Seven big names within the tech and consumer discretionary spaces release earnings results this afternoon. Here’s what we’re expecting:

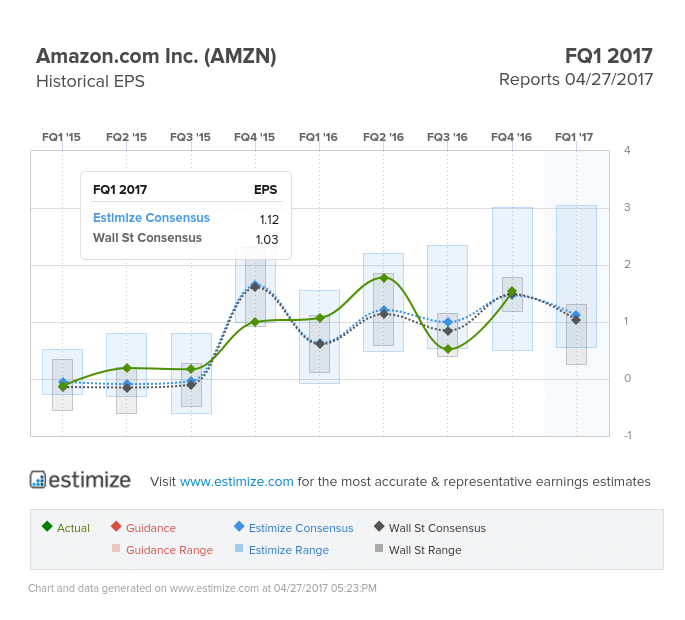

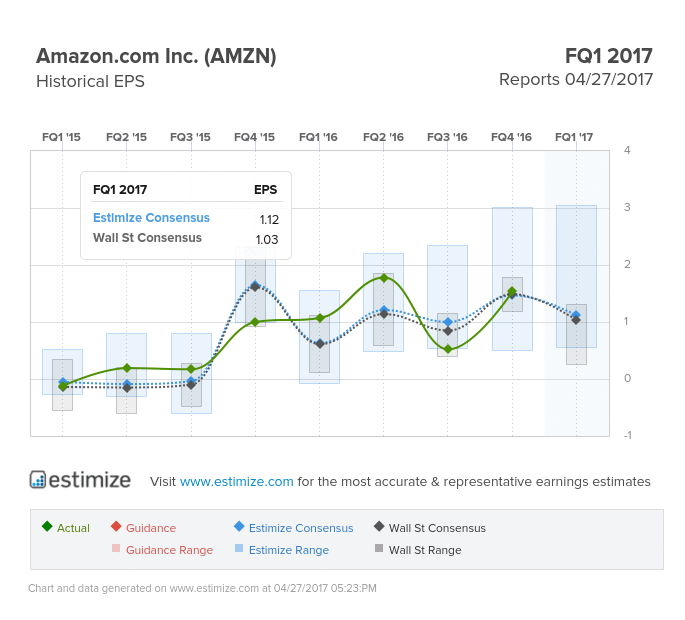

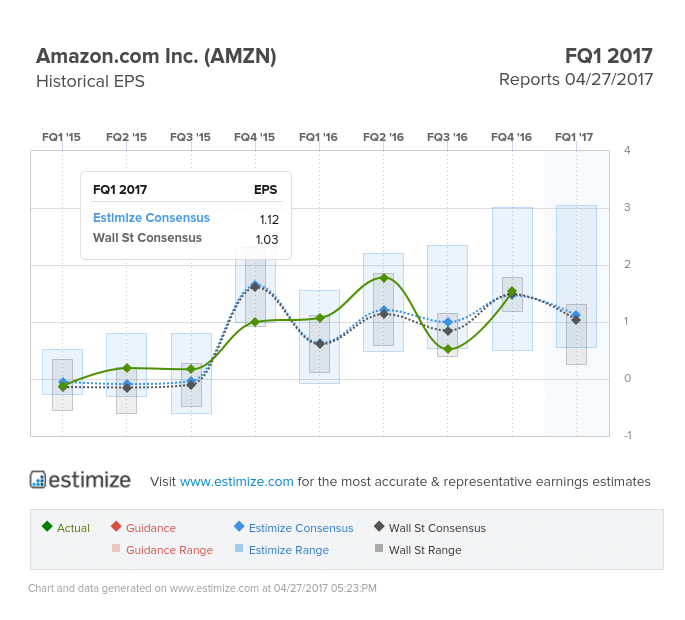

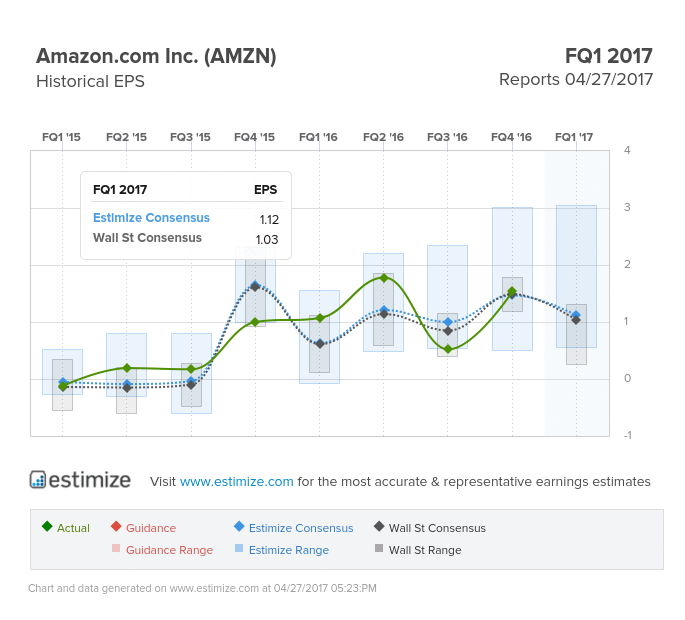

Amazon.com Inc. (AMZN) – Consumer Discretionary – Internet & Catalog Retail

Key Takeaways

The Estimize consensus is calling for earnings per share of $1.12 on $35.55 billion, about 9 cents higher than Wall Street on the bottom line and $159 million on the top.

This puts profit growth at 5% YoY, and sales growth at an even higher 22%.

EPS estimates have fallen 38% since the last quarterly report, with revenues only declining 1% in that time.

Margins on AWS continue to support bottom line growth as the retail business does the same to the top line. AMZN is eating everything in retail.

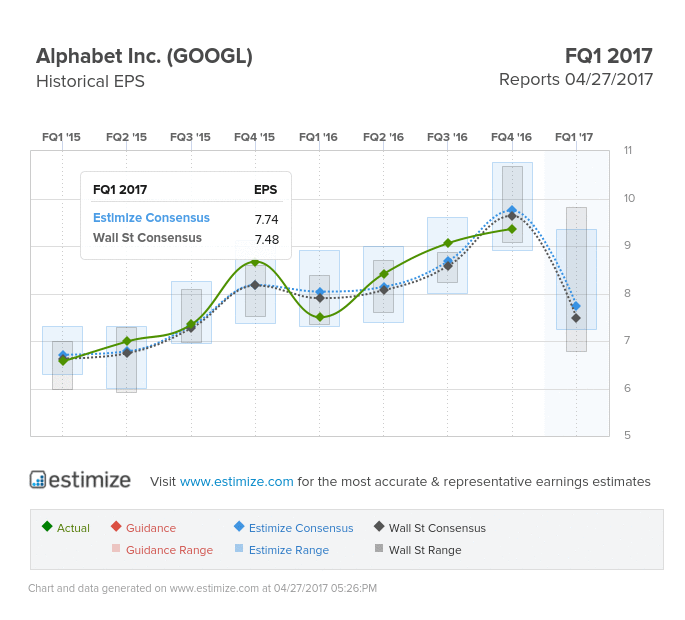

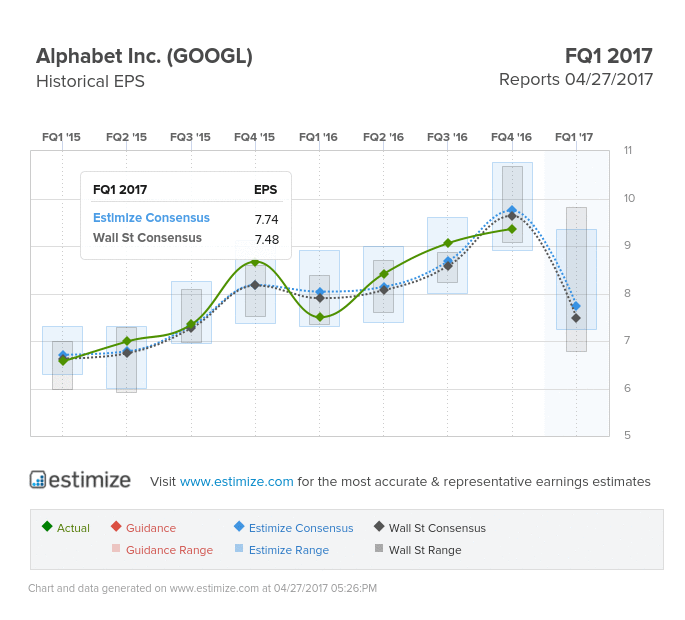

Alphabet Inc (GOOGL) – Information Technology – Internet Software & Services

Key Takeaways

The Estimize consensus is calling for GAAP earnings per share of $7.75 on $19.77 billion, about 11 cents higher than Wall Street on the bottom line and $120 million on the top.

Alphabet’s move away from non-GAAP to GAAP coverage makes the year-over-year comparisons apples-to-oranges at this point.

Google’s core business, advertising, makes up about 90% of total revenue with Youtube ads driving a majority of the recent growth.

Microsoft Corporation (MSFT) – Information Technology – Software

Key Takeaways

The Estimize consensus is calling for earnings per share of 72 cents on $23.64 billion, 3 center higher than Wall Street on the bottom line and $90 million on the top

This puts profit growth at 16% YoY, and sales growth at an even higher 7%.

EPS estimates have fallen 1% since the last quarterly report, with revenues up 4% in that time.

Clouding computing and Productivity business remain two strong points while personal computing continues to slide

Investors expect that integrating Linkedin with Azure and other CRM products to boost sales and capture greater market share