Indian Indices Continue Momentum; IT Sector Up 1.4%

Aug 28, 2017Jeremy Parkinson0

After opening the day higher, stock markets in India have continued their momentum. Sector indices are trading on a positive note with stocks in the realty sector and IT sector witnessing maximum buying interest. The BSE Sensex is trading up 148 points (up 0.5%) and the NSE Nifty is trading up 48 points (up 0.5%). The BSE Mid Cap index is trading up by 0.9%, while the BSE […]

Teladoc Jumps After Winning Federal Employee Program Contract

Aug 28, 2017Jeremy Parkinson0

The Blue Cross and Blue Shield Service Benefit Plan, also known as the Federal Employee Program, has selected Teladoc to provide general medical and behavioral health services for the 2018 benefit year, the company announced earlier in a press release. Teladoc shares are up 11%, or $3.30, to $33.15 in midday trading. The Federal Employee […]

Trade Deficit Increases Slightly

Aug 28, 2017Jeremy Parkinson0

The trade deficit in July increased by 1.7% to -$65.1 billion vs an Econoday consensus estimate of -64.1 billion. The Census Bureau revised June slightly, to -64.0 billion from -63.9 billion. Third-quarter GDP is off to a slow start, at least for international trade in goods where the July trade gap widened more than $1 billion to […]

Spot Gold Spikes Above $1300 To Highest Since Election

Aug 28, 2017Jeremy Parkinson0

While Dec gold futures broke above $1300 overnight (and are spiking above $1310), spot gold prices just broke above $1300 to the highest price since Trump’s election. Since Friday’s close, before the worst of Harvey hit, gold is the best performing asset with bonds, dollar, and stocks slightly lower.

Gold/Dollar – Monster Breakout Test In Play

Aug 28, 2017Jeremy Parkinson0

The Gold/Dollar chart below reflects that Gold was much stronger than the U.S. Dollar (US$) from 2001 until 2011. Since 2011, the US$ has been stronger than Gold, as the ratio has declined for six years. Is it time for the worm to turn (Gold stronger than US$)? The ratio below reflects a big test […]

Everything You Need To Know For September – MM #157

Aug 28, 2017Jeremy Parkinson0

The summer lull is about to end and Jackson Hole provides a hint for things to come. The calendar is packed with known events and a lot of known unknown events, such as the nomination of a new Fed Chair. We preview all the big events you need to know about. Jackson Hole: What can […]

Three Options Illustrating Smart Hedging Potential

Aug 28, 2017Jeremy Parkinson0

Wesley Gray, the Alpha Architect, joined me recently in co-hosting a podcast with the Wharton School’s Nikolai Roussanov, one of world’s top academics on the topic of currencies. Roussanov’s academic work has focused on the carry trade—a currency factor he sees as explanatory in major currency group movements. The carry trade represents the tendency for higher interest rate currencies to […]

Diversify Into Gold On U.S. “Political Instability” Advises Blackrock

Aug 28, 2017Jeremy Parkinson0

For now I would prefer to bet on gold’s diversifying properties rather than political stability” – Russ Koesterich, Blackrock. Not for the first time this year, Blackrock’s Koesterich has spoken about his faith in gold during times of both financial and political instability. Those times are now, the world’s largest money manager believes. Since the beginning […]

Pure Rubbish? What The Buffett Indicator Is Really Predicting

Aug 28, 2017Jeremy Parkinson0

Every so often an article is produced that is so misleading that it must be addressed. The latest is from Sol Palha via the Huffington Post entitled: “Buffett Indicator Is Predicting A Stock Market Crash: Pure Nonsense.” Sol jumps right in with both feet stating: “Insanity equates to doing the same thing over and over again and […]

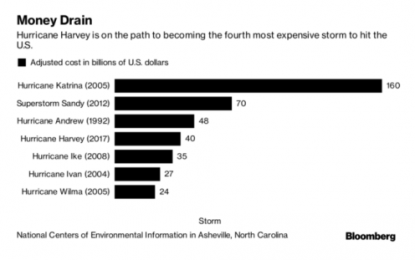

Harvey Damage Could Top $40 Billion: Only One In Six Insured, 15% Of Refining Capacity Down

Aug 28, 2017Jeremy Parkinson0

Damage from Hurricane Harvey is expected to total tens of billions of dollars. Current estimates range from $20 billion to $40 billion, but only one in six have insurance. Bloomberg reports Harvey’s Cost Reaches Catastrophe as Modelers See Many Uninsured. Hurricane Harvey’s second act across southern Texas is turning into an economic catastrophe — with damages […]