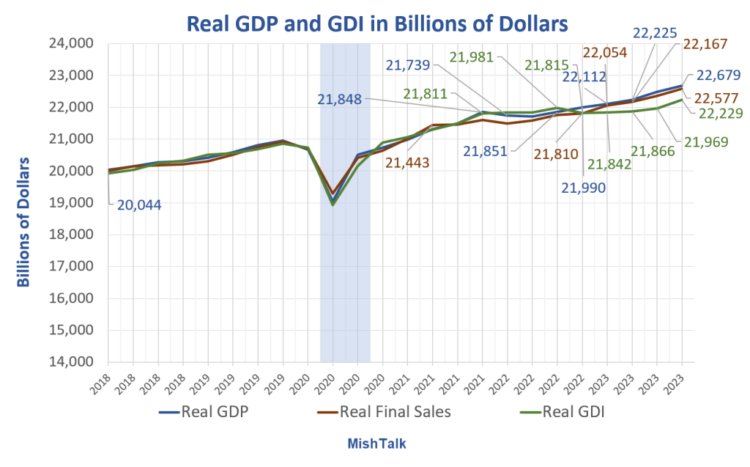

GDP and GDI data for the fourth quarter from the BEA, chart by MishChart Notes

GDP and GDI data for the fourth quarter from the BEA, chart by MishChart Notes

GDI reporting lags GDP reporting by a month in the first three quarters of the year and by two months for the fourth quarter.Due to lags, GDP gets all the media writeup, but many economists and analysts, me included, think GDI is a better number.

Real GDP, Real Final Sales, Real GDI 2023

Percent Change From Previous Quarter, Annualized

GDI caught my attention but it is not as strong as it looks. The 2023 annual total for GDP is +2.5 percent but GDI is only 0.5 percent.Price Indexes

If the measures of inflation are understated, them Real GDP and GDI are overstated.Contributions to GDP 2023 Q4 Final

Real GDP and Real GDI Percent Change from Same Quarter a Year Ago

I created that chart today to better highlight the GDP to GDI discrepancy.Year-over-Year GDI was essentially flat for four consecutive quarters while GDP rose 0.7%, 1.7%, 2.4%, and 2.9% for the same periods.In the fourth quarter, GDI did jump 1.9 percent from a year ago vs 3.1 percent for GDP. The 2023 annual total for GDP is +2.5 percent but only 0.5 percent for GDI.

HappinessIn the US, if things were really so great, why are so many people so unhappy?The answer is asset holders are doing well, renters aren’t. The renters are zoomers, millennials, and blacks.Many of those who want to buy a home are priced out and have other financial difficulties.

Credit Card and Auto Delinquencies SoarCredit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card DebtCredit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due. For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29. Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

Generational Homeownership Rates  Home ownership rates courtesy of Apartment ListThe above chart is from the Apartment List’s 2023 Millennial Homeownership ReportThose struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.The same age groups struggling with credit card and auto delinquencies.

Home ownership rates courtesy of Apartment ListThe above chart is from the Apartment List’s 2023 Millennial Homeownership ReportThose struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.The same age groups struggling with credit card and auto delinquencies.

ConclusionsTwo different polls show millennials and zoomers are unhappy. And they are unhappy for the reasons stated: Many have concluded they will never be able to afford a house or have kids. Those who have concluded that are likely correct.For more discussion, please see US Drops to Number #23 in the World Happiness ReportGlobally, the US is doing better than the most of the world.For discussion, please see Expect a Financial Crisis in Europe With France at the EpicenterMore By This Author:Expect A Financial Crisis In Europe With France At The Epicenter The Fed’s Balance Sheet Reduction: Mission Accomplished?Consumer Stress Is Evident In The Declining Price Of New Homes