What Does Nasdaq Know?

Mar 11, 2016

Jeremy Parkinson

Finance

Nasdaq risk is dramatically higher than S&P risk at current levels. Despite the exuberant ramp of the last few weeks, the ratio of Nasdaq VIX to S&P VIX is at its highest in over 6 months. This is worrisome since the last time Nasdaq traders were this much more concerned about future risk than S&P traders, […]

What The World’s Leading Energy Insiders Fear Most

Mar 11, 2016

Jeremy Parkinson

Finance

On Wednesday, you saw what the annual Windsor gathering of energy executives, ministers, and ambassadors agreed on were the most important “shifts” in the energy sector today. But one topic got more attention during my briefing than any other. And I wasn’t the only one talking about it, either. You see, there’s a crisis brewing… It’s already […]

Anti-Gold Bug Says “Buy Gold!”

Mar 11, 2016

Jeremy Parkinson

Finance

Veteran trader Dennis Gartman appeared on CNBC Futures Now yesterday and he made it clear right up front that he is not a “gold bug.” I’m not a gold bug. I don’t like the gold bugs. I’m not a believer that the world is coming to an end.” After that disclaimer Gartman, the anti-gold bug said, “Buy gold!” Video […]

EC

This Is Still The Worst Possible Environment For Stock Investors

Mar 11, 2016

Jeremy Parkinson

Finance

The latest Z.1 data was released yesterday showing that, as of the end of the year, the stock market was still very overvalued, investors were still overly bullish and the S&P 500 was still very overbought relative to its long-term regression trend. In other words, this is still the worst possible environment for equity investors. Let’s start […]

EC

HH

Update: Global Asset Allocation

Mar 11, 2016

Jeremy Parkinson

Finance

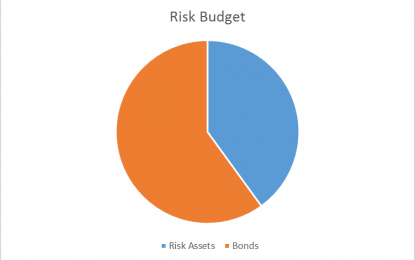

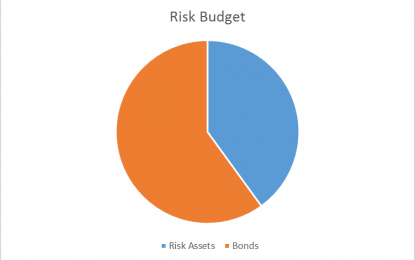

The risk budgets this month are again unchanged. For the moderate risk investor, the allocation between risk assets and bonds remains at 40/60 versus the benchmark of 60/40. The changes in our indicators since last month’s update have not been sufficient to warrant a change. Credit spreads did narrow significantly over the last month but […]

E

A Major Bear Market Sign Is Developing

Mar 11, 2016

Jeremy Parkinson

Finance

I’ve outlined some very dependable markers of bear turns now developing in our stock market in some recent articles.I don’t like being a such sour puss as I mainly like analyzing individual stocks and seeing them climb. All I ask of the market is to leave my individual stocks alone. A flat, boring market is […]

Core Market Risk Clears

Mar 11, 2016

Jeremy Parkinson

Finance

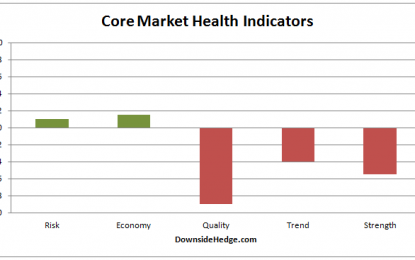

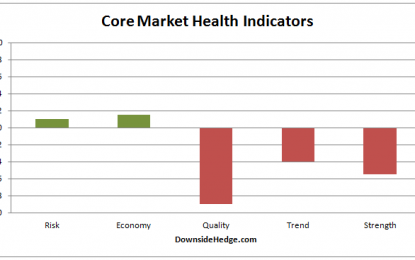

All of my core market health indicators bounced around this week without much change. However, my core measures of risk moved enough to go positive. This changes the core portfolio allocations as follows: Long / Cash portfolio: 40% long and 60% cash Long / Short hedged portfolio: 70% long high beta stocks and 30% short […]

Record Low U.S. Rig Counts: Rig Count Capitulation?

Mar 11, 2016

Jeremy Parkinson

Finance

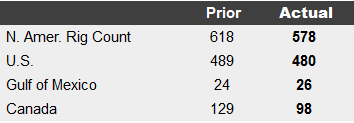

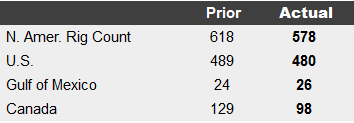

Baker Hughes (BHI) Rig Count Data shows the total U.S. rig count is 480, down by 9 in the last week. North American rig counts declined by 40 to 578. Canada accounts for 31 of the North American decline. Citing Baker Hughes, MarketWatch reports “The previous record US low was at 488 rigs on April 23, 1999. The number […]

Testing Critical Resistance Here: My Three Observations

Mar 11, 2016

Jeremy Parkinson

Finance

This rally has come out of nowhere, and it is doing it completely overbought prior to today. The run-up into two key resistance points that conjoined at one specific price point, creates the potential for the market to fail here and not have anything left in the tank that would allow for it to break through. See for yourself:

Sector ETFs To Benefit From Global Negative Interest Rates

Mar 11, 2016

Jeremy Parkinson

Finance

The world is heading toward negative interest rates policies (NIRP) to stimulate sagging growth and prevent deflationary pressure. Most central banks, including the ones in Japan, Sweden, Switzerland, Denmark and Europe have adopted this policy. The central bank of Denmark was the first and foremost to set a negative tone for rates in mid 2012. […]