Time To Stay Alert

Jul 10, 2017

Jeremy Parkinson

Finance

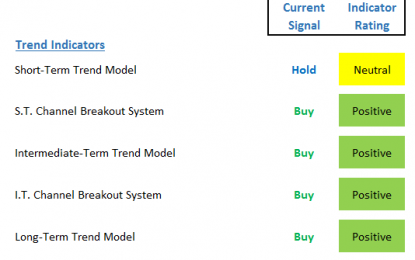

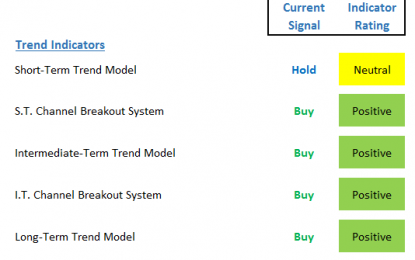

It’s the start of a new week as well as the semi-official start of the second half of the year, so let’s get right to our objective review the key market models and indicators and see where things stand. To review, the primary goal of this weekly exercise is to remove any subjective notions I […]

E

What Will Lead Stocks Higher?

Jul 10, 2017

Jeremy Parkinson

Finance

Market Analysis A tool to help confirm the overall market trend is the Bullish Percent Index (BPI). The Bullish Index is a popular market “breadth” indicator used to gauge the internal strength/weakness of the market. Like many of the technical market internal indicators, it is used both to confirm a move in the market and […]

Investing: The Incredible Power Of Staying In The Now

Jul 10, 2017

Jeremy Parkinson

Finance

A Simple And Powerful Concept Eckhart Tolle’s New York Times Best Seller The Power Of Now has sold over 3 million copies worldwide and has been translated into over 30 languages. The basic premise of the book is captured in the excerpt below: “Nothing has happened in the past; it happened in the now. Nothing will ever […]

Commodities Halftime Report: Separating The Wheat From The Chaff

Jul 10, 2017

Jeremy Parkinson

Finance

Of the 14 commodities we track closely at U.S. Global Investors, wheat rose to take the top spot for the first half of 2017, returning more than 25 percent. The grain was followed closely by palladium—used primarily in the production of catalytic converters—which gained 24 percent. To view our ever-popular, interactive Periodic Table of Commodity […]

Can Pepsi Keep With The Health Craze?

Jul 10, 2017

Jeremy Parkinson

Finance

Pepsico, Inc. (PEP) will release FQ2’17 earnings before the market opens on Tuesday, July 11th. Pepsi has been on somewhat of a rollercoaster ride in terms of EPS and revenue, the company’s Q4 and Q1 showed a downward trend, with a bounceback in Q2; which is exactly what Estimize and the Street are predicting for this […]

Only Four People Can Move The Global Oil Market

Jul 10, 2017

Jeremy Parkinson

Finance

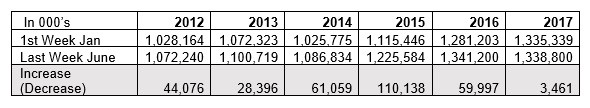

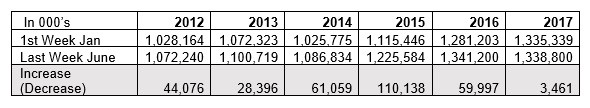

I’ve got some data for you that is surprisingly bullish for oil. Even more surprising is what that data relates to, those bloated U.S. oil storage levels. The data I’m about to specifically shows you details the movement in amount of oil that the United States has in storage this year versus recent history. All […]

CloudHealth Is A Prospect For Acquisition

Jul 10, 2017

Jeremy Parkinson

Finance

According to Gartner, more than $1 trillion in IT spending will be directly or indirectly affected by the shift to cloud by 2020, making cloud computing one of the most disruptive forces of IT spending since the early days of the digital age. CloudHealth’s cloud management platform is riding this wave of corporate cloud adoption. […]

Confident Americans Set To Spend Record Amount On Summer Vacation

Jul 10, 2017

Jeremy Parkinson

Finance

For the next couple of months, your Facebook and Instagram feeds will likely be dominated by beach holiday photos, beers in the sand and people’s legs at the pool. School is out for summer and people are ready to vacation! American consumers are as confident as ever and this should translate to a great summer […]

Intel Downgraded To Underperform From Hold At Jefferies

Jul 10, 2017

Jeremy Parkinson

Finance

Jefferies analyst Mark Lipacis downgraded Intel (INTC) to Underperform, his firm’s equivalent of a sell rating, and cut his price target on the shares to $29 from $38. Intel closed Friday up 25c to $33.88. The chipmaker’s Xeon/Xeon PHI platform is disadvantaged versus Nvidia (NVDA) in emerging parallel workloads like deep neural networking, Lipacis tells […]

This Mining Stock Much Stronger Than GDX

Jul 10, 2017

Jeremy Parkinson

Finance

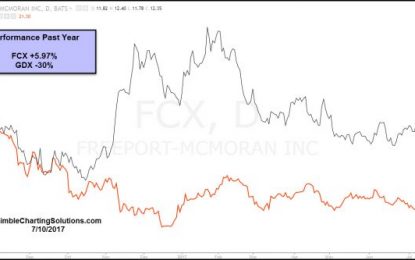

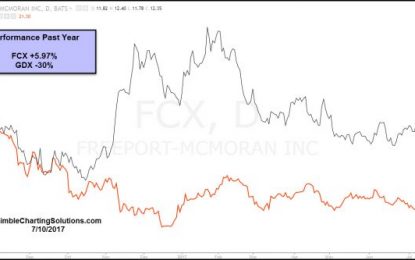

The past year has been rough for Gold Mining stocks, as Gold Miner ETF (GDX) has declined over 30%, in the chart below. Below compared GDX to Freeport Mcmoran (FCX) over the past year, reflecting a large difference in performance. Over the past year, GDX has been a good asset to avoid from a buy and hold basis and […]