Gold: This Will Make You Appreciate Momentum Indicators

Jul 10, 2017

Jeremy Parkinson

Finance

Tom Denham, the editor of Elliott Wave International’s Metals Pro Service, tells you about the importance of the market’s price momentum and explains what momentum is saying about the trend in gold. Watch this new interview to get Tom’s latest outlook across the metals markets.

Pieris Pharmaceutical – Chart Of The Day

Jul 10, 2017

Jeremy Parkinson

Finance

The Chart of the Day belongs to Pieris Pharmaceuticals (PIRS). I found the biopharmaceutical stock by using Barchart to sort today’s All Time High list first for the highest Weighted Alpha, then again for technical buy signals of 80% or more. Since the Trend Spotter signaled a buy in 5/4 the stock gained 67.51%. Pieris Pharmaceuticals, Inc. is a biopharmaceutical company. […]

Fireweed Zinc: The Coiled Spring In The Zinc Bull Market

Jul 10, 2017

Jeremy Parkinson

Finance

Brandon Macdonald, the CEO of Fireweed Zinc joined me to discuss the company’s large Zinc-Lead-Silver deposits known as Tom and Jason. Fireweed has an extremely tight share structure, experienced management team, huge exploration potential and is well poised to capitalize on the coming Zinc Bull Market. Video Length – 00:18:55

This FAANG Is Not Dot-Com

Jul 10, 2017

Jeremy Parkinson

Finance

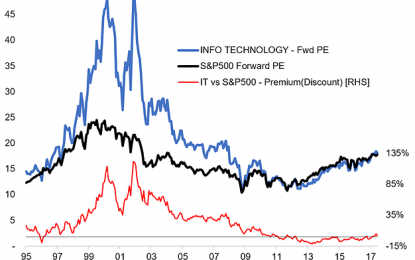

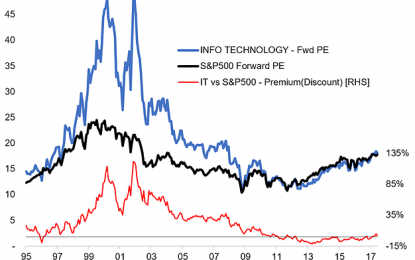

There’s been a lot of talk about the so-called FAANG stocks and parallels being drawn against the 2000’s dot com bubble. With S&P500 valuations steadily pushing higher vs history and relative to global equities, it’s somewhat understandable. But this ain’t dot com. Not by a long shot. I explored this issue alongside a broader look […]

Index Correlations Collapse, What’s Next?

Jul 10, 2017

Jeremy Parkinson

Finance

Video length: 00:13:28 On the surface, stocks continued to rebound today. In tonight’s video update, we dive deeper and look at the index correlations. Why are they so important and what do they tell us about what may come next? Watch tonight’s video to find out. Join us this week for “Greek Week” which includes […]

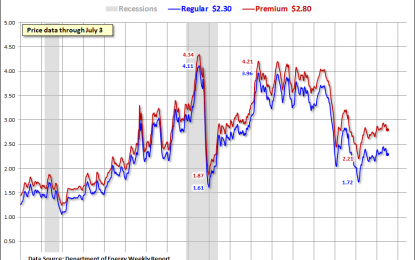

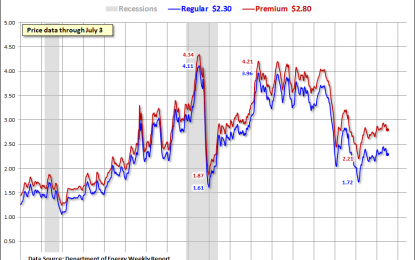

Weekly Gasoline Price Update: WTIC Down 15% In 2017

Jul 10, 2017

Jeremy Parkinson

Finance

It’s time again for our weekly gasoline update based on data from the Energy Information Administration (EIA). The price of Regular is down a penny from last week and Premium is unchanged. According to GasBuddy.com, Hawaii has the highest average price for Regular at $3.03 and San Francisco, CA is the most expensive city, averaging $3.09. […]

Small-Cap Value Leads June Returns

Jul 10, 2017

Jeremy Parkinson

Finance

As a welcomed gift for the Independence Day holiday, Lipper Fund Data and Analytics just released June performance data for the entire universe of mutual funds available to domestic investors. Topping the U.S. Diversified Equity category were small-cap value funds which gained 3.1 percent in June versus the broad category’s 1.2 percent appreciation. That’s pretty […]

SNAPgeddon Strikes – Stock Falls Below IPO Price, Down 40% From Highs

Jul 10, 2017

Jeremy Parkinson

Finance

Well that escalated quickly… Just 4 months after its magnificently-lauded IPO – proving to every Bob, Dick, and Mary on business media that this time is different and everything’s awesome – Snap has collapsed back to below its IPO price and down 42% from its post-IPO highs. SNAP IPO’d at $17 and opened at $24, trading up […]

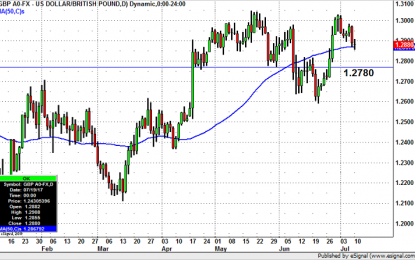

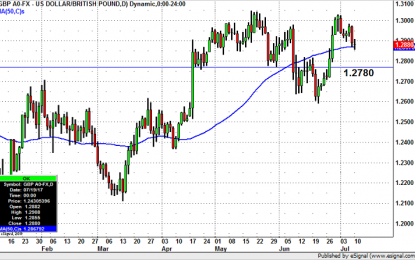

GBP/USD – Buy Or Sell?

Jul 10, 2017

Jeremy Parkinson

Finance

From a fundamental perspective, GBP/USD should be trading lower. Consistently softer UK data casts doubt on the hawkish comments from the Bank of England. Service, manufacturing and construction sector activity slowed in the June while industrial and manufacturing production turned negative. This along with a stronger pound in May caused the trade deficit to […]

Europe Stocks Look Interesting

Jul 10, 2017

Jeremy Parkinson

Finance

There was an interesting article written recently by Barry Ritholtz who says that people are feeling cautious towards the market, so they are looking for technical reasons to support their caution. I kind of agreed with the article, but some of the market caution seems reasonable to me. For instance, John Murphy mentioned in his […]