October 2017 Leading Economic Index Suggests Solid Growth Into 2018

Nov 20, 2017

Jeremy Parkinson

Finance

The Conference Board Leading Economic Index (LEI) for the U.S improved this month – and the authors say “The growth of the LEI, coupled with widespread strengths among its components, suggests that solid growth in the US economy will continue through the holiday season and into the new year”. Analyst Opinion of the Leading Economic […]

E

EUR/USD Looking For A Potential Bullish Reversal

Nov 20, 2017

Jeremy Parkinson

Finance

Good day traders! Today’s quick peek is on EUR/USD. Intraday price reaction from 1.1808 on EUR/USD suggests that pair is still making a corrective decline and that wave b was flat. As such, it can be an impulsive sell-off now down to 1.1700 level where new support can be found this week, and ideally will […]

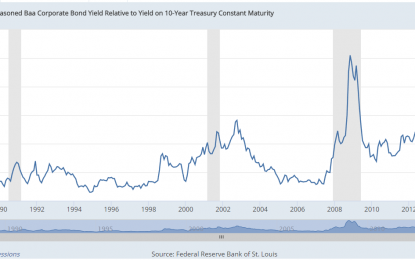

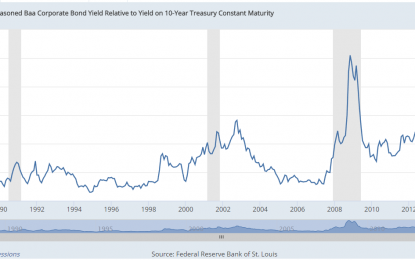

Market Jitters And Fake Liquidity In Leveraged Loans And High Yield

Nov 20, 2017

Jeremy Parkinson

Finance

The economic data out of Europe, the US and Japan have been very good in the last few months. And I believe this will continue. But equity valuations have become stretched and bond market spreads are razor thin. With the US treasury yield curve flattening to almost 60 basis points between 2 and 10-year maturities […]

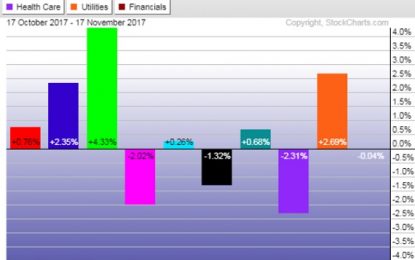

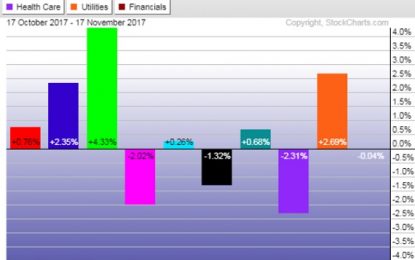

This Simple Strategy Beat The Market By 170%

Nov 20, 2017

Jeremy Parkinson

Finance

Headline writers are warning of a junk bond apocalypse. The articles warn that this is bad news for stocks. Many analysts believe bond traders are smarter than stock market traders. Bonds require more math to understand, and the logic is that only smart traders work in that market. Since bond traders are smart, the theory […]

E

Buy Dips During Holiday Week

Nov 20, 2017

Jeremy Parkinson

Finance

Trading Strategy Patti Domm in CNBC believes that stocks have a good chance of trading higher in the week ahead, if the typical Thanksgiving holiday week trading patterns take over. The S&P 500 has averaged a gain of 0.6 percent during Thanksgiving week, and has been higher 75 percent of the time since 1945. In the years […]

GBP/USD Marches Toward Monthly-High (1.3321) Ahead Of BoE Testimony

Nov 20, 2017

Jeremy Parkinson

Finance

GBP/USD remains bid coming into the last full-week of November, and the pair appears to be on track to test the monthly-high (1.3321) as it extends the bullish sequence from the previous week. It stands to be an eventful week for the British Pound as Chancellor of the Exchequer Philip Hammond is scheduled to present the updated U.K. budget […]

A Final Move

Nov 20, 2017

Jeremy Parkinson

Finance

The dominant chart construction in Gold continues to be the possibility of an inverted H&S bottom pattern on the weekly and monthly graphs. Note: Some of you might have read that Ray Dalio (Bridgewater) is accumulating a sizable position in GLD. I believe Dalio will be right, but that he is early. See http://www.zerohedge.com/news/2017-11-13/ray-dalio-goes-gold-buying-spree-adds-575-gld-http://www.zerohedge.com/news/2017-11-13/ray-dalio-goes-gold-buying-spree-adds-575-gld- I […]

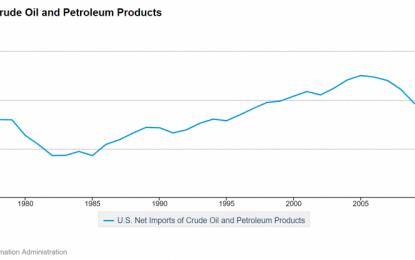

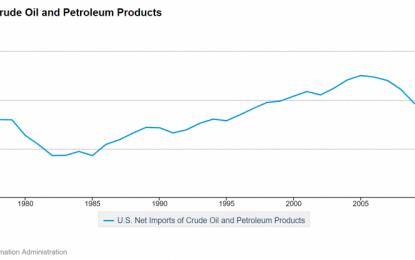

Can The U.S. Achieve Energy Independence?

Nov 20, 2017

Jeremy Parkinson

Finance

The International Energy Agency projects that the U.S. is set to become the world’s leading oil and natural gas production superpower. Is that realistic? Last week I had articles published in both Forbes and the Wall Street Journal (WSJ) addressing a recent report from the International Energy Agency (IEA). The IEA made headlines when it projected […]

German Politics: What’s Next?

Nov 20, 2017

Jeremy Parkinson

Finance

Talks to forge a new coalition government in Germany passed the self-imposed deadline at the end last week, and the markets paid little attention. The euro finished last week a little below $1.18, up to a little over 1% on the week. Talks continued over the weekend and then, late yesterday, the pro-business Free Democrats, with […]

A SIMPLE Kind Of Plan

Nov 20, 2017

Jeremy Parkinson

Finance

The SIMPLE Plan is a type of retirement account for small businesses that is simpler (ah hah!) to administer and more portable than the 401(k) plans that are more appropriate for larger businesses. SIMPLE is an acronym (probably a backronym, more likely) which stands for Savings Incentive Match PLan for Employees. Photo by Thomas Hill A […]