Crisis Struck 10 Years Ago: What’s Changed?

Apr 01, 2018

Jeremy Parkinson

Finance

The financial crisis and the massive federal response reshaped the world we live in. Or did it? The Wall Street Journal has an interesting infographic series of 25 charts entitled 10 Years After the Crisis. Here’s eight of the 25. Median Income Barely Up Forget averages. The median is what counts most. Real median wages fell […]

EUR/USD Continues To Retain Downside Pressure

Apr 01, 2018

Jeremy Parkinson

Finance

The EUR/USD pair continues to hold on to its downside as it looks to extend its correction. On the upside, resistance comes in at the 1.2350 level with a cut through here opening the door for more upside towards the 1.2400 level. Further up, resistance lies at the 1.2450 level where a break will expose […]

USD/CAD Forecast: April 2018

Apr 01, 2018

Jeremy Parkinson

Finance

The US dollar has been very choppy against the Canadian dollar during trading over the month of March, initially breaking above the 1.30 level, but being turned around completely to form what could be looked at as a two-week shooting star. I think at this point, if we can break above the 1.31 level, that […]

The Alerian Problem

Apr 01, 2018

Jeremy Parkinson

Finance

What do you do if your fund’s index is shrinking? This is the dilemma that many retail investors in MLP-dedicated mutual funds and ETFs will be confronting in the months ahead. The trend for MLPs to simplify by combining with their corporate General Partner (GP) is well established. The recent Federal Energy Regulatory Commission (FERC) […]

E

The Canadian Economy Slowed In The Second-Half Of Last Year

Apr 01, 2018

Jeremy Parkinson

Finance

The Canadian economy expanded 3% for all of 2017, which was the fastest rate of growth in six years. Real final domestic demand mirrored the total economy and advanced 3% last year. Nonetheless economic growth decelerated sharply in the last two quarters of 2017. At annual rates real GDP expanded 4% in Q1 and 4.4% in […]

E

G6 Digest – Prices For The Week Ahead

Apr 01, 2018

Jeremy Parkinson

Finance

Below is a brief recap of last week’s price projections and the price targets for next week. The Euro continues trading in a narrow range and after reaching the weekly upside target reversed and broke below the CIT Cloud. Average up/down swing duration 5/3 days. The trend remains neutral and the projected price range for […]

The Start Of Q2

Apr 01, 2018

Jeremy Parkinson

Finance

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the […]

E

Market Briefing For Monday, April 2 – And Happy Easter

Mar 31, 2018

Jeremy Parkinson

Finance

Happy Easter & Passover to all! It’s been a ‘Monster Bull’ since I said ‘if Trump wins it’s going to the moon’; not interstellar space. For now that’s the point. Next week I will address several new topics of potential influence: among those are Japan’s decision to make ALL pension managers for the State ‘performance’ […]

GBP/USD Forecast Apr. 2-6: Losing Its Shine

Mar 31, 2018

Jeremy Parkinson

Finance

GBP/USD made a move to the upside but eventually ended the week lower. Where next? The first week of April features the all-important purchasing managers’ indices. Here are the key events and an updated technical analysis for GBP/USD. UK GDP was confirmed at 0.4% q/q and 1.4% y/y. While this was no surprise, the numbers are […]

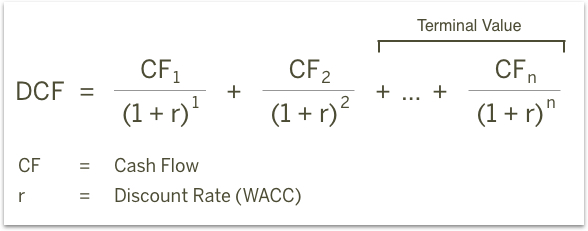

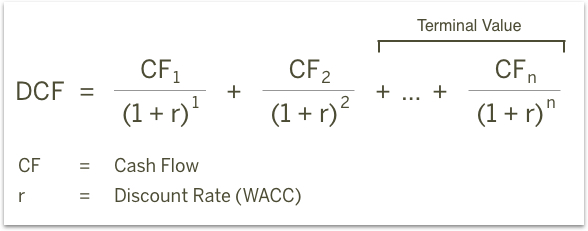

Estimating Domino’s Pizza Free Cash Flow And Intrinsic Value

Mar 31, 2018

Jeremy Parkinson

Finance

With the stock up 21.5% over the last three months, investors may be tempted to sell their shares of Domino’s Pizza, Inc. (NYSE: DPZ). In this article, I am going to calculate the fair value of Domino’s Pizza by forecasting its future cash flows and discounting them back to today’s value. Value investors may find the results […]