Dividend Champion Portfolio July Update

Jul 10, 2017

Jeremy Parkinson

Finance

The High Yield Dividend Champion Portfolio is a publicly tracked stock portfolio on Scott’s Investments. Its goal is to capture quality high yield stocks with a history of raising dividends. The screening process for this portfolio starts with the “Dividend Champions” as compiled by DRIP Investing. The list is comprised of stocks that have increased their dividend payout for […]

Gold And Silver Capitulation

Jul 10, 2017

Jeremy Parkinson

Finance

The big news this week was the flash crash in silver late on 6 July. We will publish a separate forensic analysis of this, as there is a lot to say and see. It’s hard to tell—we don’t have the tools to measure such a thing—but it seems like the hype and aggression from the […]

ETF Watchlist: Week Of July 10, 2017

Jul 10, 2017

Jeremy Parkinson

Finance

Friday’s market rally following a strong jobs report pushed the major indices back into the green for week and kicked off a solid start to Q3. The Dow, Nasdaq and the S&P 500 were all up marginally, but the real market action is set to kick off later this week as earnings season is back! […]

The Bears Suck When It Comes To Sell-Offs, So Just Buy

Jul 10, 2017

Jeremy Parkinson

Finance

They do suck. I mean how many times can the bears possibly blow a sell-off that is handed to them on a silver platter. Consequently, sell-offs that appear to be substantial, like the one last Thursday, has become a green light to buy the dip. Sure you can have a few multi-day sell-offs but those […]

The Last Time Hedge Funds Were This Short Gold, It Rallied 18% In A Month

Jul 10, 2017

Jeremy Parkinson

Finance

Gold is suffering its worst drawdown this year, and hedge funds are betting more losses are in store… but judging by the precious metals’ performance the last two times hedgies piled in like this, the ‘smart money’ may be about to get a nasty surprise… As Bloomberg notes, signs that global central banks, including the Federal Reserve, are […]

May 2017 Headline Consumer Credit Grew

Jul 10, 2017

Jeremy Parkinson

Finance

The headlines say consumer credit rate of annual growth grew from last month. Our analysis disagrees – and we see a moderately lower growth rate. Analyst Opinion of the Consumer Credit Situation Not only does this data set suffer from backward revision (moderate to significant enough to change trends), but the use of compounding (projecting […]

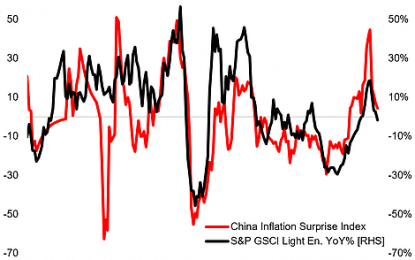

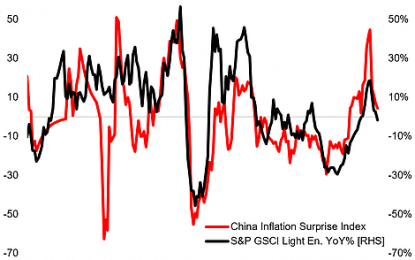

China Inflation Surprises, Commodities, And EM

Jul 10, 2017

Jeremy Parkinson

Finance

The latest inflation figures out of China weren’t much to talk about on the face of it, with CPI at 1.5% yoy in June and PPI at 5.5% – both unchanged from June and more or less in line with expectations. But what is notable, besides the persistent underlying inflation pressures we’re seeing, is the […]

PDL BioPharma Is A Solid Biotech Investment In A Friendly Regulatory Environment

Jul 10, 2017

Jeremy Parkinson

Finance

PDL BioPharma (NASDAQ:PDLI) acquires and manages products, royalty agreements and debt facilities in the biotech space. It is in the process of changing its business into a specialty pharma holding company, similar to Valeant Pharmaceuticals (NYSE:VRX), Perrigo (NASDAQ:PRGO), Horizon (NASDAQ:HZNP), and Depomed (NASDAQ:DEPO). Most of these types of companies, including PDLI, have taken hits recently. […]

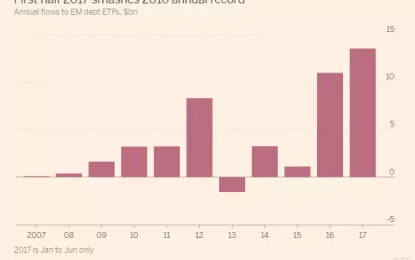

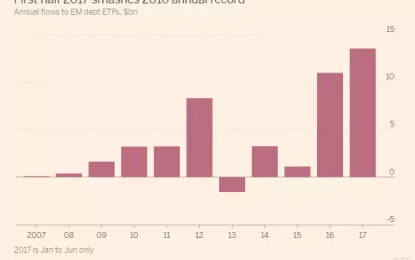

‘People Are Going To See There’s No Liquidity’: EM ETFs Face ‘Minsky Moment’

Jul 10, 2017

Jeremy Parkinson

Finance

Back in April, we brought you something called “CitiWide Change Bank Is Back: Emerging Markets ETF Edition.” In that post, we lampooned (for the umpteenth time) the ridiculous notion that you can explain away an absurd underlying business model by citing “volume.” That argument is popular among those who defend the liquidity mismatch inherent in HY […]

7 Low Price-To-Sales Stocks To Bank On For Fabulous Returns

Jul 10, 2017

Jeremy Parkinson

Finance

While Price-to-Earnings is the first thing to cross one’s mind while using valuation metrics, Price-to-Sales has emerged as a convenient tool to determine the value of stocks that are incurring losses or are in an early cycle of development, generating meager or no profits. Though a loss-making company with a negative Price-to-Earnings ratio falls out […]