The latest installment from Tadas Viskantas’s series on “financial blogger wisdom” (is that an oxymoron?) asked a bunch of smart people (and also me) about smart beta. I was short:

Smart beta and factor investing are the newest versions of high(er) fee active management promising the fairy tale of “market beating” returns in exchange for higher fees and usually delivering lower returns (after taxes and fees).

Regulars know I am not a big fan of Smart Beta and Factor Investing (sorry to all my friends in the industry who love these approaches!). For the uninitiated, Smart Beta basically involves taking an index fund and changing it so it captures a “smarter” type of return. For instance, you might take a market cap weighted index fund like the S&P 500 and equal weight it so that it doesn’t expose you to the procyclical tendencies of the market cap weighted fund which will tend to be overweight the riskiest stocks at the riskiest points in the market cycle. The evidence that this is countercyclical is weak as Vanguard has shown and as I expressed in my new paper.

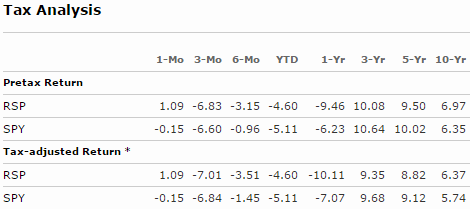

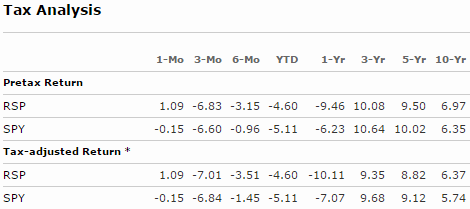

Further, you will generally pay higher taxes and fees in these funds without a high probability of better results. For instance, the equal weight S&P 500 has a pretty mixed performance versus the market cap weighted S&P as it’s performed better on a 10 year basis, but underperformed on all periods shorter than 10 years.

The nominal returns are slightly better over longer periods, but that’s only because the equal weight fund has a much higher standard deviation with 95% of the total correlation. So, the intelligent asset allocator has to ask themselves why they’d pay for 95% of the correlation while guaranteeing higher taxes and fees without a reasonably high probability of better risk adjusted performance? Should you really pay higher fees for the empty promise of “market beating returns”? I say no.