EUR/USD is off the highs but also refusing to fall. What’s next? The team at Bank of America Merrill Lynch explains how markets are torturing the bears:

Here is their view, courtesy of eFXnews:

Themes: the Fed in the driver’s seat. Our last report argued that the March ECB meeting would be the most difficult in recent years; the price action that followed has confirmed it. In our view, the ECB delivered more than what markets had expected, but markets were not impressed and EUR/USD is now stronger. The FX market did not like Draghi’s comment that there would be no more rate cuts, but subsequent offsetting comments by other ECB officials failed to weaken the Euro. Surprisingly dovish comments by Yellen in March also supported the Euro.

We have argued that FX markets have stopped focusing on data and what central banks actually do, and are now focusing on what central banks may or may not do ahead. Indeed, further easing by a number of central banks this year (BoJ, ECB, RBNZ, Riksbank, Norges Bank) has failed to weaken the respective currencies.

We expect balanced short-term EUR/USD risks, but would still sell any rallies as our medium-term outlook remains bearish.We will have to wait for the second half of this year to see if the ECB needs to ease policies again. Our economists expect the next Fed hike only in June. For now, higher US inflation leads to lower real yields, which is weighing on the USD. However, we expect divergence of monetary policies to weaken the Euro eventually. In our baseline of a continued global recovery, the Fed will have to hike, while the ECB cannot stop QE before its inflation target comes within reach. Our year ahead EUR report had argued that this would be a frustrating year for EUR bears and this is what we have seen so far.

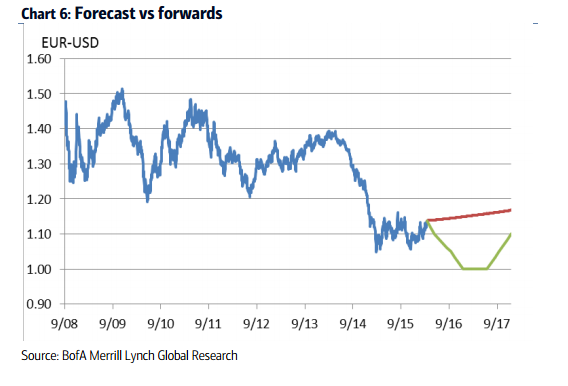

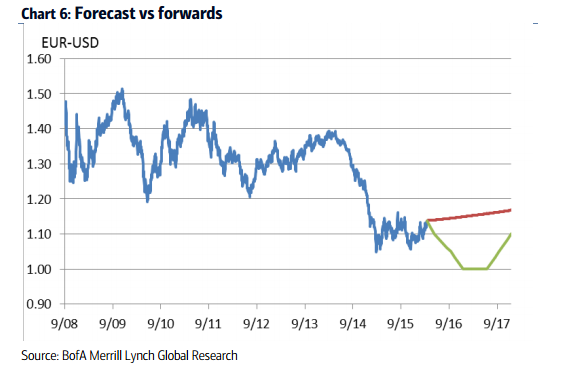

Forecasts*: The choppy road to parity. We continue to expect EUR/USD to weaken to below 1.10 by June and as low as parity by end-2016. We expect this move to be consistent with the data, which should address the Fed’s concerns about the strong USD. Our projections are consistent with a temporary undervaluation of EUR/USD, which however we explain by the ECB’s monetary policy stance relatively to that of the Fed.