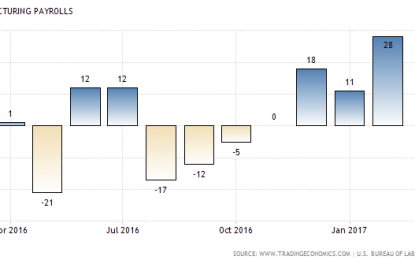

The U.S. Economy, Post-Payrolls & Pre-FOMC

Mar 12, 2017Jeremy Parkinson0

This week’s Notes From the Rabbit Hole included a little Payrolls/Wages related economic discussion before moving on to the usual coverage of stock markets, commodities, precious metals, bonds, currencies and related indicators and market internals. With FOMC on tap there will be more data noise directly ahead, but then I expect markets to smooth out […]

Emerging Markets: Preview Of The Week Ahead – March 13

Mar 12, 2017Jeremy Parkinson0

EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed […]

4 Big Winners Of Trump’s Healthcare Plan

Mar 12, 2017Jeremy Parkinson0

On Tuesday, the Trump administration provided its formal backing to a draft bill introduced by House Republicans which aims to repeal and replace the Obamacare healthcare law. Such an action comes as no surprise since Trump has always been an outspoken critic of the Affordable Care Act. Healthcare stocks declined on Monday after the GOP […]

Unparalleled Credit And Global Yields

Mar 12, 2017Jeremy Parkinson0

New Fed Q4 Z.1 Credit and flow data was out this week. For the first time since 2007, annual Total Non-Financial Debt (NFD) growth exceeded $2.0 TN – a bogey I’ve used as a rough estimate of sufficient new Credit to fuel self-reinforcing reflation. Based on some nebulous “neutral rate,” the Fed rationalizes that it’s […]

Canadian Dollar Remains Weak Thanks To Oil Decline, Data Generally Soft

Mar 12, 2017Jeremy Parkinson0

Fundamental Forecast for USD/CAD: Bullish – USD/CAD has rallied towards the top of a six-month range but further weakness may lie ahead – Canadian unemployment data posts significant beat, stabilizing Loonie. – Fed rate decision, oil inventories on Wednesday likely to drive oil, with repercussions for USD/CAD. The Canadian dollar has been range bound for the last six-months against the USD and […]

NZD/USD Forecast March 13-17

Mar 12, 2017Jeremy Parkinson0

The New Zealand dollar suffered under the fresh strength of the US dollar and falling milk prices. The GDP report is left, right and center now. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD. The GDT auction showed a drop in prices once again, and this time the rate was nearly double […]

Did Super Mario Draghi Lie To The Press?

Mar 12, 2017Jeremy Parkinson0

A few weeks ago, Mario Draghi, the president of the ECB, and ECB member Weidmann confirmed interest rates would continue at a relatively low level as this would be very helpful for the governments of Eurozone countries to get their finances back under control. This indeed seemed to be absolutely necessary to us, and in […]

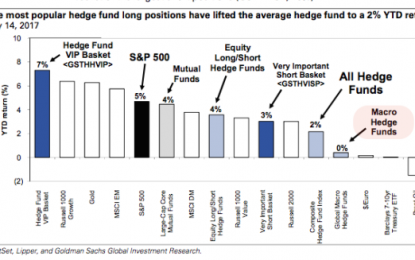

Hedge Funds Covered The Most S&P Shorts Since The Election, Sold Most USD/JPY In Three Years

Mar 12, 2017Jeremy Parkinson0

Looking at the most recent CFTC Commitment of Traders report, BofA makes two notable observations ahead of what may be a volatile week between the Fed’s 25bps rate hike announcement on Wednesday, just hours after the Dutch General Election, and on the same day as the US debt ceiling expiration hits. The first is that […]

Markets Showing Unconfirmed Intermediate Top

Mar 12, 2017Jeremy Parkinson0

In the last letter, I mentioned that I had a P&F projection to 2400 and that, after a correction, there was a possibility that it could be followed by a push a little higher to about 2410. So far, so good. Reaching the target brought a forty-five-point retracement but, because it found support just above […]

“There’s No Diversification”: When This Ship Sinks, We’re All Going Down With It

Mar 12, 2017Jeremy Parkinson0

“You heard it here first,” is becoming increasingly relevant here at HR. That doesn’t necessarily mean we’re over here cooking up scoops and exclusives, but what it does mean is that when it comes to putting the pieces together and saying: “here goddammit, this is what all of this means,” we’re quickly becoming second to […]