Key Takeaways

- Axie Infinity’s AXS token has risen by more than 250% in the past five days.

- AXS seems to have entered overbought territory based on technical and on-chain metrics.

- A spike in selling pressure could see the token price drop to $28.

Axie Infinity has been posting massive gains while most cryptocurrencies have been struggling to resume their respective uptrends. Now, AXS could be gearing up for a correction before its uptrend continues.

Axie Infinity Looks Overbought

Axie Infinity could be due for a correction.

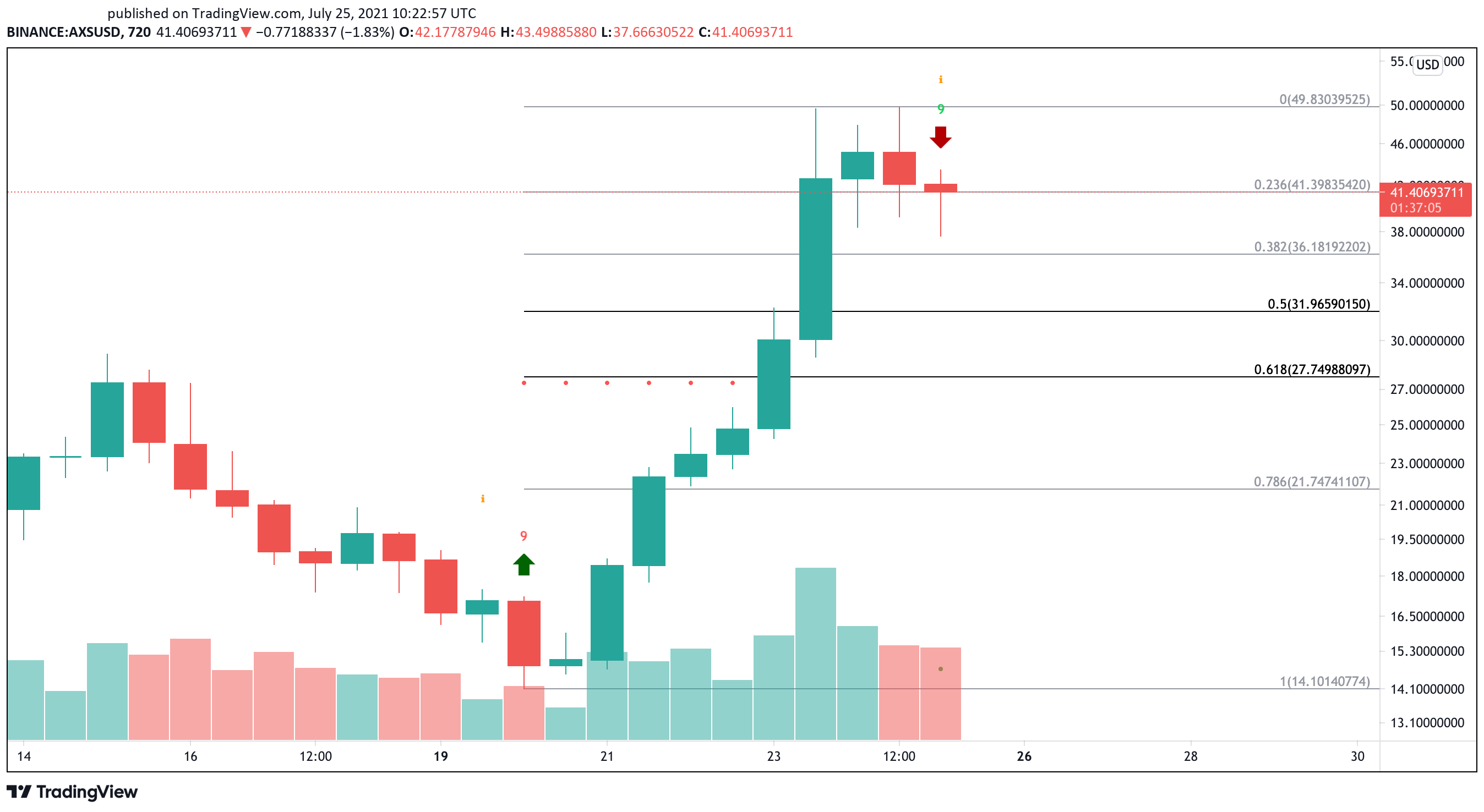

The popular NFT game’s AXS token has surprised cryptocurrency enthusiasts in recent weeks as it continues to surge without any apparent signs of slowing down. Over the past five days alone, the AXS price has skyrocketed by a whopping 253%, from a low of $14 to reach a new all-time high of $50 on July 24.

The sudden upswing seems to have been anticipated by the Tom DeMark (TD) Sequential indicator, which presented a buy signal in the form of a red nine candlestick on the 12-hour chart.

This technical index has proven to be quite effective at determining where Axie Infinity is going next. Since the token’s inception in November 2020, the TD has forecasted local tops and bottoms.

Interestingly, the TD Sequential now indicates that Axie Infinity is trading at overbought levels after presenting a green nine candlestick on the 12-hour chart. The bearish formation is indicative of a one to four 12-hour candlesticks correction before the uptrend resumes.

If validated, AXS could drop towards the 61.8% Fibonacci retracement level at around $28.

IntoTheBlock’s Daily Active Addresses model shows a bearish divergence between network growth and AXS’ price action. The number of new daily addresses being created peaked on July 13 at 306 addresses while prices were rising.

Such market behavior indicates that investors could be booking profits, increasing the downward pressure behind Axie Infinity.

Under such unique circumstances, this cryptocurrency could target $72 before reaching the psychological $100 level.