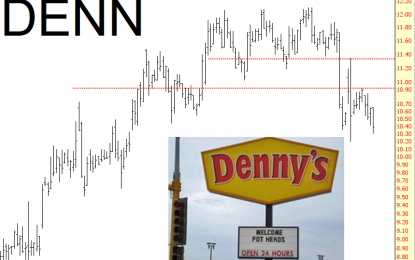

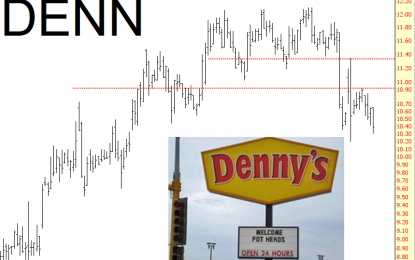

Grand Slam

May 15, 2015

Jeremy Parkinson

Finance

I confess to being baffled by the strength of Denny’s over the past year or two. That bafflement, combined with the chart, compelled me to short it a few days ago at $10.72.

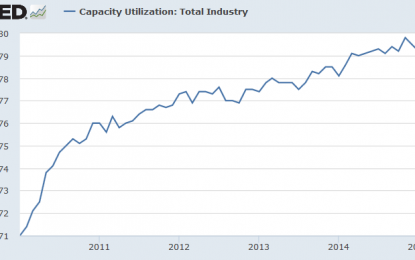

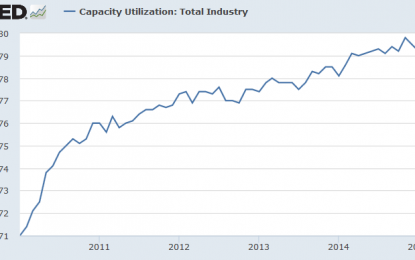

Fall In Capacity Utilization Reflects The Effective Demand Limit

May 15, 2015

Jeremy Parkinson

Finance

The Effective Demand limit upon the economy is not a very visible concept in the econo-blogosphere. Yet, it represents a limit upon the utilization of labor and capital toward the end of a business cycle. When real GDP reaches its effective demand limit, normally we would see capacity utilization peak and start to fall. Capacity […]