European stocks rose amid earnings beats, offsetting weakness in the energy sector and easing investor concerns ahead of the weekend’s French election. Asian shares and U.S. futures also rise. The dollar weakens against the euro and most crosses, while crude oil rebounds following renewed OPEC chatter of a production cut, this time with Saudi Arabia seemingly onboard.

World stocks eked out small gains on Thursday, with the MSCI’s world stock index up 0.13 percent, as investors resisted risky bets ahead of the first round of the French presidential election over the weekend. Oil prices, which fell sharply on Wednesday on supply news, regained some losses after Saudi Arabia’s energy minister said that OPEC is likely to reach an agreement to extend the group’s production cuts into the second half of 2017. Overall, markets have stuck to familiar trading ranges buffeted by concern over political risks and continued tensions over North Korea.

What happened overnight? Here is a 30 second summary from JPM:

Stocks were mixed in Asia while equities in Europe have a bid and US futures are bouncing too. On the macro front, nothing major occurred (although there are a few interesting headlines, esp. the ones concerning easier China capital controls). The main focus was on earnings w/a slew of reports out of both the US and Europe (on balance earnings over the last 12-18 hours were positive although no single report is altering the broader market narrative). There were a bunch of articles talking about the potential for a US gov’t shutdown (which still seems unlikely). Finally, Saudi Arabia sounds confident in extending the OPEC deal although maybe by less than 6 months.

Looking at markets, the Stoxx Europe 600 Index fluctuated before advancing 0.1%, helped by a rally in food producers after Unilever NV and Nestle SA results beat estimates. It has been a pretty busy morning of Eurozone earnings w/a bunch of large reports (ABB, Man Group, Nestle, Pernod Ricard, Publicis, Rio Tinto, Schneider Electric, Unilever, and more). Pretty much all the large caps are rallying in Europe after reporting. Man Group, Schneider Electric, and Publicis are some of the top stocks in the SXXP following their earnings. Sawai Pharmaceutical said on Thursday it would buy U.S. generic drug maker Upsher-Smith Laboratories for $1.05B (per Reuters). VIRT has reached a deal to buy KCG and an announcement is likely Thurs; VIRT will pay $20/shr. (per Bloomberg and CNBC).

In Asian trading, Japanese stocks failed to hold on to slim gains and closed flat on the day. S&P 500 futures rose 0.3% after the cash market slid 0.2% on Wednesday.

Quoted by Reuters, Fan Cheuk Wan, head of investment strategy and advisory, Asia, at HSBC Private Banking said that “given the binary risk of the French presidential elections and geopolitical concerns over North Korea, investors are staying on the sidelines.”

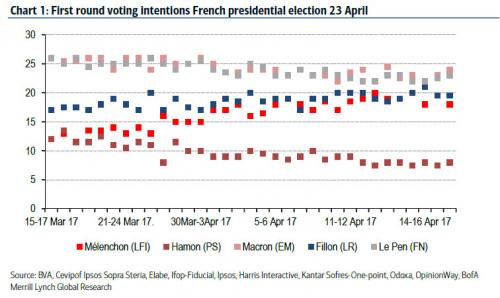

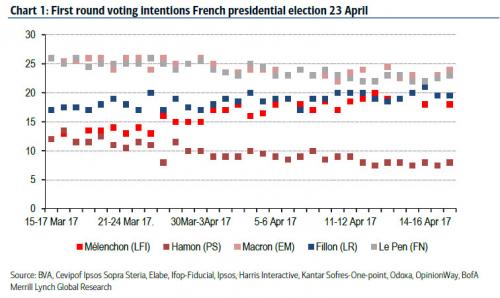

Investors are facing a stern test of nerves on Sunday where polling ahead of the first round of the French elections suggests that any two candidates can make it into the second round.

Millions of French voters remain undecided, making this the least predictable vote in France in decades, and raising fears of a potential surprise result that could spread turmoil in markets. As Reuters notes, however, France’s borrowing costs nudged down on Thursday before a bond auction that is likely to be watched more closely than usual. There was some optimism for a market-friendly “status quo” outcome when a Harris Interactive-France Televisions poll show Macron’s lead rising by 1 point to 25% over Le Pen at 22%, which in turn sent the EUR to session highs.

However, a subsequent poll from OpinionWay showed that Macron’s lead remained unchanged at 23%, just 1 point above Le Pen at 22% and Fillon and Melenchon both within poll error distance.

Additionally, ongoing tensions around North Korea and Syria ratchet up market risks. U.S. President Donald Trump’s travails trying to implement his fiscal agenda are also clouding the growth picture, while the Federal Reserve’s plan for monetary tightening looks increasingly unsure. “This political uncertainty’s not going away for a while,” said Ben Kumar, a London-based investment manager at Seven Investment Management.“Markets are trying to get their heads around whether that will actually affect company earnings. For the first part of this year the message was no, it doesn’t matter, earnings upgrades came through in Europe and the U.S.”

Indeed, a run of disappointing U.S. economic data and questions about whether the Trump administration can push through tax cuts have dented some of the enthusiasm for risky assets in recent weeks. A sharp dip to three-week lows in oil prices overnight was the latest sign of an unwind in the global reflation trade. Crude oil clawed back some of the loss but concerns about a supply glut capped the rebound.

“Rising U.S. oil inventory data is now starting to impact the market’s aggressive long position in crude,” said analysts at Morgan Stanley in a note to clients.

Following the above mentioned Saudi comments on a potential deal extension, Brent crude futures were up 0.5% to $53.22 a barrel after sliding more than 3 percent in the previous session. U.S. West Texas Intermediate crude futures CLc1 were up 0.4%.

In currency markets, the euro rose 0.4 percent to a three-week high of $1.0748 against the dollar. The greenback was 0.2 percent weaker against a basket of major currencies

The greenback slipped against most peers. Commenting on the dollar slide, SocGen’s Kit Juckes writes that “the Fed’s biggest challenge may be that inflation expectations are still falling, steadily de-coupling from its 2% target. It’s hard to see how the Fed can remain hawkish against a backdrop of falling inflation expectations and hard, in the process, to see the dollar getting more than a nominal bounce until there are clearer signs of economic robustness.”