The Bank of New York Mellon Corporation (BK) has been a holding in Warren Buffett’s investment portfolio since the third quarter of 2010.

Why is this important?

Well, Warren Buffett is arguably the best investor ever. He has grown his company, Berkshire Hathaway (BRK-A) (BRK-B), to a ~$444 billion market capitalization through years of sound business decisions and intelligent investing.

Accordingly, his investment portfolio is a great place to look for high-quality investment opportunities. You can see a full analysis of Warren Buffett’s investment portfolio here.

Among Warren Buffett’s investment portfolio, the Bank of New York Mellon Corporation – or BNY Mellon, for short – stands out because Buffett has been purchasing significant amounts of its stock over the past several quarters.

Don’t just take my word on it. Here’s the number of BNY Mellon shares owned by Berkshire Hathaway at the end of each of the last three quarters:

Buffett has increased his BNY Mellon stake by ~52% during each of the last two quarters.

Clearly, something is special here.

This article will analyze BNY Mellon’s business model, growth prospects, and competitive advantages to determine why Warren Buffett is loading up on this stock.

Business Overview & Recent Financial Performance

The Bank of New York Mellon Corporation is a large, diversified financial services firm with a very globalized operating presence. The company serves more than 100 markets in 35 countries through an employee base of ~52,800.

BNY Mellon was formed on July 1, 2007 through the merger of the Bank of New York and the Mellon Corporation. Today, BNY Mellon is headquartered in New York and has a market capitalization of $56 billion.

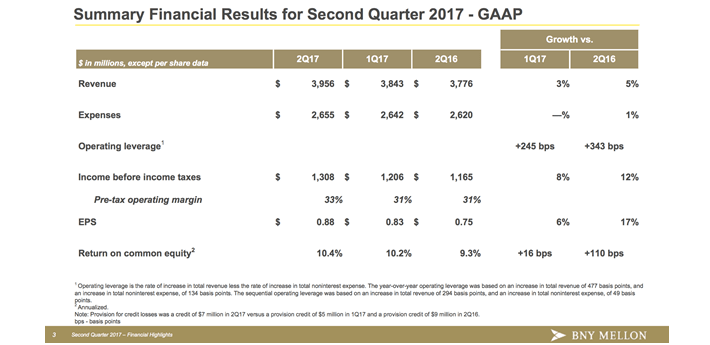

On July 20, 2017, BNY Mellon reported financial results for the second quarter of fiscal 2017.

The company’s performance was very strong, posting 5% revenue growth and 17% earnings-per-share growth (both relative to the prior year’s period).

Moreover, BNY Mellon continued to be very profitable. The financial services firm saw a return on common equity of 10.4% (higher than many of its U.S. peers), which represented expansion of 110 basis points from the same period a year ago.

Source: BNY Mellon Second Quarter Earnings Presentation, slide 3

BNY Mellon continued to be a very shareholder-friendly capital allocator in the quarter.

The company returned more than $700 million to shareholders through share repurchases and dividend payments, and also executed a 26% increase to its quarter common stock dividend.