Is The Value Style Outperformance Sustainable?

Mar 12, 2016

Jeremy Parkinson

Finance

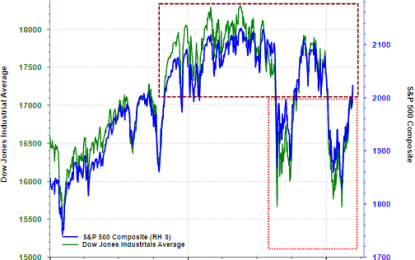

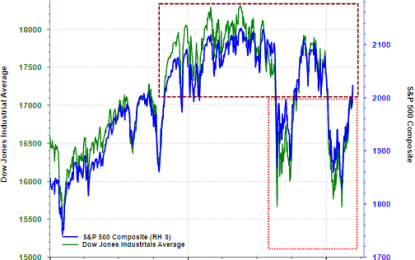

Until the market’s (S&P 500 Index) recent rebound from the February 11, 2016 low, investors have essentially gone two years with flat returns in stocks. Certainly it has not been a market that has just traded sideways, but one with significant volatility, both up and down. The most recent recovery has pushed the S&P 500 […]

E

Markets Weekend Update – March 12, 2016

Mar 12, 2016

Jeremy Parkinson

Finance

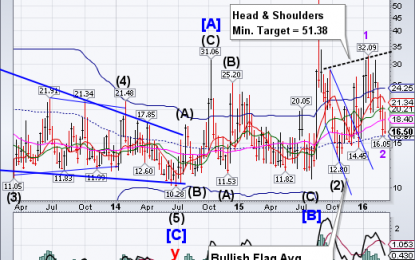

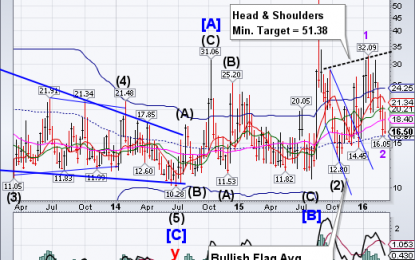

VIX made a wide swing between weekly Intermediate-term resistance at 20.21 and weekly mid-Cycle support at 15.97, but did not make a new low. An aggressive buy signal (NYSE sell signal) may be confirmed with a rise above Long-term support/resistance at 18.40. A breakout above the neckline suggests a very robust follow-through rally that may […]

Financial Market Liquidity Isn’t That Important For The Economy As A Whole

Mar 12, 2016

Jeremy Parkinson

Finance

Photo Credit: Ricardinyo || Secondary Markets are *not* the gears of the capitalist economy Okay, time for some secular economic and financial heresy, which is always somewhat fun. Secondary market liquidity isn’t very important to the functioning of the general economy of the capitalist world, including the US. (That said, my exceptions to this statement are listed […]

Low Volume Gains Tempers Strong Finish

Mar 12, 2016

Jeremy Parkinson

Finance

A brief update as work travel keeps me away from my blog. A strong finish to the end of week was tempered by the relatively light volume which came with the buying. The S&P knocked on the door of the 200-day MA on solid technical strength. It will be important for buyers to keep buying pressure […]

94% Success This Week

Mar 12, 2016

Jeremy Parkinson

Finance

This week was really incredible.I took 18 trades, and was green on 17, for a 94% success rate. My only loss was on Friday on $SSKN -$57.You can see the highlights from the week below. We had especially strong trades on $LNCO, $LEU $ASTC, and $VCEL. This week we saw extreme strength in the small caps […]

Peabody Energy Follow-Up

Mar 12, 2016

Jeremy Parkinson

Finance

The lottery ticket on BTU has worked pretty quickly. Prices are all over the place on this near-Chapter 11 bond, but I think the offer has gone up to about 7 1/2. I wrote some calls on BTU equity against the position. The logic in this trade is very strong; if the bonds are worth […]

Oil Is So Much More Than A Commodity

Mar 12, 2016

Jeremy Parkinson

Finance

Oil is so much more than a commodity. It’s a force bigger than the $1 trillion market. It’s a weapon, it’s a strategic asset and it’s a curse. Oil can make or break a country, a company, a person. Oil builds fortunes and it makes you poor. And it sets the stage for one of […]

Greenback’s Tone Sours, Sterling May Shine

Mar 12, 2016

Jeremy Parkinson

Finance

The reversal of the US dollar’s gains half way through Draghi’s press conference has undermined the near-term technical tone. The risk is on the downside, at least in the first part of the week, ahead of the FOMC meeting. The US Dollar Index posted an outside down session on March 10. It drove the five-day moving […]

Have The Long-Term Trends Improved? You Can Decide

Mar 12, 2016

Jeremy Parkinson

Finance

21 Charts In This Week’s Video Video Length – 00:31:35

Gold Daily And Silver Weekly Charts – Central Banks As Financial Cosmeticians

Mar 12, 2016

Jeremy Parkinson

Finance

Friday was just one of those days where the ‘invisible hand’ tried to instill some confidence in the wise and benevolent judgement of the money masters, after a central bank, in this case the ECB, does something very visible and ‘lays an egg’ in doing it. So after all this yesterday, are you feeling more […]