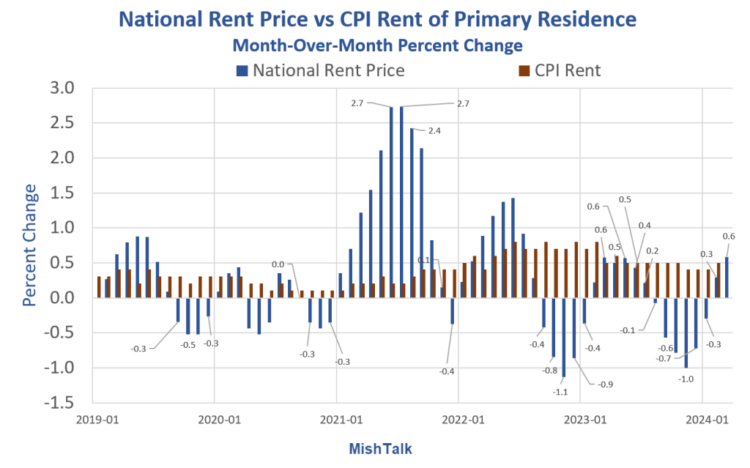

Rent data from Apartment List and the BLS.

Rent data from Apartment List and the BLS.

Apartment List reports rising prices after six months of declines. However, even a cursory glance at the chart shows seasonal variations that makes the data mostly unusable.Here’s the Apartment List Report for March of 2024 to discuss.

For the last two years seasonal declines have been steeper than usual and seasonal increases have been milder. As a result, year-over-year rent growth dipped into negative territory last summer and has remained there since, currently sitting at -0.8 percent. In other words, as the market has cooled, apartments are on average slightly cheaper today than they were one year ago.

Let’s stop right there because they aren’t.Apartment List does not measure all rents, only new leases. And New leases are approximately 9 percent of the market.While new leases may be cheaper, and likely are it’s such a tiny percent of the market that it is wrong to claim prices are falling.Seasonal adjustments compound the errors.

Zooming in a bit, 81 of the nation’s 100 largest cities saw rents go up in March. But on a year-over-year basis, rent growth is positive for only 42 of these cities. Many of the steepest year-over-year declines remain concentrated in Sun Belt cities that are rapidly expanding their multifamily inventory, such as Austin (-7.1 percent year-over-year), Atlanta (-5.3 percent), and Nashville (-4.8 percent).

Again, these are prices for new leases. Austin is so overbuilt, that the city may have actual declines even on existing lease renewals. Unfortunately, Apartment List does not track this, so the reported declines are much too high.

Apartment List Metro-Level Rent Data That is a very interesting chart. Kudos to Apartment List for producing it.The areas in blue are places where the prices of new leases is falling and red shows metro areas where the price of rent is rising.It’s hardly a uniform picture to say the least.I do not know if the data is properly weighted, but if it isn’t that’s another source of error in the national reports.

That is a very interesting chart. Kudos to Apartment List for producing it.The areas in blue are places where the prices of new leases is falling and red shows metro areas where the price of rent is rising.It’s hardly a uniform picture to say the least.I do not know if the data is properly weighted, but if it isn’t that’s another source of error in the national reports.

Apartment List Conclusion

March’s 0.6 percent rent increase marks a shift into the busy season for the rental market, despite year-over-year rent growth remaining negative at -0.8 percent. Historical seasonal patterns suggest that rents will continue trending up for the coming months, but we still expect rent increases to be moderated by a robust construction pipeline delivering new units throughout the remainder of 2024.

Understanding the Apartment List data, that is an accurate assessment of their data. Since they do not use seasonal adjustments, their month-over-month numbers are highly likely to rise.Their comment about construction is also accurate.The problem is the data is of limited national use for reasons stated: Seasonality, new lease vs renewals, and national weighting. Apartment List needs to do a much better job of explaining the limits and flaws in their reporting.But if you live in Austin or any of the blue areas in the above chart, and your lease is up for renewal, you may have a good opportunity to move or negotiate a rent reduction.

CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight MonthsFor over two years, analysts said rent was declining or soon would be. But for the 30th consecutive month, rent was up at least 0.4 percent. Gasoline rose 3.8 percent adding to the misery.  CPI Data from the BLS, chart by Mish.

CPI Data from the BLS, chart by Mish.

Whereas Apartment List shows no seasonal adjustment, the BLS adjustment have a lagging effect because of smoothing.Rent is up at least 0.4 percent for 30 straight months but that is not the way it works in practice.Rather, rent adjusts in one fell swoop once a year. And most leases renew in May through September. Thus we have seasonality within seasonality.For discussion, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight MonthsBecause of the BLS lags, analysts have turned to Apartment List, Zillow and other sources that are more timely.They may be more timely but the errors are worse. It is a huge mistake to assume new leases (9 percent of the market), set the price and not the 91 percent of existing lease renewals.Add in seasonality and weighting issues, and the reports we have been hearing for two years, that rents are declining, are bogus.That is the trap Apartment List fell into as well.Sticky-Price CPI Is Up 4.4 Percent From a Year AgoAlso see The Atlanta Fed Sticky-Price CPI Is Up 4.4 Percent From a Year AgoI will update Zillow rent prices shortly. Like Apartment List, it is also a flawed measure that people rely on because it says what they want to hear.More By This Author:Real GDP For The Fourth Quarter Revised Up, GDI JumpsExpect A Financial Crisis In Europe With France At The Epicenter The Fed’s Balance Sheet Reduction: Mission Accomplished?