Buy shares in these three companies that are about to rally from their undervalued lows. Trading for under $10 each, these stocks are much too cheap for their growth prospects.

In my last column I noted that I am becoming increasingly cautious on equities after the recent rally in the market. My cash allocation is up to 15% of my overall portfolio and the majority of my holdings are in large cap blue chip stocks trading at attractive valuations and paying solid dividend yields. That does not mean that my entire portfolio is chock-full of holdings that look set to hit “singles.” There are some great values in the small cap part of the market after many sectors have undergone their own “stealth” bear markets over the past six months, particularly biotech. Here are three small cap stocks that currently sell under $10 a share, but are deeply undervalued within the current market.

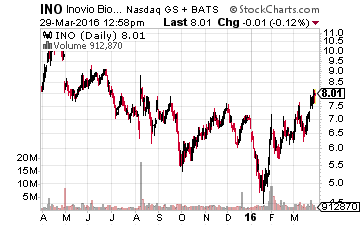

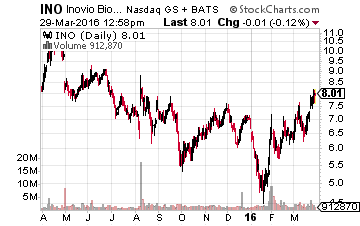

Let’s start with small vaccine maker Inovio Pharmaceuticals (NASDAQ: INO) that has held up remarkably well given the over 40% decline in the biotech sector since late July of last year. The company has been in the news recently as it is one of several firms trying to develop a vaccine to the Zika Virus. That, however, is not its main attraction. First, the company has an extensive pipeline of emerging vaccines that are moving along in development. Second, more than 25% of its roughly $575 million market capitalization is represented by net cash on its balance sheet. It is well funded for all of its development at least through 2018. This is important given how demand for secondary offerings for small biotech concerns has almost completely dried up in the past couple of months, pushing down the stock prices of most companies that need to raise funding in the foreseeable future.

Inovio has numerous trial milestones in 2016. One of the more intriguing vaccines the company has in its pipeline is its INO-3112 immunotherapy compound. It reached a collaboration deal with larger MedImmune around this focus area in the summer of 2015 which granted Medimmune is exclusive rights to INO-3112 immunotherapy. Inovio received $27.5 million dollars as an upfront payment and will receive performance milestone payments up to $700 million dollars upon reaching development and commercial milestones. In addition, Medimmune will also fund all development costs associated with the study and has agreed to pay Inovio double-digit tiered royalties upon commercialization of INO-3112. Inovio plans to initiate human trials in 2016. Inovio currently trades for right around $8.00 a share. The four analysts that cover the firm have price targets ranging from $13.00 to $31.00 a share on the stock.