Image Source: PixabayIndustrial profits recovered to positive growthIndustrial profits rose from -4.3% YoY in 2023 to 10.2% YoY ytd through February 2024. This was the first positive growth since June 2022 and was also the highest growth rate since December 2021.By sector, this was mostly due to manufacturing profits recovering to 17% YoY ytd, up from -2.0% YoY in 2023. Mining remained in negative growth at -21% YoY, down from -19.7% YoY. Utilities continued to outperform with 63.1% growth, up from 54.7% YoY in 2023.By industry, similar to the industrial production data, we saw a strong performance in the “computer, communications and other electronic equipment manufacturing” category, with profits up 210.9% YoY ytd, likely amid a tech self-sufficiency push as well as a consumer electronics upgrade cycle. Other industries seeing strong profit growth included ferrous metal mining and processing (101.3% YoY ytd), non-ferrous metal smelting and rolling processing (65.5% YoY ytd), and transportation equipment (90.1%). Industries continuing to see negative profit growth included coal (-36.8% YoY ytd), and pharmaceuticals (-4.4% YoY ytd).By ownership structure, private enterprises continued to outperform, with profit growth of 12.7% YoY ytd, up from 2.0% YoY in 2023. Encouragingly, state-owned enterprises also returned to positive profit growth of 0.5% YoY ytd, up from -3.4% YoY in 2023.China’s industrial profits confirm bottoming out

Image Source: PixabayIndustrial profits recovered to positive growthIndustrial profits rose from -4.3% YoY in 2023 to 10.2% YoY ytd through February 2024. This was the first positive growth since June 2022 and was also the highest growth rate since December 2021.By sector, this was mostly due to manufacturing profits recovering to 17% YoY ytd, up from -2.0% YoY in 2023. Mining remained in negative growth at -21% YoY, down from -19.7% YoY. Utilities continued to outperform with 63.1% growth, up from 54.7% YoY in 2023.By industry, similar to the industrial production data, we saw a strong performance in the “computer, communications and other electronic equipment manufacturing” category, with profits up 210.9% YoY ytd, likely amid a tech self-sufficiency push as well as a consumer electronics upgrade cycle. Other industries seeing strong profit growth included ferrous metal mining and processing (101.3% YoY ytd), non-ferrous metal smelting and rolling processing (65.5% YoY ytd), and transportation equipment (90.1%). Industries continuing to see negative profit growth included coal (-36.8% YoY ytd), and pharmaceuticals (-4.4% YoY ytd).By ownership structure, private enterprises continued to outperform, with profit growth of 12.7% YoY ytd, up from 2.0% YoY in 2023. Encouragingly, state-owned enterprises also returned to positive profit growth of 0.5% YoY ytd, up from -3.4% YoY in 2023.China’s industrial profits confirm bottoming out

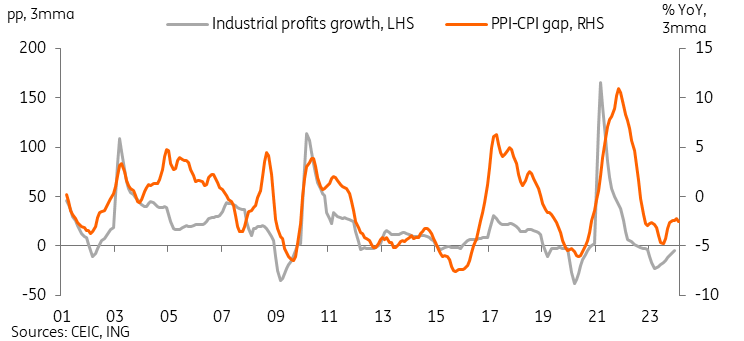

More signs point to a recovery of industrials in 2024After an upside surprise to industrial production to start the year, a further recovery of industrial profits sends another signal that we are indeed seeing a gradual recovery after a bottoming out last year. The PPI-CPI spread has also been trending in a favourable direction, though it remains to be seen if the rebound in CPI can be sustained as the boost from the Lunar New Year effect will no longer be in play in the upcoming months’ data. A weak base effect through all of 2023 will boost the YoY numbers this year, and manufacturers could benefit from the trade-in policies expected to be implemented this year. If the recovery of manufacturing continues, it would contribute toward reaching the 2024 growth target, but more supportive policies are still needed to sustain the momentum and recovery.More By This Author:Asia Morning Bites For Wednesday, March 27Weakness In US Investment Keeps The Focus On The Consumer Low Affordability To Weigh On Eurozone Housing Market In 2024