Earlier today Fed Chair Janet Yellen made a speech to the Economic Club of New York on The Outlook, Uncertainty, and Monetary Policy.

In her speech,Yellen was Lovey-Dovey Citing “Other Tools” and More QE.

Let’s explore the effect of Yellen’s newfound lovey-doviness on interest rate hike expectations and other financial assets.

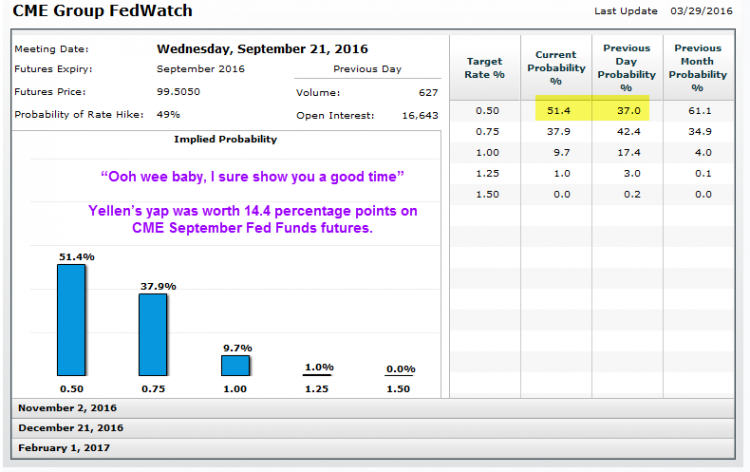

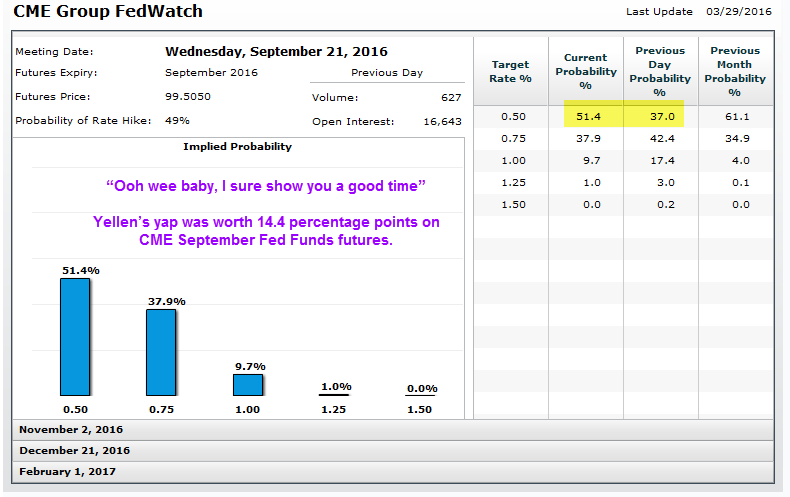

Rate Hike Odds September

Rate Hike Odds November

Measuring Yellen Yap

Gold is up $21 (1.73%), treasuries rallied, the S&P 500 stock market is up 17 points (0.82%) and the dollar down about 0.82%.

I offer this musical tribute.

You’re the cutest thing that I ever did see

I really love your peaches

Want to shake your tree

Lovey dovey, lovey dovey, lovey dovey all the time

Ooh wee baby, I sure show you a good time

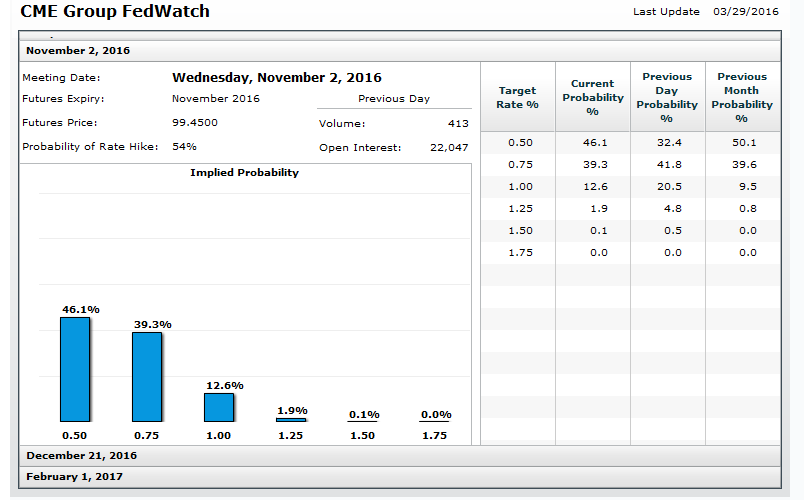

Rate Hike Odds Shift to November

Rate hike odds have now shifted to November as noted by a look at September and November implied probabilities.

Yesterday the probability of no hike in September was 37%. Today it’s 51.4%.

Yellen’s yap was worth 14.4 percentage points on CME September Fed Funds futures.

Actually, the odds between yesterday and today didn’t really change one bit. Rather, the market’s expectation of them did.

Those speculating on delayed hikes and the eventual capitulation of Yellen to lovey doviness came out ahead.