As a market built on Trump rally optimism meets a legislative reality that might not be able to get much done, including any meaningful tax reform, where does one invest in a market environment which Goldman Sachs now categorizes as “Gridlock” in the subtitle of a “Where to Invest Now” report?

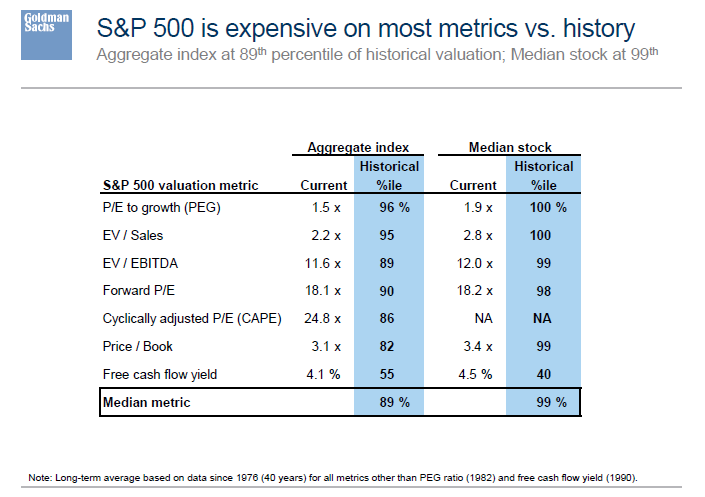

With median stock prices trading near 99th percentile, don’t worry about legislative accomplishment

With its legislative agenda “delayed” after a derailed attempt at healthcare reform, a tax policy that is now going back to the drawing board and even financial reform in jeopardy, Goldman notes that market bulls are turning their focus to corporate and economic fundamentals.

Even here, however, the numbers provide a mixed bag.

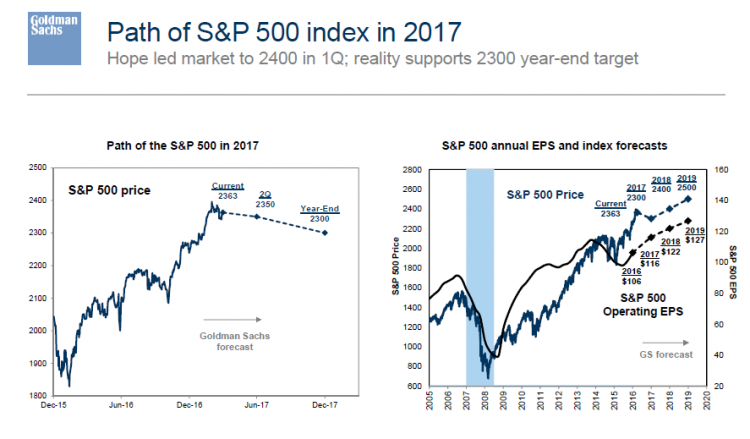

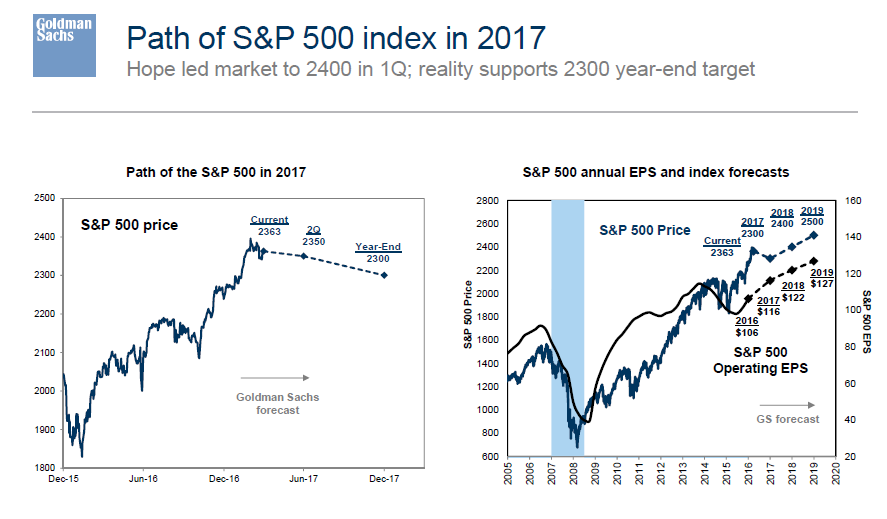

While corporate operating earnings per share are expected to rise 9% to an average of $116, the question is, with the S&P 500 index trading at an elevated valuation in the 89th percentile – and the median stock trading in the 99th percentile — just how much positivity is already priced into the market and how far can any rally go?

In such an environment, Goldman’s Global Investment Research team, headed by David J. Kostin, sifts through a cloudy landscape in an attempt to find the diamonds in the rough. The conclusion is corporations with high tax rates, low labor costs and stocks with secular growth potential.

Where to invest with legislative accomplishments in question

For Goldman Sachs, the path of the S&P 500 is going to be one of steady decline as the “hope led market” that rocketed the index to 2400 will give way to a 2300 print to close 2017. From this point, Goldman sees a 100-point rise in each of 2016 and 2019 as corporate EPS climbs to $122 and $129 respectively.

Tax beneficiaries have given up their strong gains, after Goldman’s high tax rate basket of stocks rocketed from $99 to $103 just after election day, topping out near $104 and are now trading at $98, reflecting diminished hope for meaningful tax reform. Likewise, infrastructure stocks, which jumped after election day on hopes of massive Trump fiscal stimulus, have mostly given back all their gains and the “bank deregulation premium” has all but vanished as the markets move “from hope to reality.”