Pre- Market Week ETF Look

Mar 12, 2017Jeremy Parkinson0

There’s quite clearly a diversity of opinion here on Slope, as SB’s post pointing to bullish times ahead is somewhat different than my all-hell-is-about-to-break-loose view. Time will tell. On the latter, I offer these ETF charts…DIA First is the Dow 30 DIA which, if nothing else, is quite a distance from its main supporting trendline. Last week saw some […]

Moving Off Extreme Oversold Readings

Mar 12, 2017Jeremy Parkinson0

It wasn’t a bad Friday but not the strong close to the week I was looking for. Miners are telling me metals will bounce in the week to come along with lots of other stocks after a week of rest and a small correction. We remain at extremely oversold levels even though we hardly fell in […]

Bernanke Was Right

Mar 12, 2017Jeremy Parkinson0

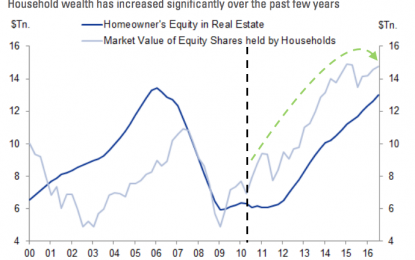

And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion. –Ben Bernanke, Washington Post Op-Ed, 2010 They laughed at old Ben. “That’ll never work,” they said. “This won’t benefit Main […]

AUD/USD Forecast March 13-17

Mar 12, 2017Jeremy Parkinson0

AUD/USD posted slight losses for a second straight week, as the pair closed at 0.7539. This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD. In the US, a sparkling jobs report has virtually ensured a rate hike coming next week. Still, wage growth disappointed, falling short of the forecast. In Australia, the RBA […]

The 3 Biggest Picture ‘Long-Short’ Trades In The World

Mar 12, 2017Jeremy Parkinson0

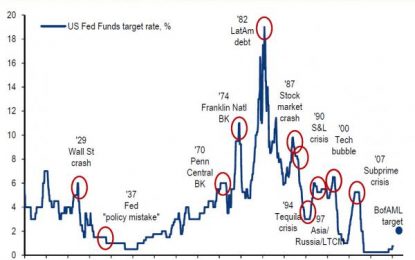

Eight years after the beginning of “Bull & Fed’s Excellent Adventure”, BofA’s Michael Hartnett is starting to have his doubts. The bull market catalyst – extraordinary, unprecedented central bank policies – is fading globally and the so-called “Humpty-Dumpty’ Trade looms: The Fed has hiked 2 times in past 10 years; March 15th will be the 2nd hike in 3 months […]

ETFs In Focus On Exxon’s Big Investment Plans

Mar 12, 2017Jeremy Parkinson0

ExxonMobil Corp’s (XOM) chief, Darren Woods announced on Monday (March 6, 2017) that the company will invest $20 billion to expand its manufacturing capacity and create 45000 jobs in the U.S. The new head of the state, President Trump expressed his satisfaction with the development and called Exxon a true success story. Exxon now looks to […]

Stock Consolidation Patterns In Trend Following

Mar 12, 2017Jeremy Parkinson0

Stock consolidation patterns give investors potential to take up new positions in trend following or even add on a successful position. When adding or pyramiding, one should not get to top heavy. When I add to my stock positions, I will only add 10% of my position size on any consolidation or even pull back […]

EC Has The S&P 500 Run Ahead Of Other Major Market Classes?

Mar 12, 2017Jeremy Parkinson0

The sharp fall in oil prices was the most interesting market news last week. It sends a signal that investors are waking up the fact that the brittle OPEC output deal always was going to be challenged by U.S. producers restarting their drills as prices rose. I am no expert, but this does not come as a […]

Base-Line Shifts In Commodity Prices

Mar 12, 2017Jeremy Parkinson0

The stock market, as measured by the Dow Jones seems to be at an inflection point. It hasn’t seen a new all-time high since March 1st. And for what it’s worth, trading volume (market demand) for the 30 blue-chip companies contained in the Dow Jones is falling off. It needs to be noted that until […]