Week In Review: Chi-Med To Raise $100 Million In US Offering Next Week

Mar 12, 2016

Jeremy Parkinson

Finance

Deals and Financings Hutchison China MediTech (Chi-Med) (AIM: HCM), a company developing novel drugs for oncology and autoimmune diseases, is scheduled to raise $100 million by listing ADS shares on the NASDAQ exchange (see story). The offering values Chi-Med at $1.9 billion. Each ADS will be equal to one-half of each London-traded Chi-Med share. Chi-Med will […]

Speculators Cut Long Sterling Exposure While Adding To Long Aussie

Mar 12, 2016

Jeremy Parkinson

Finance

The Commitment of Traders reporting period ending March 8 showed little position adjusting ahead of the ECB meeting two days later. A little more than 3/4 of the gross positions we track saw less than 5k contract change and only two were above 6k. The gross long speculative sterling position was cut by a quarter […]

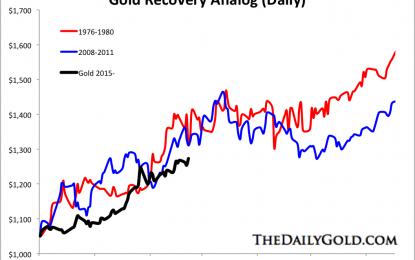

Can Gold Climb To $1400/oz?

Mar 12, 2016

Jeremy Parkinson

Finance

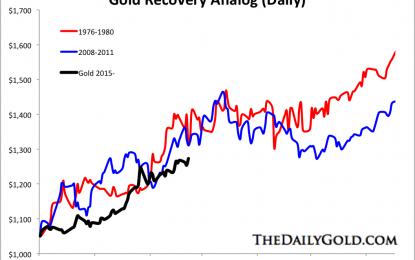

At the start of 2016, renowned fund manager and bond king Jeff Gundlach predicted Gold would surge to $1400/oz. That was quite the call considering Gold was still in a bear market. He reiterated his target a few days ago in a webcast. Gold closed the week below $1260/oz after reaching as high as $1287/oz […]

Flying By The Seat Of Your Pants

Mar 12, 2016

Jeremy Parkinson

Finance

I can “prove”, using sources on the internet, almost anything. Gold going up, gold declining. Market momentum increasing, market crashing. Even studies and research conflicts, and much of it out of date and based on flawed sampling. In fact, most of what I read is simply extrapolated opinion. People tend to believe in something, look […]

GSV Capital Corp. Reports Fourth Quarter And Fiscal Year 2015 Financial Results

Mar 12, 2016

Jeremy Parkinson

Finance

OODSIDE, Calif., March 10, 2016 (GLOBE NEWSWIRE) — GSV Capital Corp. (“GSV Capital” or the “Company”)(Nasdaq:GSVC) today announced financial results for the quarter and fiscal year ended December 31, 2015. Date Net Assets (Millions) Net Asset Value (per share) As of December 31, 2015 $ 268.0 (1 […]

Oil Market Commentary 3-11-2016

Mar 12, 2016

Jeremy Parkinson

Finance

It was a sleepy Friday where we touched $39 a barrel briefly before profit taking into the European close. We have near term support for WTI at $37.22 for the April contract, with the next level of stronger support at the $36.12 area on the charts. If we break $36 a barrel this will signal […]

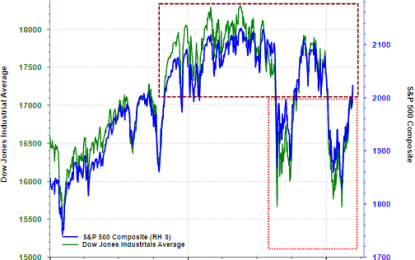

Is The Value Style Outperformance Sustainable?

Mar 12, 2016

Jeremy Parkinson

Finance

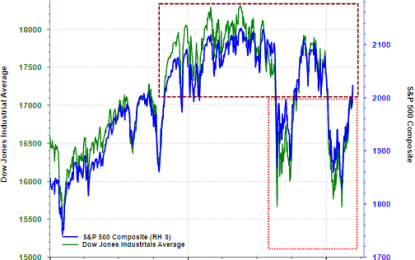

Until the market’s (S&P 500 Index) recent rebound from the February 11, 2016 low, investors have essentially gone two years with flat returns in stocks. Certainly it has not been a market that has just traded sideways, but one with significant volatility, both up and down. The most recent recovery has pushed the S&P 500 […]

E

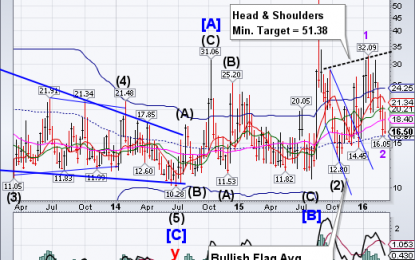

Markets Weekend Update – March 12, 2016

Mar 12, 2016

Jeremy Parkinson

Finance

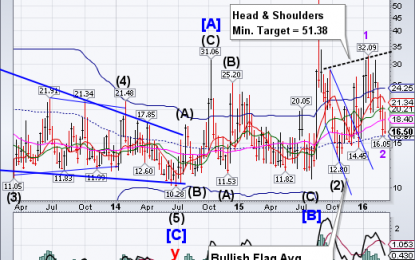

VIX made a wide swing between weekly Intermediate-term resistance at 20.21 and weekly mid-Cycle support at 15.97, but did not make a new low. An aggressive buy signal (NYSE sell signal) may be confirmed with a rise above Long-term support/resistance at 18.40. A breakout above the neckline suggests a very robust follow-through rally that may […]

Financial Market Liquidity Isn’t That Important For The Economy As A Whole

Mar 12, 2016

Jeremy Parkinson

Finance

Photo Credit: Ricardinyo || Secondary Markets are *not* the gears of the capitalist economy Okay, time for some secular economic and financial heresy, which is always somewhat fun. Secondary market liquidity isn’t very important to the functioning of the general economy of the capitalist world, including the US. (That said, my exceptions to this statement are listed […]

Low Volume Gains Tempers Strong Finish

Mar 12, 2016

Jeremy Parkinson

Finance

A brief update as work travel keeps me away from my blog. A strong finish to the end of week was tempered by the relatively light volume which came with the buying. The S&P knocked on the door of the 200-day MA on solid technical strength. It will be important for buyers to keep buying pressure […]