Missile Smishile

Aug 29, 2017Jeremy Parkinson0

“Greatness is upon you. You must believe it though.” – Germany Kent Stocks came back strong after another North Korean missile was fired. Many stocks are at the low end of their still forming bases which means swing trading remains my strategy. Gold soared and is breaking out of a major base and miners are […]

Insurance Companies Taking A Hit From Hurricane Harvey

Aug 29, 2017Jeremy Parkinson0

Unless you have been living under a rock, you know that Hurricane Harvey is causing unprecedented damage to Southeastern Texas, primarily the city of Houston. The main issue is flooding rains which by the end of the storm could stand at over 40 inches. Some reports estimate that the storm could cost as much as $40 […]

Financial Markets Chart Package…

Aug 29, 2017Jeremy Parkinson0

Here is a quick review of the global markets. Most markets are in the midst of a pullback within a broader uptrend. S&P 500 (US) The S&P 500 is down about 3% from it’s recent all time highs. Currently fighting to stay above the 50 day MA. A break below 2417 makes the 200 day […]

Maui Land & Pineapple – Sold

Aug 29, 2017Jeremy Parkinson0

80% technical sell signals Below its 20, 50 and 100 day moving averages 56.12% off its recent high Today I deleted Maui Land & Pineapple (MLP) or the Van Meerten Special portfolio for negative price momentum: Barchart technical indicators: 80% technical sell signals Trend Spotter sell signal Below its 20, 50 and 100 day moving averages Relative […]

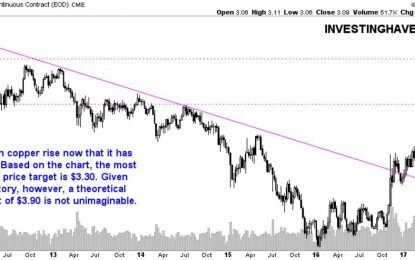

How High Can The Price Of Copper Rise In 2017?

Aug 29, 2017Jeremy Parkinson0

One of the most recurring questions from readers of the last couple of days is how high the price of copper can rise in 2017. That is obviously a great question, but an easy one to answer. One the one hand we expect a stiff stock market correction, as documented in is the S&P 500 correcting […]

‘Traders’ Panic-Buy Stocks, Shrug Off Nuclear Armaggedon, Debt Ceiling, & Biblical Flood Fears

Aug 29, 2017Jeremy Parkinson0

If NKorea doesn’t launch a rocket tonight, stocks may sell off tomorrow — zerohedge (@zerohedge) August 29, 2017 Blink and you missed it… The message from the plunge/panic protection team is clear… Video length: 00:01:45 For a few brief hours overnight – until the bell rang at 09:30ET on the NYSE – investors were anxious about […]

Market Talk – Tuesday, August 29

Aug 29, 2017Jeremy Parkinson0

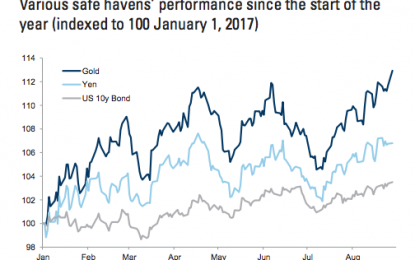

Back to geopolitical risks again today after North Korea spooked markets with yet more missile test, but this time flying over Japan. All Asia markets were hit as a result of this, with a rush into safe-haven assets such as gold, oil and treasuries. Interesting that oil traded heavy even as the news hit the […]

Not All Swaps Are Created Equal; Part 1 (Eurodollar University)

Aug 29, 2017Jeremy Parkinson0

I’ve never understood the myth of central bank dollar swaps. They are automatically placed in the category of QE or IOER, perhaps because very few seem to understand what was really happening with them (as well as outside of them). The Fed expands its balance sheet which everyone assumes is the same as expanding either […]

Denmark Sees The Future: Selling Oil Interests To Expand Renewable Energies

Aug 29, 2017Jeremy Parkinson0

This is what Saudi Arabia is planning to do with its Aramco IPO as well:raise cash to fund the development of more efficient and diverse, renewable energy resources. Et tu Canada? See: Sale of oil assets fueling Denmark’s transition to green energy: In another sign that the petroleum era is drawing to a close, Denmark is […]

Why Not Take A Minute Away From Buying XIV On Your Credit Card To Put On These Goldman-Approved Hedges?

Aug 29, 2017Jeremy Parkinson0

Are you looking to hedge all of the risk exposure you put on today when you bought the fuck out of the nuclear war dip? Probably not. In all likelihood, you’re writing a bunch of naked puts and loading up on XIV with a home equity loan and whatever you could get as far as […]