Walmart Nation: Mapping The Largest Employers In The U.S.

Nov 17, 2017

Jeremy Parkinson

Finance

In an era where Amazon steals most of the headlines, it’s easy to forget about brick-and-mortar retailers like Walmart. But, even though the market values the Bezos e-commerce juggernaut at about twice the sum of Walmart, the blue big-box store is very formidable in other ways. For example, revenue and earnings are two areas where […]

Stocks And Precious Metals Charts – The Willful Mispricing Of Risk

Nov 17, 2017

Jeremy Parkinson

Finance

Today was a stock options expiry. Gold and silver rallied smartly, back up to the levels where they roughly were before they were bushwhacked on the Comex into the FOMC meeting and Non-Farm Payrolls boogie woogie. I guess the theory that this smackdown of gold to retest 1270 earlier this week was a gambit ahead […]

The Natural Gas Gap Continues To Hold

Nov 17, 2017

Jeremy Parkinson

Finance

The natural gas gap held again today as the December natural gas contract bounced off it and rallied a bit through the day on marginally colder weather forecasts. Some of the move was weather-driven, as the front of the strip saw the largest gains and parts of the rally coincided with American modeling guidance, but […]

Unmasking The VooDoo: Trends

Nov 17, 2017

Jeremy Parkinson

Finance

When discussing technical analysis and trends, the erudite snoots among us, which unfortunately can include me, like to talk about physics. Objects, or trends, in motion will stay in motion unless acted upon by an outside force. That’s inertia and yes, markets have it. How else do we explain momentum stocks, let alone bubbles? As […]

Market Talk – Friday, November 17

Nov 17, 2017

Jeremy Parkinson

Finance

The tax reform bill passing the US House yesterday certainly added to sentiment, after great earnings releases for markets but Asia need more help for cash today. Having opened strong all core markets then drifted and even saw the Nikkei trade negative. For the week it closes down 1.3% which has broken a two month […]

Shiller Is Wrong

Nov 17, 2017

Jeremy Parkinson

Finance

Robert Shiller had an interesting interview on CNBC in which he took the concept of passive investing to the woodshed, calling indexers freeloaders (on other people’s work) and stopping just short of calling the strategy un-American. I found the clip via Cullen Roche who also had some thoughts on the Shiller segment. One of Cullen’s major points, that I […]

Gold Gains As Stocks Slide, Yield Curve Crashes, & Dollar Dumps

Nov 17, 2017

Jeremy Parkinson

Finance

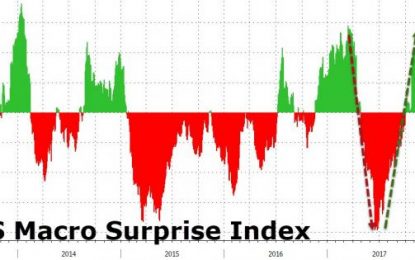

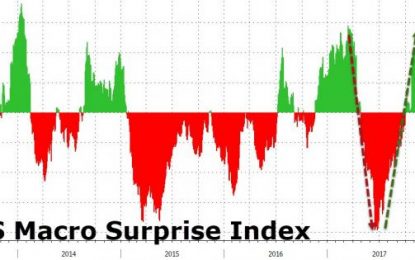

Economic Data continues to surprise to the upside (compared to what had been terrible expectations)…is this as good as it gets? But credit, the yield curve, and now stocks are not loving it… Small Caps were the only major index green today… The Dow and S&P 500- fell for the 2nd week in a row […]

November 2017: ECRI’s WLI Growth Index Rate Down

Nov 17, 2017

Jeremy Parkinson

Finance

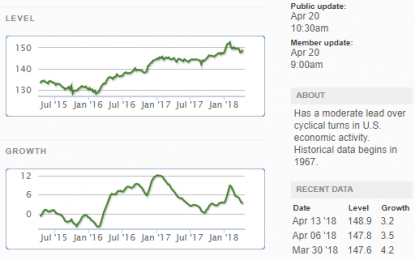

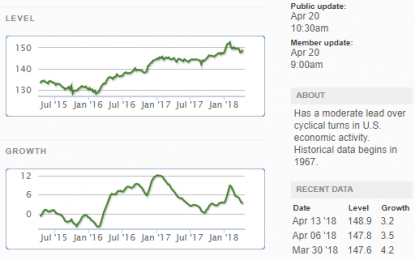

ECRI’s WLI Growth Index which forecasts economic growth six months forward remains in expansion. This is compared to RecessionAlerts similar weekly leading index. Analyst Opinion of the trends of the weekly leading indices Both ECRI’s and RecessionAlerts indicies are indicating modest growth six months from today. Current ECRI WLI Level and Growth Index: Here is […]