Will The Light News Week Facilitate Range Trading?

Nov 18, 2017

Jeremy Parkinson

Finance

Last week, we warned that dollar’s downside correction to its two-month advance was not over. It slipped further against the euro, yen, and sterling, while it strengthened against the dollar-bloc currencies. The outlook remains mixed for the week ahead, making it difficult to discuss the dollar in general. The Dollar Index is heavily weighted toward the complex […]

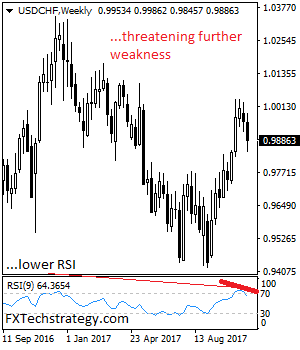

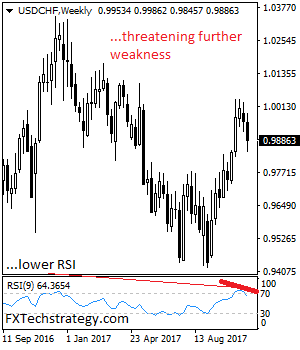

USD/CHF: Bearish, Eyes Further Downside Pressure

Nov 18, 2017

Jeremy Parkinson

Finance

USD/CHF: The pair looks to weaken further lower having declined the past week. On the downside, support lies at the 0.9850 level. A turn below here will open the door for more weakness towards the 0.9800 level and then the 0.9750 level. On the upside, resistance resides at the 0.9950 level where a break will […]

HH

Moody’s Boosts Modi: India Gets First Sovereign Credit Upgrade Since 2004

Nov 18, 2017

Jeremy Parkinson

Finance

Moody’s upgrade to India’s credit rating comes as a much-needed boost for India’s Prime Minister, Narendra Modi, who has been criticised for the fallout from the goods and services tax (GST) and demonetisation reforms. Indeed, Moody’s argued that Modi’s reforms will help to stabilize India’s rising debt levels. According to Reuters. Moody’s Investors Service upgraded […]

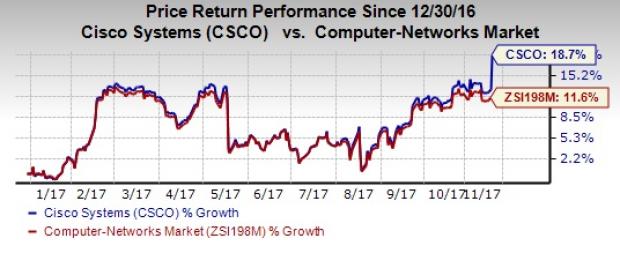

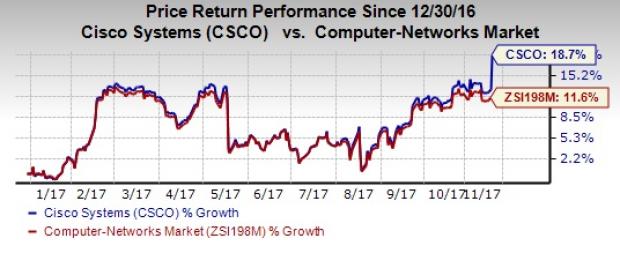

Cisco (CSCO) Stock Hits 52-Week High Backed By Q1 Results

Nov 18, 2017

Jeremy Parkinson

Finance

Shares of Cisco Systems Inc. (CSCO – Free Report) rallied to a 52-week high of $36.67, eventually closing a tad lower at $35.88 on Nov 16. The share price momentum can be primarily attributed to the company’s fiscal first-quarter 2018 earnings that came ahead of expectations. The company’s encouraging guidance has also been one of the tailwinds. Cisco reported […]

S&P 500 Snapshot: Down 0.13% From Last Week

Nov 18, 2017

Jeremy Parkinson

Finance

The S&P 500 opened Friday below yesterday’s close and oscillated around a small range throughout the day, closing with a daily loss of 0.26% and a weekly loss of 0.13%. Year-to-date, the index is up 15.19%. The U.S. Treasury puts the closing yield on the 10-year note at 2.35%. Here is a daily chart of […]

U.S. Inflation Picks Up Steam — Is A December Rate Hike Likely?

Nov 18, 2017

Jeremy Parkinson

Finance

On today’s special podcast edition of Market Week in Review, Consulting Director Sophie Antal Gilbert chatted with Mark Eibel, director, client investment strategies, about the latest U.S. core inflation and retail sales numbers and the impact they could have on the U.S. Federal Reserve (the Fed) as it weighs a December funds rate hike. Encouraging […]

HH

Is It Time To Get Back In Oil Stocks?

Nov 18, 2017

Jeremy Parkinson

Finance

Energy stocks have turned around lately, but they have been big-time laggards this year. The sector’s travails didn’t start this year; it has been struggling since about mid-2014 when oil prices turned south and didn’t settle down till early 2016. The single most important variable driving energy company stocks is the price of oil. You […]

What Happens When Quantum Computing And AI Merge?

Nov 18, 2017

Jeremy Parkinson

Finance

There’s a global arms race among companies and nations to achieve supremacy in both quantum computing and AI, Woody Preucil at 13D Research recently explained to Financial Sense Newshour listeners. Though many are still unaware of the events taking place—with significant breakthroughs just in the last couple of years—these two technologies are accelerating quite rapidly […]

Perspective On The Gold / Oil Ratio, Macro Fundamentals And A Gold Sector Bottom

Nov 17, 2017

Jeremy Parkinson

Finance

With all due caveats about the non-stellar gold CoT data, I wanted to note a constructive situation in gold vs. oil, which is a key sector fundamental consideration. Now, there is still a constructive situation in play for nominal crude oil, so take this post for perspective more than anything. Au/WTI bottomed in December of […]

Some Strange Trends Among 2017 Hedge Fund Returns

Nov 17, 2017

Jeremy Parkinson

Finance

From one perspective, there is an odd disparity in the force. Hedge fund returns in certain categories are experiencing fat tail correlation and return extremes when compared to players inside a particular category as well as compared to the category average itself. No better can this be seen than in the most formulaic of all hedge fund strategies, […]