XRP Eyes $0.52 Resistance As Ripple Developers Consider Lending On XRP Ledger

May 02, 2024Jeremy Parkinson0

Image by WorldSpectrum from Pixabay DeFi has become a cornerstone of the crypto community, and while Ethereum remains the sector overlord, the XRP Ledger (XRPL)’s DeFi ecosystem is growing steadily. To supercharge this growth, the ecosystem’s developers have proposed a new lending mechanism that eliminates the need for smart contracts.RippleX Developers proposed the new mechanism this week, stating […]

Choosing Your Favorite Dental Procedure: Recession Or Inflation?

May 02, 2024Jeremy Parkinson0

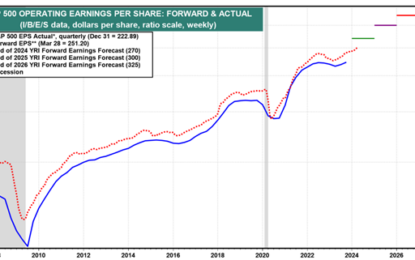

Going to the dentist can be a pleasurable or painful experience, depending on whether you have been properly brushing and flossing your teeth. If the stock market was a patient, its 2024 checkup would produce a large smile. Why so happy? Because the S&P 500 index is up a healthy +5.6% in the first four […]

The Snooze-A-Than In Jobless Claims Continues

May 02, 2024Jeremy Parkinson0

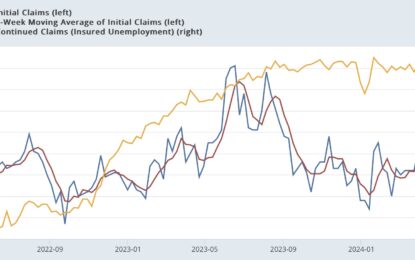

The snooze-a-thon in jobless claims continues, as both initial and continuing claims are well-behaved within the narrow range where they have been generally for the past six months.Initial claims were unchanged least week at 208,000, while the four week moving average declilned -3,500 to 210,00. With the usual one week delay, continuing claims were unchanged […]

AAPL Earnings Could Break The Market

May 02, 2024Jeremy Parkinson0

Obviously the most important event on tap Thursday is Apple (AAPL) earnings after the close. While the stock is off more than 10% YTD, it is still quite overvalued given the lack of growth IMO. In his piece on AAPL in Tuesday’s WSJ tech columnist Dan Gallagher suggested that since AAPL has come down from […]

“Safe Haven” Yen Trending Towards Zero Against Gold

May 02, 2024Jeremy Parkinson0

Image Source: Pixabay The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the […]

Apple To Report Earnings After Market Close, What To Expect

May 02, 2024Jeremy Parkinson0

Image courtesy of 123rf.com Apple Inc. (Nasdaq: AAPL) will report its fiscal second-quarter earnings on May 2, 2024, after the market closes. Analysts expect the tech giant to post earnings per share (EPS) of $1.50, slightly lower than the $1.52 reported in the same quarter a year ago. The company is projected to generate revenues of $90.36 billion, […]

The Most Important Gold Chart In 2024

May 02, 2024Jeremy Parkinson0

Image Source: Pixabay Gold against the 60/40 portfolio is the most important Gold chart for 2024. I expect this chart to give a secular bull confirmation signal over the coming months. It’s end of April reversal prevented the signal at the close of the month.Video Length: 00:06:13More By This Author:Debt Monetization & Recession is Perfect Scenario […]

It Wasn’t The Fed That Sent The Stock Market On A Wild Ride

May 02, 2024Jeremy Parkinson0

Image Source: Pixabay Copper has been a really good predictor of where the ISM Manufacturing report is going to go.Video Length: 00:19:43More By This Author:Implied Volatility Crush Sends Stocks Higher As Usual During The Fed Announcement The Bears Can Feel It In The Air Rate Cuts Odd For 2024 Are Melting Away

Chart Of The Week: The Softening Labor Market

May 02, 2024Jeremy Parkinson0

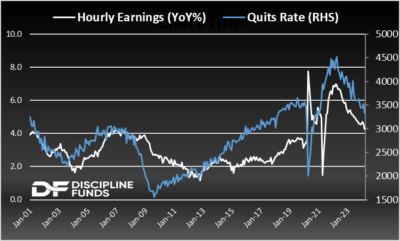

Wednesday’s Fed decision was largely unsurprising. But the most important data point of the day came long before the Fed decision. The latest JOLTS report showed the lowest levels of quits since early 2018 when Core PCE inflation was around 2%. This is an interesting data point because the quit rate has tended to be […]

Softs Report – Thursday, May 2

May 02, 2024Jeremy Parkinson0

COTTON General Comments: Cotton was lower again yesterday and trends remain down in the market. Demand remains a problem. The export sales report showed poor sales once again and demand is not likely to improve with the Dollar stronger. USDA made no changes to the domestic supply or demand sides of the balance sheets, but […]