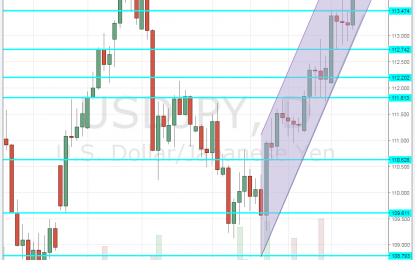

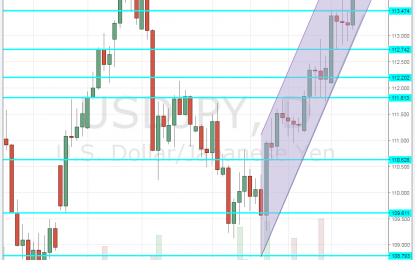

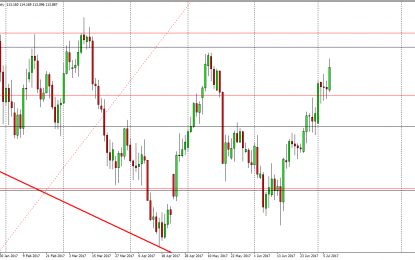

USD/JPY Forms Double-Top At A Critical Level – Break Or Bounce?

Jul 10, 2017

Jeremy Parkinson

Finance

Dollar/yen continues its upwards move. After a short pause that followed the mixed Non-Farm Payrolls, the pair continues riding the tiger along the upwards support line and hits a major barrier. 114.37 is the cycle high. The level was reached in May and the pair could not advance from there. Two months later, USD/JPY hit a […]

Sensex & Nifty End At Record Highs; Bharti Airtel, TCS & Wipro Top Gainers

Jul 10, 2017

Jeremy Parkinson

Finance

Share markets in India continued their upward climb in afternoon trade with both Sensex and Nifty closing a fresh all-time high. At the closing bell, the BSE Sensex closed higher by 355 points. While, the NSE Nifty finished higher by 97 points. Meanwhile, the S&P BSE Midcap Index ended up by 0.7% while the S&P BSE Small Cap Index ended up by 0.4%. Barring FMCG […]

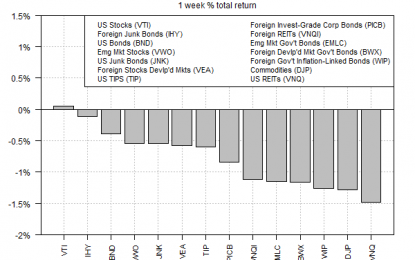

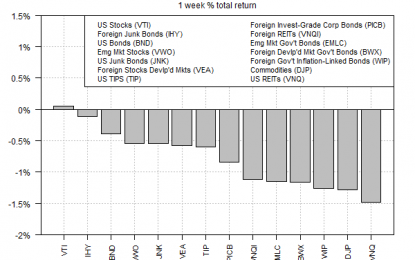

Most Markets Fell Last Week, Except For US Stocks

Jul 10, 2017

Jeremy Parkinson

Finance

Red ink dominated the first week of trading in July. The main exception: equities in the US, which edged higher. Otherwise, across-the-board losses weighed on the major asset classes, based on a set of exchange-traded products. US stocks bucked last week’s selling wave, albeit only slightly. Vanguard Total Stock Market (VTI) was fractionally higher, inching up six […]

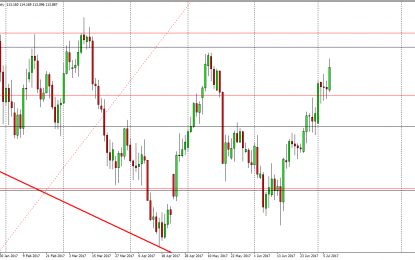

EUR/USD – Bear Speculation: Rebound From The Upper Boundary Of The A-A Channel

Jul 10, 2017

Jeremy Parkinson

Finance

Trading opportunities for the currency pair: The price is trading around the upper boundaries of the A-A and C-C channels. On the monthly timeframe, there’s a risk of falling to 1.25, but the euro is expected to strengthen significantly from September onwards. In connection with this, the range from 1.1475 to 1.1595 will be used for […]

Global Stocks Rise Amid Strong Economic Data; Yen Drops To 2 Month Low As Oil Resumes Slide

Jul 10, 2017

Jeremy Parkinson

Finance

In a quiet overnight session, S&P 500 futures are fractionally in the green (2,426, +0.2%) with European and Asian stocks as oil drops the second day after an initial ramp higher amid speculation that Libya and Nigeria may be asked to cap their production. Nasdaq 100 Index is again higher, following the biggest daily advance […]

USD/JPY And AUD/USD Forecast – Monday, July 10

Jul 10, 2017

Jeremy Parkinson

Finance

USD/JPY The US dollar rallied during the day on Friday, as the jobs number was better than anticipated. This has the USD/JPY pair reaching above the 114 level. The market looks likely to pull back, but at this point I think there’s plenty of support near the 113 handle. The 115 level above is massively […]

Firm Dollar Tone May Be Challenged By Softer Yields

Jul 10, 2017

Jeremy Parkinson

Finance

The US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last […]

The Breaking Point & Death Of Keynes

Jul 10, 2017

Jeremy Parkinson

Finance

You can almost hear the announcer for the movie trailer; “In a world stricken by financial crisis, a country plagued by spiraling deficits and cities on the verge of collapse – a war is being waged; gauntlet’s thrown down and at the heart of it all; two dead white guys battling over the fate of […]

AUD/USD Narrow Range Possibly Targeting Weekly Support

Jul 10, 2017

Jeremy Parkinson

Finance

AUD/USD has been moving in a very narrow range. The ATR for last 14 days is 48 pips and it suggest slow moving price. If the price managed to stay below 0.7645 that is the ATR projected high and W H3 camarilla, bears would have an upper hand. At this point we might see a […]

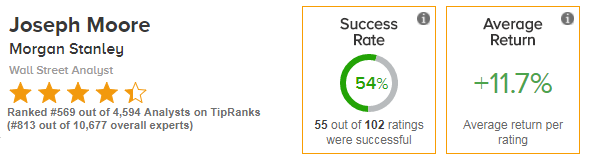

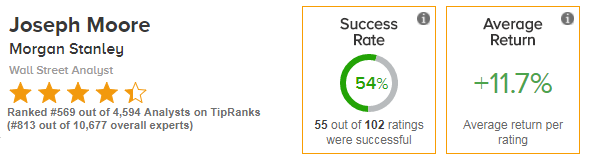

Three Reasons Why Micron Technology, Inc. Can Go Even Higher

Jul 10, 2017

Jeremy Parkinson

Finance

Micron Technology, Inc. (Nasdaq:MU) stock has already exploded after two years of poor performance. On a one-year basis, the stock has moved from just $12 to the current price of just over $30. Not surprisingly, given the rapid gain, some investors are nervous that the stock is moving into overvalued territory and that there is […]