Tesla, Meta, Microsoft Set To Report Earnings This Week

Apr 22, 2024Jeremy Parkinson0

Image courtesy of 123rf.com Tesla (Nasdaq: TSLA), Meta (Nasdaq: META), and Microsoft (Nasdaq: MSFT) are set to report quarterly earnings this week, with investors eagerly awaiting insights into their financial performance and strategic initiatives. As these tech giants navigate evolving market dynamics, regulatory changes, and intensifying competition, their earnings reports will provide crucial indicators of their resilience […]

Solana’s Market Value Plummets 31.96% In April

Apr 22, 2024Jeremy Parkinson0

Image Source: Pexels April has been a tumultuous month for Solana, a blockchain platform known for its high-speed transactions and scalability. After reaching a peak of over $200 in March, Solana has seen a drastic downturn in its market value, largely attributed to network congestion and internal disputes. A public disagreement between two prominent Solana-based projects has […]

Stocks Muted As Oil Prices Take A Breather

Apr 22, 2024Jeremy Parkinson0

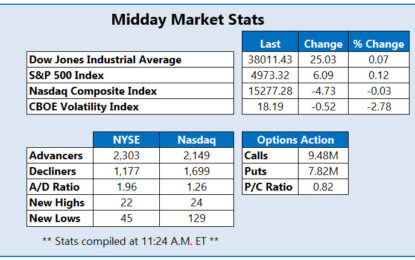

The Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) are flat this afternoon, shrugging off strong premarket gains. Tensions in the Middle East cooled after Iran said it would not respond to Israel’s attack, with oil prices moving lower. Investors are also keeping an eye on Big Tech earnings later this […]

Real Median Wage And Income Growth Continued The Increasing Trend

Apr 22, 2024Jeremy Parkinson0

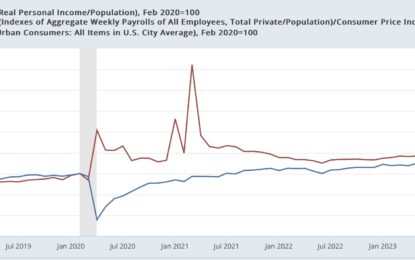

This is an update of some information I last posted several months ago.Real median household income is one of the best measures of average Americans’ well-being, but the official measure is only reported once a year, in September of the following year.So right now the most recent official measure is for calendar year 2022 (when […]

Weak Indices Masking Some Underlying Strength

Apr 22, 2024Jeremy Parkinson0

Friday was another down day on the ugly side with the S&P 500 down 1% and the Nasdaq 100 was down 2%. However, the Russell 2000 was up and there were 1000 more stocks going up than down on the NYSE. For a change, the generals were weak, but the troops were strong. Keep that tidbit […]

Dollar Slows Down A Bit, But Not Bearish Yet

Apr 22, 2024Jeremy Parkinson0

Image Source: Pixabay As you know stocks came down last week, as inflation can stay stuck at current levels, meaning that Fed may not be ready to cut rates just yet, and then you also have conflict in the Middle East between Iran and Israel. However, this escalation between Iran and Israel calmed down in the last […]

Analytical Overview Of The Main Currency Pairs – Monday, April 22

Apr 22, 2024Jeremy Parkinson0

Image Source: Pixabay The EUR/USD currency pairTechnical indicators of the currency pair: Prev Open: 1.0642 Prev Close: 1.0656 % chg. over the last day: +0.13% ECB policymakers’ statements hint at a willingness to start reducing borrowing costs as early as June, with some officials suggesting the possibility of three rate cuts before the end of 2024. With the June meeting […]

Time To Buy Chevron’s Stock As Q1 Earnings Approach?

Apr 22, 2024Jeremy Parkinson0

Chevron Corporation (CVX – Free Report), one of the world’s leading oil companies, is set to report first-quarter results on Friday, Apr 26, and as always, market participants are anxiously anticipating the release. The stock has been steadily going up this year, notching up a decent gain, as the San Ramon, CA-based integrated player has benefited from strength in the Energy space. That […]

Will The US Indices Continue Its Bearish Momentum?

Apr 22, 2024Jeremy Parkinson0

The recent trajectory of US stocks has seen a sharp shift, transitioning from a relentless rally to a persistent pullback. After experiencing five consecutive winning months without a 2% decline, the market has faced three consecutive down weeks. This 5.5% setback in the S&P 500 is primarily attributed to the uncertainty surrounding Federal Reserve policy.The […]

Will Commodities Continue To Outperform In 2024?

Apr 22, 2024Jeremy Parkinson0

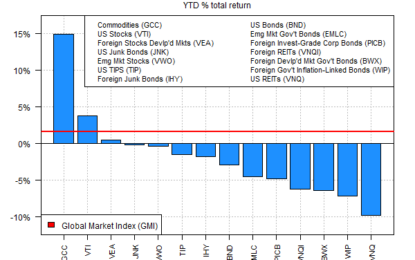

In December I wondered if commodities were poised to be the contrarian trade of 2024. Four months later, there’s no competition across the major asset classes: commodities are the upside outlier by a wide margin, based on a set of ETFs through Friday’s close (Apr. 19).WisdomTree Enhanced Commodity Strategy Fund (GCC) is up nearly 15% year to date. The […]