Philippines GDP Growth Exceeds Expectations: ETFs In Focus

Nov 18, 2017

Jeremy Parkinson

Finance

The Philippines witnessed impressive economic growth in the third quarter of 2017. Per the National Statistics Agency, GDP grew 6.9% year over year in the third quarter compared with 6.7% in the prior quarter and 7.1% in the year-ago period. It also beat a Bloomberg forecast of 6.6%. The Philippines has been one of the best performing […]

Yuan Likely To Consolidate As PBOC Maintains Neutral Monetary Policy

Nov 18, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for CNH: Neutral The PBOC will continue the current monetary policy, which has neutral impact to the Yuan. The regulator watches capital flows and told it would counter against cycles through FX market. A high level of broad credit and soaring real-estate prices prevent the PBOC to cut rates. The Chinese Yuan gained against […]

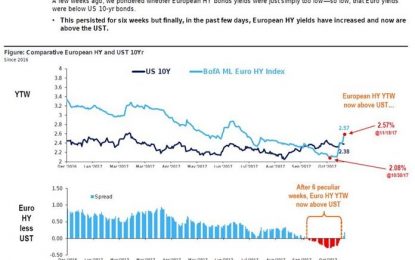

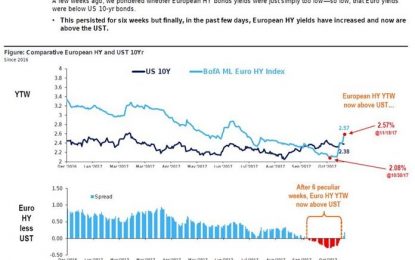

European Junk Bonds Now Yield More Than U.S. Treasuries

Nov 18, 2017

Jeremy Parkinson

Finance

On Friday, the small caps outperformed the mega caps as the Russell 2000 – RUT was up 0.40%, while the Dow was down 0.43%. In the midst of this middling action, the JNK high yield bond index was down 0.05% and the HYG high yield bond index was down 0.03%. The chart below shows the […]

Tracking The Bear – Nov. 17

Nov 18, 2017

Jeremy Parkinson

Finance

Last week, I discussed the potential year-end setup for a January correction. To wit: “It is the turn of the calendar where I see the potential for a bigger correction. Come January, I think there is a high-likelihood of ‘tax selling’ by fund-managers to lock in gains, particularly if ‘tax reform’ legislation has passed, as taxes won’t be […]

Emerging Markets: What Has Changed – Nov. 17

Nov 18, 2017

Jeremy Parkinson

Finance

In the EM equity space as measured by MSCI, Korea (+4.2%), South Africa (+3.2%), and Thailand (+1.9%) have outperformed this week, while Egypt (-5.1%), Turkey (-1.9%), and Russia (-1.8%) have underperformed. To put this in better context, MSCI EM rose 0.7% this week while MSCI DM fell -0.3%. In the EM local currency bond space, […]

US Dollar: Politics To Overshadow Yellen Speech, FOMC Minutes

Nov 18, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for the US Dollar: Neutral US Dollar pressured as “Trump trade” narrative continues to fizzle Politics to overshadow Yellen speech, FOMC minutes, PMI surveys Holiday liquidity drain might amplify volatility on major news-flow The US Dollar continued to retreat last week as the prospect of expansionary fiscal policy that boosts inflation and nudges the Fed into a […]

Shrinking Home Sizes: Downtrend Continues

Nov 18, 2017

Jeremy Parkinson

Finance

New home sizes peaked between 2014 and 2015. A distinct down-sizing is now underway. What’s going on? The National Association of Homebuilders (NAHB) reports Declining New Home Size Trend Continues. After increasing and leveling off in recent years, new single-family home size continued along a general trend of decreasing size during the third quarter of 2017. […]

Uranium Stocks In 2018: Pressure Cooker Ready To Explode

Nov 18, 2017

Jeremy Parkinson

Finance

In line with our uranium forecast for 2018 we observe this week a potentially very bullish evolution both in uranium stocks as well as in uranium’s spot price. If this trend continues 2018 could become a hugely bullish year for uranium stocks. First, uranium’s spot price rose with 15 percent this week. Note the steep rally on the […]

Are Bearish Sentiment Responses Translating Into Actual Action?

Nov 18, 2017

Jeremy Parkinson

Finance

The S&P 500 Index is only down .60% from its November 8, 2017 high yet individual investor and institutional equity sentiment has turned significantly less positive. This negative sentiment has not translated into broadly lower equity prices though, but knowing sentiment measures are contrary indicators, they are approaching levels that would be suggestive of higher […]

Week In Review: Shanghai Pharma Acquires Cardinal’s China Drug Distribution Network For $1.2 Billion

Nov 18, 2017

Jeremy Parkinson

Finance

Shanghai Pharma (SHA: 601607) paid $1.2 billion to win the bidding war for Cardinal Health’s (NYSE: CAH) China drug distribution operations (see story). Cardinal was China’s eighth-largest drug distribution company, with $3.5 billion in 2016 China revenues, while Shanghai Pharma is number three. After the companies are combined, Shanghai Pharma will become number one. In 2010, Cardinal got a foothold in […]