Gold Ratios

Aug 29, 2017Jeremy Parkinson0

The GLD ETF that tracks the yellow metal is now up 13% year-to-date after breaking out of a sideways range yesterday. Check out the chart for GLD below. We like to look at gold price ratios compared to other metals, and below we’ve charted the historical silver-to-gold ratio and platinum-to-gold ratio. When the line is […]

Tata Steel Trade Setup

Aug 29, 2017Jeremy Parkinson0

Tata Steel has made a rising wedge on the daily chart with RSI 14 negative diversion. If rising wedge breaks, one can go short below 628 Target 615-605-595. Daily Chart are hereby for your reference

Biotech ETFs Soar On Gilead-Kite Deal

Aug 29, 2017Jeremy Parkinson0

Gilead Sciences (GILD – Free Report) showered gains on the biotech ETF world on August 28 by announcing the buyout news of Kite Pharma (KITE – Free Report) for $11.9 billion. GILD shares gained over 1.2% while KITE shares surged about 28% on the day, responding to the super deal. Kite Pharma is a clinical-stage biopharmaceutical company, focused on […]

The History Of Consumer Credit

Aug 29, 2017Jeremy Parkinson0

Consumer credit has evolved considerably from the early days. Over the course of several millennia, there have been credit booms, game-changing innovations, and even periods such as the Dark Ages when the practice of charging interest (also known as “usury”) was considered immoral by some people. A TIMELINE OF CONSUMER CREDIT Below is a timeline […]

Insurers Can Stay Calm While Harvey Wreaks Havoc: Four Picks

Aug 29, 2017Jeremy Parkinson0

The untold damage and misery caused by Hurricane Harvey is not just being felt by the residents of Texas. Markets were also singed by the tropical cyclone on Monday, with energy and financials bearing the brunt of the pain. Stocks of energy companies suffered after key refineries in Texas had to close due to widespread […]

Time To Buy SEK, RUB And MXN? Our Indicators Say So

Aug 29, 2017Jeremy Parkinson0

Today we have published the August edition of Global Monetary Condition Monitor our monthly flagship publication, which covers monetary policy in 26 countries around the world and gives an overview of global monetary matters and market implications of global monetary trends. In this webcast I have a look at the currency implications of our monetary analysis in […]

Nuvectra Corporation – Sold

Aug 29, 2017Jeremy Parkinson0

64% technical sell signals Below its 20, 50 and 100 day moving averages 29.40% off its recent high This morning I deleted Nuvectra (NVTR) from the Van Meerten New High portfolio at 10.55 It is not adding any value to the portfolio: Barchart technical indicators: 64% technical sell signals Trend Spotter sell signal Below its 20, 50 […]

Has USD/CAD Reversed?

Aug 29, 2017Jeremy Parkinson0

With oil prices continuing to drift lower and with Canadian inflation subdued USD/CAD made a major reversal in US trade today recovering above the 1.2550 level as longs pressed the pair higher. With ADP and US GDP on the docket tomorrow the greenback could have another strong day and could push the pair through […]

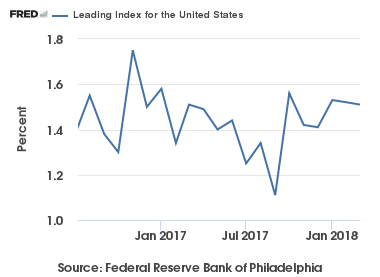

July 2017 Leading Index Review: Growth Trends Slow

Aug 29, 2017Jeremy Parkinson0

This post is a review of all major leading indicators follows – and their trends are generally indicating slower growth. Philly Fed Leading Index The Philly Fed Leading Index for the United States is continuously recalculated. Note that this index is not accurate in real time as it is subject to backward revision, Per the Philly Fed: […]

Portfolio Management Ideas For Consideration For The Remainder Of 2017

Aug 29, 2017Jeremy Parkinson0

2017 is shaping up to be both a continuation of the secular bull market as well as a year of changing market leadership. This has taken place absent any significant market volatility, leading some to question when volatility may rear its ugly head again. The June 2017 S&P DJI Commentary noted that at the midway […]