Producer Prices, Import/Export Prices Decline Again; Still Think The Fed Will Hike?

May 14, 2015

Jeremy Parkinson

Finance

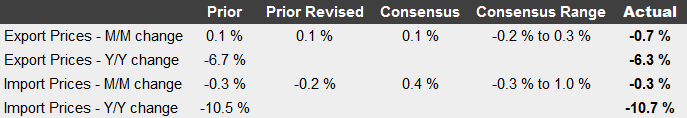

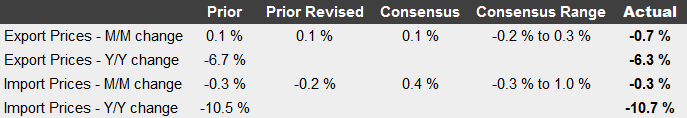

The Fed is struggling like mad to produce inflation, with little success on some fronts. Of course the Fed ignores asset bubbles in its measures. Import/Export Prices The Bloomberg Consensus range for export prices was 0.1%. The range for import prices was 0.4%. Economists were wildly off the mark on both estimates. Both prices declined. Export prices […]

3 Things: The Labor Hoarding Effect

May 14, 2015

Jeremy Parkinson

Finance

The Claims Problem This morning initial jobless claims plunged to the lowest level in the last 42 years. The chart below shows the weekly claims as compared to the 4-week moving average. Surely, this must be a sign that the economy has turned the proverbial corner as full-employment has finally been obtained. Right? Maybe […]

EC

Bond Math And The Elephant In The Room

May 14, 2015

Jeremy Parkinson

Finance

What are you expecting from the bond portion of your portfolio over the next six years? 5%? 6%? 7%? These would all have been reasonable expectations in the past, but past is not prologue, especially when it comes to investing. Whatever number you were thinking of, it is likely too high. Why? The largest Bond […]

The Battle for the Living Room

May 14, 2015

Jeremy Parkinson

Technology

FOSTER CITY, Calif. — First, it was for the little screens. Now, it’s for the big ones. In living rooms across America, an epic clash is looming for the hearts, minds and eyeballs of U.S. consumers as major device platform providers, as well as cable companies and telecommunications carriers, again try to reinvent the big-screen […]

Bund “Stable” As Put-Call Ratio Collapses To 6-Month Low

May 14, 2015

Jeremy Parkinson

Finance

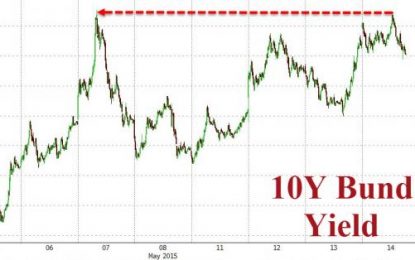

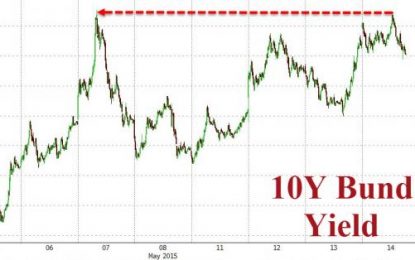

Bund yields rose once again overnight, testing last week’s melt-up 77bps top briefly but have ‘stabilized’ as US markets come online hovering 1bps lower. As bund prices have collapsed so it appears knife-catchers have been busily leveraging up with Call option open interest soaring dramatically (and put option open interest). This has smashed the put-call ratio […]

Record Low Claims Show That Boiling Bubble Economy Will Push Fed Over The Cliff Soon

May 14, 2015

Jeremy Parkinson

Finance

The headline, fictional, seasonally adjusted (SA) number of initial unemployment claims for last week came in at 264,000, beating the Wall Street conomist crowd consensus guess of 285,000. For the second time in 3 weeks the mainstream media headline writers crowed about the 15 year record low. In reality, on the basis of the actual data before […]

Gold Investment Demand Grows In Q1 2015

May 14, 2015

Jeremy Parkinson

Finance

The World Gold Council (WGC) released its Gold Demand Trends report for the first quarter of 2015. The WGC considers 2014 a year of stabilization for the gold market, and the the first quarter of the year saw this trend continue. The supply-demand picture for gold remained relatively unchanged. However, looking to the rest of 2015, the […]

Huge Long Term Upside Available In Aetna

May 14, 2015

Jeremy Parkinson

Finance

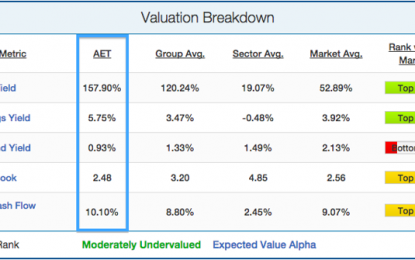

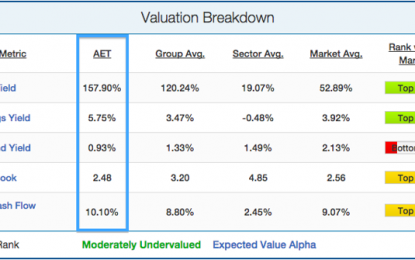

A) Introduction With the fears of decreased profitability arising from the Affordable Care Act now firmly gone, the market has begun to realize the great opportunity available in managed health care providers and insurers. Within this industry, Aetna Inc. (AET) has been by far the best performer. Aetna provides health insurance plans and coordinates the […]

Bonds Breaking Support, Is It Due To King Dollar Weakness

May 14, 2015

Jeremy Parkinson

Finance

CLICK ON CHART TO ENLARGE Did key bond ETF’s create long-term double tops over the past couple of years? The above 3-pack takes a look at three different bond ETF’s. AGG and LQD earlier this year attempted to break above 2012 highs. At this time it looks like they failed and may have created double tops. […]

Second Quarter GDP Forecast: Blue Chip Vs. GDPNow; Where Might The Fed Be Wrong?

May 14, 2015

Jeremy Parkinson

Finance

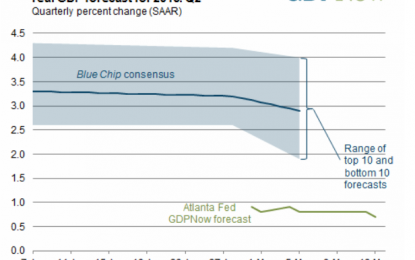

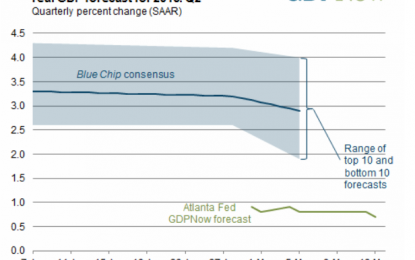

Following yesterday’s dismal retail sales report, inquiring minds may be interested in the Atlanta Fed GDPNow Forecast. The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2015 was 0.7 percent on May 13, down slightly from 0.8 percent on May 5. The nowcast for second-quarter real consumer spending […]