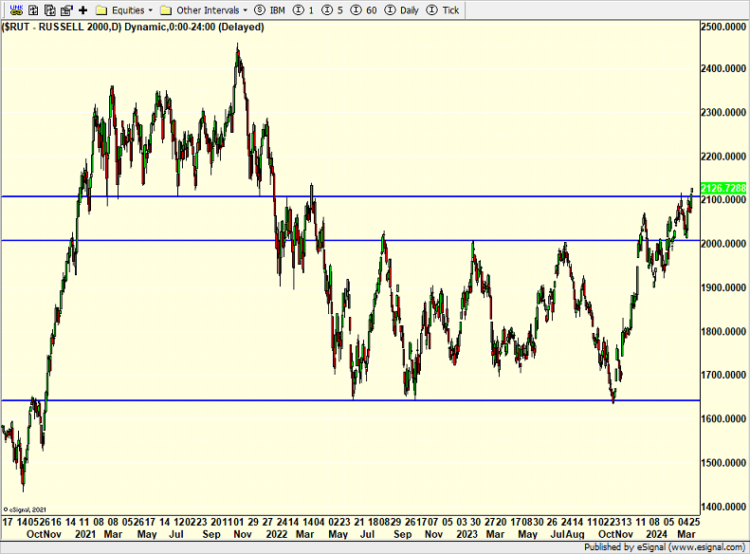

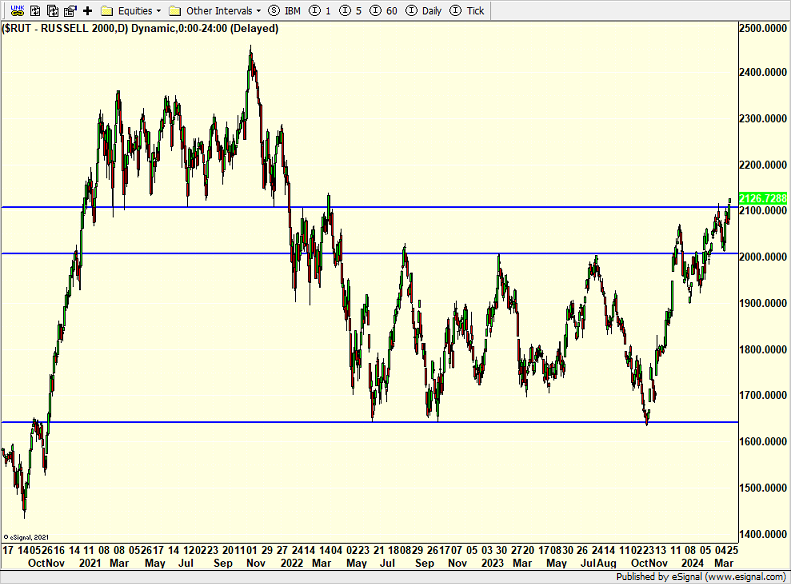

Today is the last day of the week, month, and quarter as markets are closed in observance of Good Friday. March and Q1 definitely flew by! As a reminder I will be conducting my quarterly webinar on Wednesday at 7:30 pm where I review the events of Q1, discuss our strategies and their performance as well as take a sneak peak into what is ahead in Q2.Markets remain very quiet with low volatility. I don’t know why they do this, but the government is set to release an important measure of inflation tomorrow when the markets are closed. While I understand they are scheduled, why not wait when market participants can react versus having almost no one around and very little liquidity in the overnight markets.Pulling up an old chart below, remember when the masses were so acutely focused on the small caps lack of performance? Every time the index hit the 2000 area it was abruptly turned back. Until it wasn’t. I vividly recall the bears chirping about a new bear market in October 2023 when the Russell 2000 was heading towards 1650 and the old lows. OUCH if you sold or went short back then.

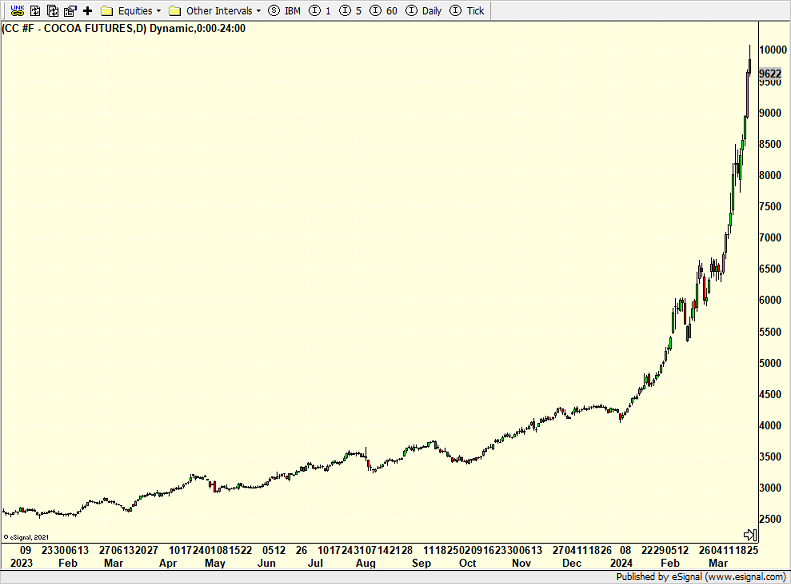

Today, we don’t hear much from the bears on the small caps after they rallied 27% in 5 months. Now we just hear about the “broadening” of the rally and small cap catch up. Heck, Tom Lee has been yelling about this group soaring 50% in 2024. My oh my what a change in sentiment from the gloom, doom, fear and despondency.Finally, take a look at this AI darling. It looks like an old Dotcom stock from 2000, doesn’t it?Except that’s the chart of cocoa futures. You don’t see moves like this too often. It makes Nvidia look like a boring, stodgy stock. We bought Hershey’s somewhere around the 6500 mark as the company is very well run and has excellent financials. The problem was that its main input cost in chocolate was killing the company’s margins.

Interestingly, the stock stopped selling off as cocoa continued to soar. A huge change in character. That’s what got me interested to finally buy. And I do love candy!

On Tuesday we bought more levered NDX. We sold some EPOL. On Wednesday we sold levered S&P 500.More By This Author:Volatility Is Depressed But It Should Be

Fed Has Cover For Rates Cuts But Inflation Not Giving Up

Stock Market Trend Morphing As It Weakens