Uranium, The Bond Market, And USD Comments

Nov 17, 2017

Jeremy Parkinson

Finance

(Audio length 00:09:14) Doc joins me today to look at the charts of Uranium, TLT, and the US Dollar. We address some technical factors as well as touching on the fundamentals that are the long-term drivers. Also of note gold is starting to breakout. This happened after we recorded but is of note at $1,293 […]

Housing Starts And Completions Surge

Nov 17, 2017

Jeremy Parkinson

Finance

Housing starts rose 13.7 percent from September to a seasonally adjusted annual rate (SAAR) of 1.290 million. This is the fastest pace since October 2016. The number of units is 2.9% below the 1.328 million estimate a year ago. Housing Starts 1960-Present The 13% jump is a huge surge but from hurricane depressed levels. It’s […]

Corn Just Hit Rock Bottom. Get Set To Profit

Nov 17, 2017

Jeremy Parkinson

Finance

All prices are set by how investors feel. Buying and selling shares or futures is an inherently inexact thing. Whether you are using supply/demand data or just a gut feeling, buying shares is a bet on what will happen in the future. That’s why sentiment indicators are useful … but only in the extremes. When sentiment […]

Global Silver Investment Demand Maybe Down, But Still Double Pre-2008 Market Crash Level

Nov 17, 2017

Jeremy Parkinson

Finance

While physical silver investment demand experienced a pronounced decline this year, the volume is still much larger than the level prior to the 2008 U.S. Housing and Banking Crash. Investors frustrated by a silver market plagued with lousy sentiment and weak demand, may not realize that silver bar and coin demand is projected to be […]

Gold Miners’ Q3’17 Fundamentals

Nov 17, 2017

Jeremy Parkinson

Finance

The gold miners’ stocks have spent months adrift, cast off in the long shadow of the Trumphoria stock-market rally. This vexing consolidation has left a wasteland of popular bearishness. But once a quarter earnings season arrives, bright fundamental sunlight dispelling the obscuring sentiment fogs. The major gold miners’ just-reported Q3’17 results prove this sector remains […]

3 Top Mid-Cap Growth Mutual Funds For Great Returns

Nov 17, 2017

Jeremy Parkinson

Finance

Mid-cap growth funds focus on realizing an appreciable amount of capital growth by investing in stocks of firms, the value of which is projected to rise over the long term. However, a relatively higher tolerance to risk and the willingness to park funds for the longer term are necessary when investing in these securities. This […]

Bitcoin Invalidates Breakdown

Nov 17, 2017

Jeremy Parkinson

Finance

Square, a payment company, is playing around with Bitcoin. In an article on CNBC, we read: Jack Dorsey’s company is testing support for bitcoin through its Cash payments app. “We’re exploring how Square can make this experience faster and easier, and have rolled out this feature to a small number of Cash app customers,” a Square […]

The Most Active Equity Options And Strikes For Midday – Friday, November 17

Nov 17, 2017

Jeremy Parkinson

Finance

Gold Up Most In 3 Months, Spikes Above Key Technical Level

Nov 17, 2017

Jeremy Parkinson

Finance

Gold continues to shine in the post-Saudi-coup world… And the precious metal just broke above its 50-day moving average, after bouncing off its 200-day on Tuesday. This is gold’s best day in 3 months… Gold is gaining as the dollar index slumps to near 1-month lows… Of course, it’s USD/JPY that really […]

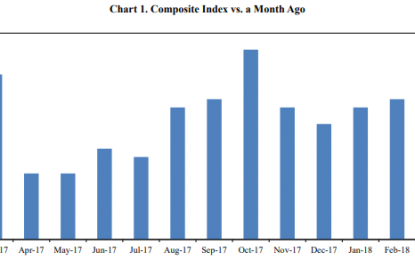

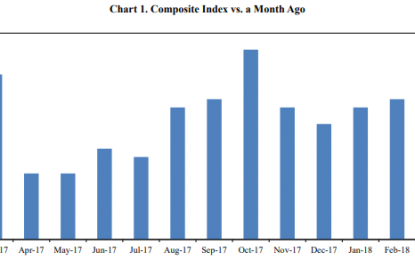

November 2017 Kansas City Fed Manufacturing Remains Positive But Declines

Nov 17, 2017

Jeremy Parkinson

Finance

Of the three regional manufacturing surveys released for November, all were in expansion. Analyst Opinion of Kansas City Fed Manufacturing Kansas City Fed manufacturing has been one of the more stable districts and their index declined. Key internals were in expansion but likewise declined. There market expectations from Bloomberg / Econoday were 20 to 24 […]